Elliott Management's High-Stakes Bet on Reshaping Southwest Airlines

Activist investor vs Southwest

Elliott Investment Management has acquired a substantial $1.9 billion stake in Southwest Airlines. This bold move by one of Wall Street's most prominent activist investors signals a potentially transformative shift for the Dallas-based carrier.

Let’s analyze what this development could mean for Southwest, its leadership, and the broader U.S. airline industry.

Elliott’s Activist Play

To understand the gravity of the situation, we first need to understand Elliott Management's track record and tactics.

Founded by billionaire Paul Singer in 1977, Elliott Management has earned a reputation as a tenacious and savvy activist investor. The firm is known for taking sizable positions in companies it believes are underperforming or mismanaged, and then aggressively pushing for changes to unlock shareholder value.

Elliott's playbook often involves advocating for leadership shakeups, strategic pivots, cost-cutting measures, and even full-blown sales of the companies it targets. With a war chest of around $65.5 billion in assets under management as of December 2023, Elliott has the financial firepower to make even the largest corporations take notice.

In the case of Southwest, Elliott's $1.9 billion investment translates to an ownership stake of approximately 11%, instantly making it one of the airline's largest shareholders.

Such a significant position gives Elliott considerable influence to pressure Southwest's board and management to enact its desired reforms.

Southwest's Turbulent Times

To understand why Southwest might be vulnerable to an activist campaign, it's important to examine the challenges the airline has faced in recent years. Long known for its low-cost, no-frills approach and strong corporate culture, Southwest has struggled to maintain its edge in an increasingly competitive industry.

The carrier's troubles came to a head during the 2022 holiday meltdown, when a combination of severe winter weather and antiquated crew scheduling software led to the cancellation of over 16,700 flights, stranding millions of passengers. The debacle cost Southwest over $1 billion and dealt a severe blow to its reputation for reliability.

But Southwest's issues run deeper than one isolated incident.

Southwest Airlines has been grappling with rising costs, including labor and maintenance expenses. The company has faced significant inflationary cost pressures, particularly with respect to salaries, wages, and benefits, which constituted approximately 43% of its operating expenses in 2023.

Additionally, Southwest has been negotiating new labor agreements, which have further increased costs.

While Southwest reported record revenue of $26.1 billion in 2023, its profit of just $465 million paled in comparison to rivals like Delta ($1.4 billion) and United ($3.3 billion).

Compounding these woes are the delivery delays of Boeing's 737 MAX jets, which have forced Southwest to scale back its growth plans and restructure parts of its network. The airline now expects to receive only 20 MAX planes in 2024, down from an earlier projection of 46.

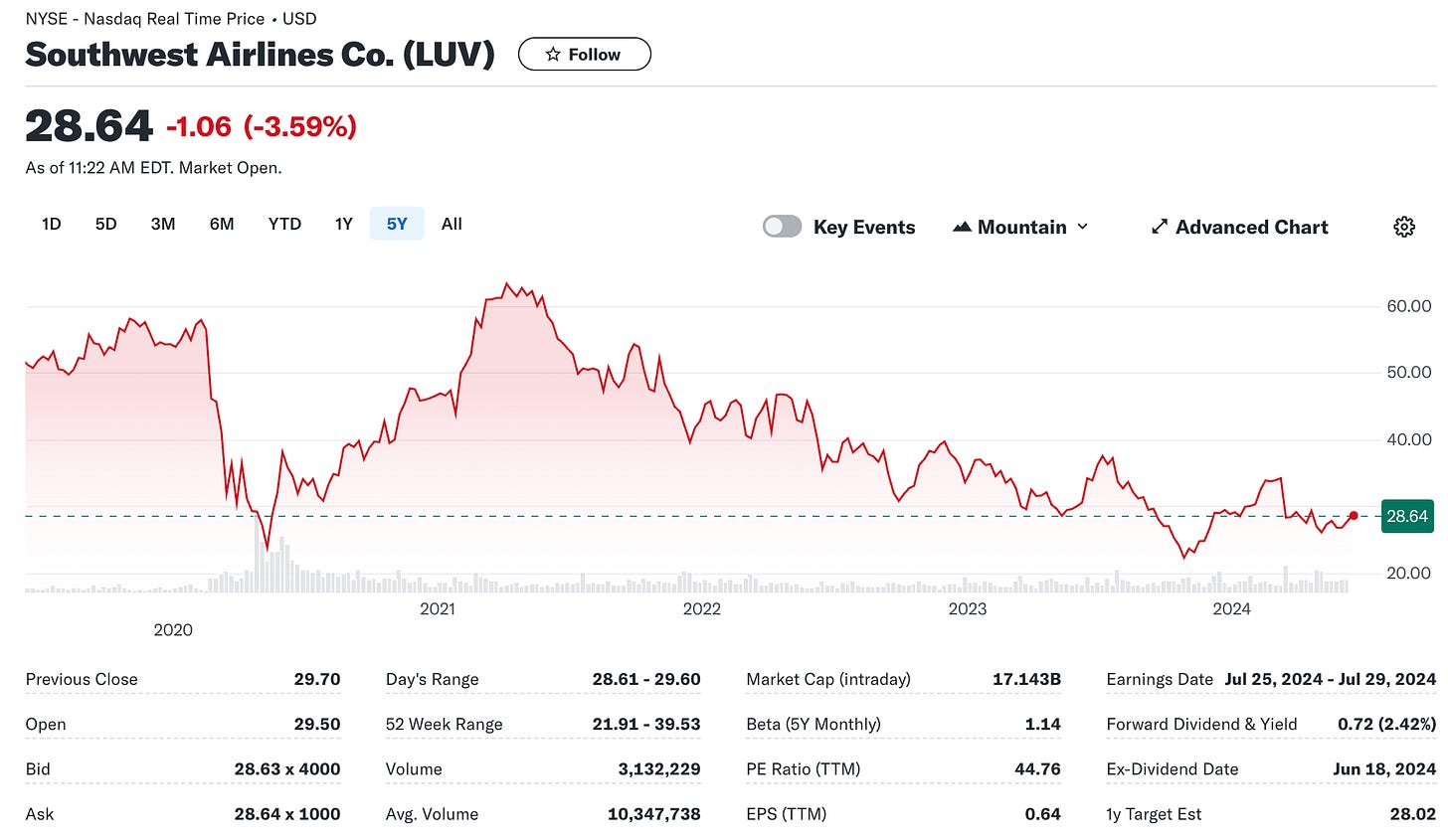

These setbacks have weighed heavily on Southwest's stock, which has lagged the broader market and its peers over the past year.

A Leadership in the Crosshairs

At the heart of Elliott's activist campaign are Southwest's CEO Bob Jordan and chairman Gary Kelly.

In a scathing letter to the airline's board, Elliott argued that the two executives have presided over a prolonged period of underperformance and are ill-equipped to modernize Southwest for the current industry landscape.

Jordan, a 36-year Southwest veteran, took the reins as CEO in February 2022 after previously serving as executive vice president of corporate services. While he has pledged to address Southwest's operational and technology shortcomings, Elliott contends that his tenure thus far has been marked by "poor execution" and a "stubborn unwillingness" to evolve the company's strategy.

Kelly, who preceded Jordan as CEO for nearly 17 years before transitioning to the role of executive chairman, has also come under fire from Elliott. The activist firm alleges that Kelly bears responsibility for Southwest's failure to keep pace with industry advancements and its over-reliance on an outdated business model.

In a statement, Southwest said it looks forward to engaging with Elliott to better understand its views, while expressing confidence in Jordan and the management team's ability to execute the company's strategic plans.

Our Board and Executive Leadership Team are thoughtfully reviewing Elliott's letter and presentation and look forward to further conversations with Elliott to better understand its view on the Company.

We are confident that Southwest Airlines has the right strategy, the right plan and the right team in place to drive long-term value for our Shareholders.

We are focused on restoring our industry-leading financial performance, the successful execution of our multi-faceted Tactical Action Plan to improve operational performance announced in first quarter 2023, alongside recent technology investments and operational resiliency programs that led to the operation of 99% of scheduled flights in first quarter 2024.

However, if history is any guide, Elliott is unlikely to back down easily from its demands for leadership changes.

The Case for Change

So what exactly does Elliott hope to achieve by shaking up Southwest's C-suite? Based on the firm's past activist campaigns, several potential objectives come to mind.

First and foremost, Elliott likely sees an opportunity to boost Southwest's profit margins and stock performance by pushing the airline to streamline its operations and cut costs. This could involve measures like renegotiating labor contracts, outsourcing certain functions, or reducing the airline's workforce.

Elliott may also pressure Southwest to accelerate the modernization of its fleet and technology infrastructure. The holiday meltdown exposed glaring weaknesses in the carrier's crew scheduling systems and other legacy IT platforms. Investing in state-of-the-art software and retiring older, less fuel-efficient planes could help Southwest improve reliability and competitiveness.

Another area ripe for activism is Southwest's route network and business model. Elliott could urge the airline to reconsider its long-standing commitment to a single-class cabin and open seating, arguing that offering premium options and assigned seats could attract higher-paying business travelers.

Expanding into more international markets and forming alliances with foreign carriers are other strategic shifts that may be on the table.

Finally, given Elliott's track record, a sale or breakup of Southwest can't be ruled out as an endgame. While such a drastic outcome seems unlikely given Southwest's size and iconic brand, stranger things have happened when activist investors get involved.

Risks and Rewards

As with any activist campaign, Elliott's gambit at Southwest comes with both potential risks and rewards for stakeholders.

On the upside, a successful shakeup could rejuvenate Southwest and position it for long-term success in an evolving industry. By addressing operational inefficiencies, investing in modern technology, and exploring new revenue streams, a reformed Southwest could deliver better returns for shareholders while providing an improved experience for customers and employees.

However, there are also dangers to consider.

Southwest's unique culture and employee-centric approach have been key to its past triumphs.

A heavy-handed activist intervention risks alienating the airline's workforce and eroding the goodwill it has built up over decades. Layoffs, benefit cuts, or other austerity measures could damage morale and lead to labor unrest.

There's also the question of whether Elliott's vision for Southwest aligns with the best interests of all stakeholders.

Activist investors are often criticized for prioritizing short-term gains over long-term stability and growth. A myopic focus on cutting costs and boosting margins could undermine Southwest's ability to invest in its future and weather industry downturns.

The Broader Industry Impact

Beyond the implications for Southwest itself, Elliott's move could have ripple effects across the U.S. airline industry.

If the activist campaign proves successful in driving up Southwest's valuation, it may embolden other investors to target airlines perceived as underperforming. This could lead to a wave of copycat activist plays, putting pressure on carriers to preemptively streamline operations and cut costs to ward off potential threats.

On the other hand, a drawn-out battle or negative outcome at Southwest could have a chilling effect on activist appetite for the sector.

Airlines are notoriously complex and capital-intensive businesses, with thin margins and exposure to high risks like fuel price swings and economic downturns. A high-profile stumble by Elliott could deter other activists from wading into the industry.

Either way, the Southwest situation bears close watching for competitors, investors, and policymakers alike.

The U.S. airline industry has consolidated significantly in recent decades, with the four largest carriers now controlling over 80% of the domestic market. Any major shakeup at one of these players has the potential to reshape competitive dynamics and impact consumers.

So What’s Next?

The ultimate outcome of Elliott's activist campaign at Southwest remains to be seen. The firm's track record suggests it will strongly pursue its agenda, but Southwest's leadership and board may prove resistant to wholesale changes.

In the coming weeks and months, I expect to see a flurry of public statements and behind-the-scenes negotiations as the two sides jockey for position.

Elliott will likely continue to make its case for why change is necessary, while Southwest will defend its current strategy and leadership.

If the stalemate persists, a proxy battle for control of Southwest's board is a real possibility. This would set the stage for a high-stakes showdown at the airline's next annual shareholder meeting, where investors would vote on competing slates of director nominees.

Final Thoughts

Southwest has long been admired for its distinctive culture, loyal customer base, and consistent profitability.

If an activist investor can successfully reshape an airline of Southwest's stature, it would send shockwaves through the sector and potentially invite similar challenges at other carriers.

One thing I can say with confidence is that the coming months will be pivotal for Southwest. The choices made by the airline's leadership, board, and shareholders will have far-reaching consequences not just for the company, but for the U.S. airline industry as a whole.

How Southwest responds to this activist challenge will be a key test of its resilience and adaptability.

Ultimately, the goal should be to ensure that Southwest emerges from this episode as a stronger, more agile, and more sustainable business. Whether that requires a change in leadership, a revamped strategy, or a doubling down on the airline's core strengths remains to be seen.

Overall, Elliott Management's activist campaign at Southwest Airlines represents a watershed moment for the U.S. aviation industry. The coming clash between one of Wall Street's most formidable investors and one of America's most iconic airlines will be closely watched by stakeholders across the sector.

The reverberations from this high-stakes battle will be felt for years to come.