The global aerospace industry stands at a critical juncture as we approach 2026, characterized by record-breaking revenues, unprecedented demand, and transformative technological shifts.

We are witnessing a sector that generated approximately $922 billion in 2024, yet faces significant operational challenges that threaten to constrain growth potential.

This comprehensive analysis examines the multifaceted dynamics shaping the aerospace industry’s trajectory, from commercial aviation and defense sectors to emerging technologies and regional market variations.

Table of Contents

Executive Summary: An Industry at Maximum Capacity

The aerospace and defense sector enters 2026 with contradictory signals. On one hand, the industry posted revenue growth of approximately 4% in 2024, with projections indicating continued expansion.

On the other hand, demand dramatically outstrips supply. Commercial aviation backlogs exceed 14,000 aircraft, equivalent to a decade of production at current rates. Airlines face delays that could cost the industry $11 billion in 2025 alone, driven by production bottlenecks, supply chain fragility, and workforce constraints. Defense budgets continue rising, with US defense spending planned to increase by roughly 15% in fiscal year 2026, yet manufacturers struggle to scale output to meet strategic imperatives.

This report provides aerospace industry professionals, company executives, and analysts with data-driven insights into market dynamics, technological trends, regional opportunities, and strategic imperatives that will define competitive advantage through 2030 and beyond.

Market Size and Growth Projections: Understanding the Numbers

Global Market Valuation and Forecast Trajectory

The aerospace industry demonstrates robust fundamentals despite operational constraints. Different research methodologies yield varying projections, but all point toward substantial growth:

Market Segment | 2024 Value | 2025 Value | Projected 2030 Value | CAGR | Source |

|---|---|---|---|---|---|

Global A&D Market | $885.20 billion | $846.94 billion | $1.3 trillion | 8.2-8.64% | Zion Market Research |

Aerospace Manufacturing | N/A | $789.25 billion | $900+ billion | 2.76% | Statista |

US A&D Industry | N/A | $995 billion | $1.2 trillion | N/A | AIA Aerospace |

Commercial Aerospace | $322.77 billion | $340.04 billion | $420.06 billion | 5.3% | Research and Markets |

The US aerospace and defense industry contributed $443 billion in economic value, $257 billion in labor income, and maintained a $73.86 billion trade surplus that underscores America’s global leadership position.

Revenue Distribution Across Segments

The aerospace industry comprises three primary revenue streams, each exhibiting distinct growth patterns and market dynamics:

Commercial Aviation: This segment represents the largest single revenue source, driven by passenger aircraft demand, cargo operations, and associated services. Boeing’s Commercial Market Outlook 2025-2044 projects that airlines worldwide will need more than 44,000 new airplanes over the next 20 years, valued at $8.5 trillion. The recovery in global air travel, coupled with fleet modernization requirements, sustains robust order books despite delivery delays.

Defense and Military Aviation: Global defense spending reached record levels in 2024, with military budgets growing 9% year-over-year. The US military spending rose to $801 billion from $778.23 billion, representing nearly 38% of global military expenditure. Defense priorities are shifting toward autonomous systems, hypersonic weapons, space capabilities, and cyber warfare technologies.

Space Industry: The commercial space sector experienced explosive growth, with the global space economy reaching a record $613 billion in 2024. Industry forecasts project this will expand to $1.8 trillion within 10 years, driven by satellite constellations, launch services, space tourism, and emerging lunar economy initiatives.

Commercial Aviation: Demand Outpacing Production Capacity

Aircraft Backlog Crisis and Delivery Constraints

The commercial aviation sector faces an unprecedented backlog situation that fundamentally constrains industry growth. As of mid-2025, global aircraft backlogs topped 14,000 units, representing approximately 10 years of production at current delivery rates. This backlog reflects both strong underlying demand and manufacturers’ inability to scale production adequately.

Boeing and Airbus, the duopoly that controls the large commercial aircraft market, continue struggling with production ramp-up challenges. Through October 2025, Boeing delivered 440 aircraft and needed to average 50 deliveries per month for the remainder of the year to reach annual targets. Airbus maintains a delivery lead but faces its own constraints, particularly with the A350 program where output remains below planned rates.

Impact on Airlines and Operating Economics

The slow pace of aircraft production creates cascading economic consequences throughout the aviation value chain. According to IATA analysis, supply chain challenges could cost airlines more than $11 billion in 2025, driven by four primary factors:

Excess fuel consumption: Delayed deliveries of new, fuel-efficient aircraft force airlines to operate older, less efficient jets longer than planned

Higher maintenance costs: Extended service life for aging aircraft increases unscheduled maintenance events and parts replacement

Lost revenue opportunities: Inability to expand capacity limits airlines’ ability to capture growing travel demand

Competitive disadvantage: Airlines receiving delayed deliveries cede market share to competitors with newer fleets

The Oliver Wyman Fleet & MRO Forecast confirms these cost estimates and projects that production constraints will persist through at least 2027, preventing airlines from optimizing fleet composition and operational efficiency.

Boeing vs. Airbus Competitive Dynamics

The competition between Boeing and Airbus reached a pivotal moment in October 2025, when the Airbus A320 family overtook the Boeing 737 as the most-delivered jetliner in history, with 12,260 total deliveries. This milestone reflects Boeing’s crisis period following the 737 MAX accidents in 2018-2019, which created lasting reputational and regulatory challenges.

Current order and delivery patterns show:

Manufacturer | 2025 YTD Orders (Oct) | 2025 YTD Deliveries (Oct) | Key Programs | Outlook 2026 |

|---|---|---|---|---|

Boeing | Leading in orders | 440 aircraft | 737 MAX, 787, 777X | Production stabilization |

Airbus | Strong order intake | Maintaining lead | A320 family, A350 | A220 rate reduction to 12/month |

Airbus revised its 2026 A220 production target downward from 14 aircraft per month to 12, reflecting soft order environment and program backlog realities. Meanwhile, Boeing plans to expand 787 Dreamliner production in 2026 before further expansion in 2027, as the widebody market shows renewed strength.

Regional Aircraft and Emerging Segments

Beyond the Boeing-Airbus duopoly, regional aircraft manufacturers and new entrants are carving market niches. The narrowbody segment dominates projections, with narrowbody aircraft representing 75% of the projected 21,000+ global deliveries through 2035. Single-aisle aircraft demand is particularly strong in Asia-Pacific, where air liberalization and low-cost carrier growth stimulate robust traffic growth.

The Aviation Week Commercial Fleet & MRO Forecast projects that more than 42,000 commercial engines will be delivered over the 2026-2035 period, with narrowbody powerplants accounting for the majority of units.

Defense and Military Aerospace: Strategic Priorities and Budget Realities

Global Defense Spending Trends and Drivers

The defense aerospace sector experiences a fundamentally different demand environment than commercial aviation. While commercial markets are constrained by production capacity, defense markets face budget allocation decisions shaped by geopolitical tensions, technological competition, and strategic doctrine evolution.

Global defense budgets grew 9% in 2024, reaching unprecedented levels as nations respond to intensifying great power competition, regional conflicts, and emerging threat domains. The United States maintains its position as the dominant defense spender, with the Pentagon’s FY 2026 budget proposal seeking to increase defense spending domestically by approximately 15%.

However, budget growth does not translate uniformly across all programs. The US defense budget shows significant priority shifts, with the Pentagon cutting F-35 procurements by 45-50% in favor of missiles, drones, and next-generation platforms like the Next Generation Air Dominance (NGAD) fighter and collaborative combat aircraft.

Military Aircraft Programs and Modernization

Traditional manned fighter and bomber programs face increasing competition from unmanned systems, but they remain central to air power projection. Key program trends include:

Fighter Aircraft: Fifth-generation platforms like the F-35 Joint Strike Fighter continue production, though at reduced rates in the US budget. International F-35 partners, however, maintain strong demand. Sixth-generation programs, including NGAD in the US and Tempest in the UK, progress toward initial operational capability in the 2030s.

Bombers and Strike Aircraft: The B-21 Raider program advances toward initial deliveries, representing the future of long-range strike capability. The US Air Force plans to procure at least 100 B-21s, replacing aging B-1 and B-2 fleets.

Transport and Tanker Aircraft: Military airlift and aerial refueling capabilities remain priorities. The Boeing KC-46 Pegasus continues deliveries despite ongoing technical issues, while Airbus successfully markets the A330 MRTT internationally.

Rotorcraft: The US Army’s Future Vertical Lift program seeks to replace thousands of helicopters with tiltrotor and compound helicopter designs offering greater speed, range, and survivability.

Unmanned Systems and Autonomous Platforms

The most dramatic shift in defense aerospace involves the proliferation of unmanned aerial systems (UAS) and autonomous technologies. Deloitte’s 2026 A&D Outlook identifies AI and agentic AI as transformative forces reshaping defense capabilities.

Defense applications for autonomous systems include:

Intelligence, Surveillance, Reconnaissance (ISR): Long-endurance UAVs provide persistent battlefield awareness

Strike Operations: Armed drones conduct precision targeting with reduced risk to personnel

Loyal Wingman Concepts: Unmanned aircraft operate in formation with manned fighters, providing sensor capacity and weapons carriage

Swarming Tactics: Large numbers of low-cost drones overwhelm adversary air defenses through coordinated autonomous behavior

Contested Logistics: Autonomous cargo delivery systems supply forward positions without risking pilots

The US Department of Defense awarded contracts to four leading AI companies to accelerate AI adoption across critical mission areas, signaling institutional commitment to autonomous capability development.

Space and Missile Defense

Space domain awareness and protection constitute growing defense priorities. The US Space Force’s Data and AI Strategic Action Plan for FY2025 prioritizes enterprise-wide data and AI governance, rapid analytics adoption, and deeper partnerships across government, industry, and academia.

Missile defense systems receive sustained investment as hypersonic weapons proliferate. The US, China, Russia, and other nations race to field both hypersonic strike capabilities and countermeasures, creating a technology competition with significant aerospace industry implications.

Space Industry: Commercial Expansion and New Frontiers

Commercial Space Market Explosion

The commercial space sector transitioned from niche market to major growth driver during the 2020s. The global space economy reached $613 billion in 2024 and is projected to grow to $1.8 trillion by 2034, representing nearly threefold expansion over a decade.

Several factors propel this extraordinary growth:

Launch Cost Reduction: Reusable rocket technology, pioneered by SpaceX and increasingly adopted by competitors, dramatically reduced the cost per kilogram to orbit. This economic transformation unlocked new business models previously infeasible at higher launch prices.

Satellite Constellation Deployment: Large-scale low Earth orbit (LEO) constellations for broadband communications, Earth observation, and other applications drive unprecedented satellite manufacturing and launch demand. The commercial satellite industry accounted for $293 billion, representing 71% of the world’s space economy in 2024.

Space Tourism and Human Spaceflight: Private companies achieved regular suborbital tourist flights and progressed toward orbital tourism capabilities, creating entirely new market segments.

Lunar Economy Emergence: Multiple nations and companies pursue lunar exploration, resource utilization, and permanent presence initiatives, laying groundwork for cislunar economic activity.

Launch Industry Dynamics

The launch services market experienced record activity levels in 2025. According to The Space Report 2025 Q2, the first half of 2025 witnessed a liftoff to orbit every 28 hours from January 1 to June 30, six hours faster than the annual record set in 2024. With 81 launches through June 30, SpaceX accounted for more than half of the world’s 149 launches during this period.

This launch frequency represents a paradigm shift in space access. The FAA’s Commercial Space Transportation forecast projects continued growth as launch providers scale operations and new entrants bring additional capacity online.

Launch market concentration raises concerns about monopolistic dynamics, but new competitors are emerging. China significantly expanded its launch capabilities, both government and commercial. European providers, including Arianespace and emerging startups, work to maintain market relevance. India’s space program pursues commercial opportunities beyond traditional government missions.

Satellite Manufacturing and Services

The satellite manufacturing sector transformed from building a few dozen large, expensive satellites annually to producing thousands of smaller, standardized satellites. This industrialization of satellite production requires fundamentally different manufacturing approaches, supply chain structures, and quality assurance methodologies.

Satellite industry growth was powered by historic launch numbers in 2024, with commercial satellite industry revenues increasing substantially. The sector demonstrates maturity in applications including:

Communications: Broadband internet, particularly serving underserved regions

Earth Observation: Agricultural monitoring, disaster response, climate science, defense intelligence

Navigation: Augmentation of GPS/GNSS services with commercial alternatives

Space Situational Awareness: Tracking orbital debris and active satellites

Scientific Research: Astronomy, planetary science, fundamental physics

Supply Chain Crisis: The Industry’s Achilles Heel

Understanding the Bottlenecks

Supply chain constraints represent the single most significant impediment to aerospace industry growth in 2025-2026. Despite record order books and strong demand signals, manufacturers cannot translate orders into deliveries at planned rates due to systemic supply chain fragility.

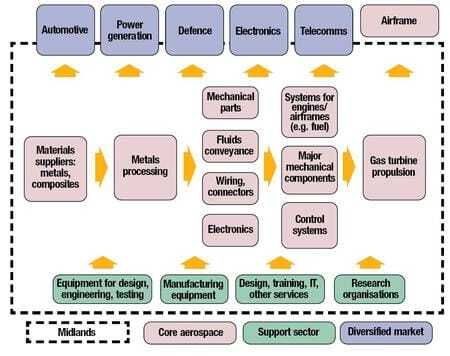

Image source: midlandsaerospace.org.uk

A Roland Berger survey conducted in 2025 found that 65% of aerospace companies still lack key resources to support production ramp-up, with personnel shortages identified as the most acute constraint. This represents minimal improvement from the 2024 survey, indicating that supply chain recovery progresses more slowly than anticipated.

The aerospace supply chain exhibits unique characteristics that exacerbate vulnerability:

Extreme Complexity: A modern commercial aircraft contains approximately 2.5 million parts sourced from thousands of suppliers across multiple countries. A single missing component can ground an entire aircraft.

Long Lead Times: Critical aerospace components require extensive manufacturing periods, often 12-24 months from order to delivery. This creates pipeline problems when demand increases suddenly.

Stringent Quality Requirements: Aerospace quality standards exceed those in virtually any other industry, requiring extensive testing, certification, and traceability. These requirements limit the supplier base and create bottlenecks at specialized vendors.

Capacity Constraints: Many aerospace suppliers operate near maximum capacity with limited ability to expand quickly. Capital intensity and skilled workforce requirements prevent rapid scaling.

Single-Source Dependencies: For many specialized components, only one qualified supplier exists globally. Any disruption at that supplier cascades throughout the entire supply chain.

Specific Constraint Areas

IATA’s analysis of the production slowdown identifies four primary constraint categories:

Raw Materials: Titanium, specialized aluminum alloys, composites, and other aerospace-grade materials face availability challenges. Geopolitical factors, including export restrictions and trade tensions, complicate sourcing strategies.

Engines and Propulsion: Engine manufacturers, particularly Pratt & Whitney and Rolls-Royce, experienced significant quality issues and production delays that ripple through airframe assembly schedules. The Pratt & Whitney GTF engine recall affected hundreds of aircraft, forcing early removal and inspection.

Avionics and Electronics: Semiconductor shortages, while improving from pandemic-era lows, continue impacting aerospace electronics production. The specialized nature of aerospace-qualified chips means consumer electronics recovery doesn’t automatically resolve aerospace constraints.

Structural Components: Forgings, castings, and machined parts from lower-tier suppliers represent persistent bottlenecks. Many of these suppliers are small to medium enterprises with limited capital for capacity expansion.

Industry Response Strategies

Aerospace companies pursue multiple strategies to address supply chain fragility, as outlined in Deloitte’s 2026 A&D Outlook:

Strategy | Description | Implementation Challenges | Expected Impact Timeline |

|---|---|---|---|

Vertical Integration | Acquiring suppliers or bringing production in-house | High capital requirements, cultural integration | 2-3 years |

Dual-Sourcing | Qualifying multiple suppliers for critical parts | Expensive qualification process, limited candidates | 18-24 months |

Supplier Development | Investing in supplier capacity and capabilities | Requires sustained commitment, uncertain ROI | 12-18 months |

Digital Supply Chain | AI-enabled visibility, predictive analytics | Technology maturity, data integration complexity | 6-12 months |

Long-Term Contracts | Guaranteeing volumes to encourage supplier investment | Reduces flexibility, carries commitment risk | Immediate for future capacity |

Reshoring/Nearshoring | Reducing geographic supply chain length | Higher labor costs, limited manufacturing base | 2-4 years |

The Roland Berger Aerospace Supply Chain Report 2025 concludes that supply chain stabilization will require sustained effort through at least 2027, with some constraint areas potentially extending beyond that timeframe.

Workforce Crisis: The Human Capital Challenge

Scale of the Talent Shortage

The aerospace industry faces a workforce crisis of historic proportions that threatens to constrain growth even if supply chain and production issues resolve. The A&D workforce reached 2.23 million employees in 2024, but critical talent shortages persist in engineering and skilled trades.

Deloitte’s 2025 Aerospace and Defense Industry Outlook reports that the A&D sector continued experiencing talent attraction and retention challenges throughout 2024 and into 2025, with no signs of easing pressure. The industry requires tens of thousands of additional workers annually just to maintain current production rates, let alone support planned expansions.

The talent shortage manifests across multiple skill categories:

Aerospace Engineers: Aircraft design, systems integration, propulsion, structures, and software engineering positions remain difficult to fill. Competition from technology companies offering more attractive compensation packages and work environments drains the aerospace talent pipeline.

Skilled Trades: Machinists, sheet metal workers, composite technicians, aircraft assemblers, and quality inspectors represent critical shortages. These roles require extensive training and certification but often receive less compensation and recognition than engineering positions.

Software and Digital Talent: As aerospace products become increasingly software-defined, demand surges for software engineers, cybersecurity specialists, data scientists, and AI/ML experts. Aerospace companies struggle to compete with tech industry compensation and culture.

Supply Chain and Operations: Planners, buyers, logistics specialists, and manufacturing engineers who understand aerospace’s unique requirements are in short supply as industry veterans retire.

Maintenance and Repair: The aftermarket sector faces acute shortages of licensed mechanics and technicians as commercial and military fleets expand.

Demographic and Retirement Challenges

The aerospace workforce skews older than many industries, with a significant portion of experienced workers approaching retirement age. McKinsey’s AIA Annual Workforce Study 2025 analyzes trends related to talent attraction, retention, and productivity within the aerospace and defense sector, highlighting the urgency of succession planning and knowledge transfer.

The “silver tsunami” of retirements carries several risks:

Knowledge Loss: Decades of accumulated expertise walks out the door as veterans retire, particularly for legacy programs

Production Disruption: Insufficient trained replacements slows production even when parts availability improves

Quality Issues: Less experienced workforces make more errors, increasing rework and reducing first-time quality rates

Training Burden: Simultaneously training large cohorts of new workers strains internal training infrastructure and mentor availability

AI-Driven Workforce Transformation

Artificial intelligence presents both a challenge and potential solution to workforce constraints. AI can augment human capabilities, allowing fewer workers to maintain higher productivity levels. However, implementing AI requires its own specialized talent, intensifying competition for data scientists and AI engineers.

Deloitte’s analysis reveals that data science, data engineering, AI, data analysis, machine learning, and statistical analysis represent the fastest-growing skills between 2024 and 2028. The percentage of industry-wide job postings requiring data analysis skills is projected to increase from 9% in 2025 to nearly 14% by 2028, while demand for data science skills is expected to grow from 3% to 5% during the same period.

This shift toward AI-augmented aerospace work demands that companies simultaneously address traditional workforce shortages while building entirely new capability categories.

Technological Innovation: Key Trends Reshaping the Industry

Artificial Intelligence and Machine Learning Integration

Artificial intelligence represents the most significant technological shift in aerospace since the introduction of fly-by-wire systems. Deloitte’s 2026 A&D Outlook positions AI and agentic AI as transformative forces, though adoption proceeds unevenly due to safety requirements and regulatory constraints.

Current AI applications in aerospace include:

Design and Engineering: AI-powered generative design tools optimize component geometry for weight, strength, and manufacturability. Engineers using AI can model aircraft performance with unprecedented accuracy, cutting development cycles and costs by up to 30%.

Manufacturing and Quality Control: Machine vision systems powered by AI detect defects that human inspectors might miss. Predictive quality models identify process deviations before they produce defective parts, reducing scrap and rework.

Predictive Maintenance: AI analyzes sensor data from aircraft systems to predict component failures before they occur. Airlines using AI-powered predictive maintenance reduce unscheduled downtime and optimize parts inventory.

Supply Chain Optimization: AI models demand patterns, optimizes inventory levels, and identifies supply chain risks. Manufacturing companies increasingly adopt AI-powered systems to analyze sensor data, detect anomalies, and predict maintenance needs.

Flight Operations: AI-based scheduling systems optimize crew assignments, route planning, and fuel efficiency. Some aircraft manufacturers experiment with AI copilot systems, though full autonomy for commercial aircraft remains distant.

Mission Planning and Execution: Military applications leverage AI for tactical decision support, threat assessment, and autonomous weapon systems. The US Air Force completed Decision Advantage Sprint experiments demonstrating how AI enables faster, smarter decisions in complex battlespaces.

According to International Data Corporation forecasts, US A&D spending on AI and generative AI is expected to reach $5.8 billion by 2029, 3.5 times higher than 2025 levels. The global aerospace AI market is projected to reach $34.14 billion by 2033, with a compound annual growth rate of 43% from 2025 to 2033.

Sustainable Aviation and Environmental Technologies

Environmental sustainability dominates commercial aerospace innovation priorities. The aviation industry committed to achieving net-zero carbon emissions by 2050, requiring transformative technological changes across propulsion, fuels, materials, and operations.

Image source: startpac.com

Sustainable Aviation Fuel (SAF): SAF production faces significant economic challenges due to high feedstock costs and conversion process expenses. The EU Regulation mandates that at least 2% of fuels taken onboard aircraft at EU airports in 2025 must be SAF, with this percentage increasing progressively.

Hydrogen Propulsion: Hydrogen-electric propulsion represents the most viable long-term pathway for zero-emission aviation, though significant technical challenges remain. Airbus tests hydrogen combustion engines on modified aircraft under the ZEROe programme, targeting entry into service in the 2030s.

Electric and Hybrid-Electric Aircraft: Battery technology limits pure electric propulsion to small aircraft and short ranges. Hybrid-electric concepts, combining conventional engines with electric motors, offer efficiency improvements for regional aircraft. Several manufacturers pursue electric vertical takeoff and landing (eVTOL) aircraft for urban air mobility applications.

Advanced Materials and Manufacturing: Composite materials reduce aircraft weight, improving fuel efficiency. Additive manufacturing (3D printing) enables complex geometries impossible with traditional manufacturing, reducing part count and weight. These technologies contribute incrementally to emissions reduction while offering cost and performance benefits.

Urban Air Mobility and eVTOL Aircraft

Electric vertical takeoff and landing (eVTOL) aircraft represent an emerging segment with substantial long-term potential. The global eVTOL aircraft market is valued at $1.19 billion in 2025 and is projected to reach $4.36 billion by 2030, growing at a CAGR of 29.65%.

The urban air mobility market size was valued at $4.21 billion in 2024 and is projected to grow from $5.00 billion in 2025 to $14.64 billion by 2032. These projections reflect optimistic scenarios; actual market development depends on regulatory approval, infrastructure availability, public acceptance, and operational economics proving viable.

Several companies race toward certification and commercial operations:

Joby Aviation: Leading US eVTOL developer with significant investment from Toyota and others

Vertical Aerospace: UK-based company with substantial pre-orders from airlines

Eve Air Mobility: Embraer spinoff leveraging established aerospace expertise

Lilium: German developer pursuing a unique ducted fan design

Archer Aviation: US company backed by United Airlines and Stellantis

Regulatory pathways for eVTOL certification remain complex and time-consuming. The FAA and EASA work to establish certification standards that ensure safety while not being so burdensome as to prevent market development. Japan plans to showcase urban air mobility using eVTOLs at the 2025 World Expo, potentially demonstrating operational viability.

Hypersonic and Advanced Propulsion

Hypersonic flight, generally defined as speeds exceeding Mach 5, represents a strategic priority for military applications and holds potential for ultra-fast commercial travel. Multiple nations pursue hypersonic weapons capable of defeating existing air defenses through sheer speed and maneuverability.

Technical challenges include:

Thermal Management: Hypersonic speeds generate extreme heating requiring advanced materials and cooling systems

Propulsion: Scramjet engines operate at hypersonic speeds but present significant design and control challenges

Guidance and Control: Hypersonic vehicles experience unique aerodynamic and control challenges

Ground Testing: Replicating hypersonic flight conditions in ground facilities proves extremely difficult and expensive

Commercial hypersonic travel, while technically feasible, faces enormous economic and regulatory hurdles. Several startups pursue hypersonic passenger aircraft concepts, but operational service remains unlikely before the 2030s at earliest.

Aftermarket Services and MRO: The Industry’s Profit Engine

Market Size and Growth Dynamics

The maintenance, repair, and overhaul (MRO) sector represents aerospace’s most stable and profitable segment. The global commercial aftermarket MRO demand is projected to grow at a 3.2% CAGR between 2026 and 2035, with increasing focus on engine maintenance.

According to Oliver Wyman’s Global Fleet & MRO Market Forecast 2025-2035, the MRO market will reach $119 billion in 2025 and $156 billion by 2035. Narrowbody aircraft will dominate MRO demand throughout this period, reflecting the segment’s fleet size and utilization rates.

The Aviation Week forecast notes that the engine segment’s share of total MRO demand is expected to rise to 53%, reflecting faster growth compared to other MRO categories. This shift results from increasing engine complexity, longer aircraft operational life, and airlines’ preference for power-by-the-hour maintenance agreements.

Competitive Landscape and Regional Shifts

The MRO market exhibits regional concentration, with major hubs in North America, Europe, and Asia-Pacific. However, the competitive landscape is shifting as new players emerge and capacity expands.

Original Equipment Manufacturers (OEMs): Engine manufacturers like GE Aerospace, Pratt & Whitney, and Rolls-Royce maintain significant aftermarket revenue through proprietary parts and service contracts. Airframe OEMs increasingly expand service capabilities to capture higher-margin aftermarket revenues. Several firms announced ambitious capacity increases, with some targeting 40-50% expansions over the next five years.

Independent MRO Providers: Companies like AAR Corp, StandardAero, and ST Engineering offer alternatives to OEM service. These independents compete on price and flexibility, particularly for older aircraft where OEM parts availability declines.

Airline In-House Operations: Large airlines maintain substantial internal MRO capabilities for their fleets. Some, like Lufthansa Technik and Singapore Airlines Engineering, developed third-party business serving other airlines.

Regional Players: The Middle East rapidly scales MRO networks, with emerging players investing heavily in facilities and capabilities. This reduces reliance on concentrated hubs and aligns capacity closer to where fleets operate.

Technology Integration in Aftermarket Services

Digital transformation pervades the aftermarket sector, fundamentally changing how MRO providers operate. Many firms pilot AI-enabled inspection systems to accelerate turnaround times and improve accuracy, reflecting a broader industry push to embed digital tools in aftermarket processes.

Key technology trends include:

Predictive Maintenance: AI analyzes real-time data collected from aircraft sensors to anticipate potential failures, allowing airlines to schedule maintenance proactively rather than reactively. This reduces unscheduled maintenance events and optimizes parts inventory.

Digital Twin Technology: Virtual representations of physical aircraft enable simulation of maintenance scenarios, optimization of procedures, and training without taking aircraft out of service.

Blockchain for Parts Traceability: Distributed ledger technology provides tamper-proof records of parts provenance, maintenance history, and certification status, addressing counterfeit parts concerns.

Augmented Reality (AR) Maintenance: Technicians use AR headsets to access real-time information, step-by-step procedures, and remote expert assistance while performing maintenance tasks.

Automated Inspection: Drones and robots equipped with advanced sensors inspect aircraft exteriors and difficult-to-access areas more quickly and thoroughly than manual inspection.

The shift from isolated analytics to orchestrated, embedded workflows spans inspection, predictive health, inventory positioning, and repair scheduling, creating integrated digital ecosystems that optimize entire maintenance value chains.

Regional Market Analysis: Global Variations and Opportunities

North America: Market Leadership and Innovation Hub

North America holds approximately 43% of the global aerospace market share, maintaining its position as the industry’s dominant region. This leadership reflects several factors:

Manufacturing Concentration: The United States hosts the largest aerospace manufacturing base globally, including Boeing, Lockheed Martin, Northrop Grumman, General Dynamics, and thousands of suppliers. Canada contributes through Bombardier (business jets), CAE (flight simulators), and a sophisticated aerospace supply chain.

Defense Spending: US defense budgets dwarf those of other nations, driving demand for military aircraft, space systems, and advanced technologies. The industry generated over $995 billion in 2024, with defense representing a substantial portion.

Innovation Ecosystem: North America’s technology sector, venture capital availability, research universities, and entrepreneurial culture foster aerospace innovation. Most eVTOL companies, space startups, and advanced air mobility ventures base operations in the US.

Commercial Aviation: Major airlines based in North America represent significant customers for both aircraft and aftermarket services. The region’s large domestic market supports aviation industry scale.

Challenges facing North American aerospace include:

Workforce shortages more acute than in other regions

Manufacturing costs higher than in emerging aerospace nations

Export control regulations complicating international business

Political uncertainties affecting defense budget stability

Europe: Technological Excellence and Collaboration

Europe accounts for approximately 27% of global aerospace market share, anchored by Airbus and a sophisticated supply chain spanning multiple countries. European aerospace strengths include:

Airbus Leadership: As Boeing’s primary competitor, Airbus drives substantial economic activity across Europe. Final assembly occurs in France, Germany, Spain, and China, with component manufacturing distributed across the continent.

Defense Collaboration: European nations increasingly cooperate on defense programs to share costs and achieve interoperability. The Tempest sixth-generation fighter program brings together the UK, Italy, and Sweden. The Future Combat Air System (FCAS) unites France, Germany, and Spain.

Regulatory Framework: The European Union Aviation Safety Agency (EASA) maintains high certification standards, though some industry participants argue that regulatory conservatism slows innovation relative to other regions.

Environmental Leadership: European regulations drive sustainable aviation initiatives, including SAF mandates and emissions trading schemes. This regulatory environment pushes technological development but increases costs.

Regional Integration: Despite political complexity, European aerospace benefits from integrated supply chains, cross-border investment, and collaborative research programs.

European aerospace faces challenges including:

Brexit complications for UK-EU supply chains and regulatory alignment

Economic disparities between northern and southern European nations

Difficulty competing with lower-cost Asian manufacturing

Defense spending below US levels, limiting military aerospace market size

Asia-Pacific: Rapid Growth and Emerging Capabilities

The Asia-Pacific region contributes roughly 18% of global aerospace market activity, but this share is rising rapidly driven by several factors:

Commercial Aviation Growth: Asia-Pacific leads global air traffic growth, driven by rising middle-class populations, economic development, and geographic factors favoring air travel. Boeing’s Commercial Market Outlook projects that single-aisle airplanes will comprise the majority of Asia-Pacific deliveries through 2044, supported by low-cost carrier expansion.

Indigenous Aerospace Development: China developed the COMAC C919 narrowbody airliner, challenging the Boeing-Airbus duopoly in its home market. While international sales remain limited due to certification and political factors, the C919 represents China’s aerospace ambitions. Japan pursues its own regional jet program, while South Korea invests heavily in aerospace capabilities.

Manufacturing Base: Asia-Pacific increasingly hosts aerospace manufacturing, from component production to final assembly. Labor cost advantages, improving technical capabilities, and government support attract investment from Western OEMs.

Space Programs: China, India, and Japan operate ambitious space programs including lunar missions, Mars probes, and satellite constellations. These programs drive domestic aerospace industry development.

Defense Modernization: Regional tensions fuel defense spending growth, particularly in military aviation. China’s military aircraft procurement supports indigenous manufacturers while also including Russian imports. Japan, South Korea, Australia, and others modernize air forces with both domestic and imported aircraft.

Asia-Pacific aerospace challenges include:

Technology gaps relative to Western aerospace leaders

Certification barriers for indigenous aircraft seeking international markets

Geopolitical tensions complicating cross-border aerospace trade

Intellectual property concerns deterring technology transfer

Middle East: Investment and MRO Hub Development

The Middle East & Africa region represents about 7% of global aerospace activity, but the Middle East specifically punches above its weight in certain sectors.

Major Airlines: Emirates, Qatar Airways, Etihad, and Saudi Arabian Airlines operate large, modern fleets and drive substantial aircraft demand. These carriers’ hub-and-spoke models support long-haul widebody aircraft that generate high per-unit revenue for manufacturers.

MRO Growth: The region invests heavily in MRO infrastructure, seeking to capture aftermarket revenue from aircraft transiting Middle Eastern hubs. According to industry analysis, the aviation sector in the Middle East is positioned for unprecedented growth over the next two decades, with the aviation industry set to more than double its economic impact by 2043.

Sovereign Wealth Investment: Middle Eastern sovereign wealth funds invest in Western aerospace companies, acquiring technology access and financial returns. These investments sometimes include offsets requiring local manufacturing or technology transfer.

Space Ambitions: The UAE achieved Mars orbit in 2021 and pursues lunar exploration. These programs, while modest compared to major space powers, signal regional aerospace ambitions beyond aviation.

Latin America: Market Development and Opportunities

Latin America contributes approximately 5% of global aerospace market activity. Brazil dominates regional aerospace through Embraer, the world’s third-largest commercial aircraft manufacturer (focused on regional jets and business aircraft).

Regional aviation growth potential remains substantial, but economic volatility, infrastructure limitations, and political instability constrain development. Airlines in Latin America represent an important market for narrowbody aircraft as air travel gradually replaces long-distance bus travel for middle-class populations.

Cybersecurity: The Growing Digital Threat

Cyber Risk in Modern Aerospace

As aerospace systems become increasingly digitized and interconnected, cybersecurity emerges as a critical concern affecting safety, operations, and competitive advantage. Aviation cybersecurity spending is projected to climb from $10 billion in 2025 to nearly $16 billion by 2032, reflecting the escalating threat environment.

Modern aircraft contain millions of lines of software code controlling flight systems, navigation, passenger services, and maintenance reporting. Ground systems managing air traffic control, airline operations, and supply chains present additional attack surfaces. A successful cyberattack could have catastrophic consequences ranging from flight safety incidents to operational disruption to theft of proprietary technology.

Threat Landscape and Attack Vectors

Cyber threats in aerospace span multiple vectors:

Aircraft Systems: While commercial aircraft flight-critical systems maintain air gaps from passenger-accessible networks, researchers demonstrated theoretical attack paths exploiting maintenance interfaces or in-flight entertainment systems. Defense aircraft face nation-state cyber threats seeking to compromise mission systems.

Supply Chain: Aerospace supply chains present numerous cyber vulnerabilities, from design files stolen from suppliers to counterfeit parts with embedded malware. The complexity and global nature of aerospace supply chains complicate security.

Air Traffic Control: ATC systems represent high-value targets where successful attacks could disrupt entire aviation networks. Legacy technologies in some ATC systems increase vulnerability.

Airline Operations: Reservation systems, crew scheduling, maintenance management, and logistics all depend on IT systems vulnerable to ransomware, data theft, and operational disruption.

Manufacturing Systems: As aerospace manufacturers adopt Industry 4.0 technologies including connected sensors, robots, and AI, they expand their cyber attack surface. Industrial control systems often lack robust security.

Mergers, Acquisitions, and Industry Consolidation

M&A Market Trends

The aerospace and defense M&A landscape in 2025 reflects strategic repositioning rather than the mega-mergers that characterized earlier decades. While 2024 deal activity remained stable, it stayed below 2019 peaks, with companies moving cautiously and focusing on integration success and long-term transformation.

The aerospace M&A market is projected to grow from $218 billion in 2025 to $382 billion by 2030, with a strong CAGR of 11.86%. Focus shifted from large cost-cutting mergers to strategic, innovation-driven acquisitions aimed at enhancing technology, global reach, and supply chain resilience.

Strategic Drivers for Consolidation

KPMG’s Emerging Trends in Aerospace and Defense 2025 identifies supply chain constraints as creating challenges and opportunities for consolidation. Several factors drive M&A activity:

Supply Chain Resilience: Prime contractors acquire suppliers to secure critical component supplies and improve delivery predictability. Vertical integration reduces dependence on constrained suppliers and captures margin from multiple value chain tiers.

Technology Acquisition: Established aerospace companies acquire startups and technology firms to access capabilities in AI, autonomy, advanced materials, and software. Traditional aerospace development cycles move too slowly to build these capabilities organically.

Scale Economics: In an industry characterized by high fixed costs and learning curve effects, scale provides competitive advantage. Consolidation among tier-2 and tier-3 suppliers continues as larger platforms emerge.

Geographic Expansion: M&A enables entry into new markets or establishment of local presence required by offset agreements and nationalistic procurement policies.

Capability Portfolios: Companies seek to offer comprehensive solutions rather than point products, driving acquisition of complementary capabilities. Defense primes particularly pursue this strategy to position as systems integrators.

Talent Acquisition: Some acquisitions primarily target engineering teams and technical expertise rather than products or facilities. This “acqui-hiring” approach addresses talent scarcity.

Key Challenges and Risks Through 2026

Production Rate Limitations

The fundamental constraint facing aerospace in 2026 is the gap between demand and production capacity. Despite record order backlogs, manufacturers cannot translate orders into deliveries quickly enough to satisfy customers or optimize their own financial performance. This production constraint reflects:

Supply chain bottlenecks creating unpredictable parts shortages

Workforce limitations preventing labor-intensive assembly scaling

Quality issues requiring production slowdowns to prevent defect propagation

Regulatory oversight constraining production rate increases after safety incidents

Resolution of these constraints will take years, meaning that production limitations will define industry performance through at least 2027-2028.

Financial Pressure and Working Capital

Aerospace manufacturers face intense working capital requirements as production scales. Paying suppliers for components months before aircraft delivery generates significant cash flow demands. Boeing projected a free operating cash flow deficit of approximately $2.5 billion in 2025, turning positive $3 billion in 2026, including 777X factors.

Airlines also face financial strain from delayed aircraft deliveries forcing expensive extension of aging aircraft operation. The $11 billion cost from supply chain delays in 2025 affects airline profitability and potentially reduces future aircraft orders if financial stress intensifies.

Geopolitical Tensions and Trade Restrictions

The aerospace industry operates globally but faces increasing geopolitical fragmentation. US-China technology competition results in export controls limiting technology transfer and cooperation. Russian aerospace isolation following Ukraine invasion removed a significant titanium supplier and export market.

Tariffs and trade tensions complicate supply chain management and market access. The fiscal year 2026 planning must account for tariffs and trade policy uncertainties affecting both costs and market access.

Certification and Regulatory Evolution

Aviation safety regulation necessarily operates conservatively, but this creates tension with industry desires to innovate rapidly. Certification timelines for new aircraft and technologies remain lengthy and expensive. eVTOL aircraft certification progresses slowly as regulators develop appropriate standards for this novel category.

Defense acquisition reform seeks to accelerate fielding of new capabilities, but implementation faces bureaucratic inertia and legitimate concerns about cutting corners on testing and evaluation.

My Final Thoughts: Outlook for 2026 and Beyond

The global aerospace industry enters 2026 with contradictory signals that will take years to resolve. Demand remains exceptionally strong across commercial, defense, and space segments. Order backlogs guarantee multi-year production runs. New technologies promise to transform capabilities and efficiency.

However, the industry cannot capitalize fully on these opportunities due to fundamental constraints in supply chains, workforce, and production infrastructure.

Several scenarios could significantly affect industry trajectory:

Optimistic Scenario: Supply chains stabilize faster than expected as investments in capacity and resilience bear fruit. Workforce development programs successfully attract talent. Production rates increase steadily. New technologies including SAF, AI, and autonomous systems mature on schedule. The industry enters a sustained period of profitable growth benefiting all stakeholders.

Base Case Scenario: Supply chain and workforce constraints persist through 2027-2028 before gradually easing. Production rates increase slowly. Financial pressure mounts on manufacturers and airlines but remains manageable. Technology adoption proceeds unevenly. Some companies execute well and gain market share while others struggle. Industry consolidation accelerates.

Pessimistic Scenario: Supply chain disruptions worsen due to geopolitical shocks or major supplier failures. Workforce shortages intensify as demographic trends play out. Production rates stagnate or decline. Quality issues trigger regulatory interventions further constraining output. Some companies face financial distress. Industry growth disappoints despite strong demand.

The most probable path lies between the base case and optimistic scenario. The aerospace industry has demonstrated resilience through numerous crises over decades. Companies are addressing known challenges through investment, innovation, and operational improvement. While progress is slower than desired, the fundamental drivers of long-term growth remain intact.