JetBlue Airways is implementing its transformative JetForward strategy while navigating significant operational and financial challenges.

As we move towards 2026, the New York-based carrier holds approximately 3.6% market share in the US airline industry and operates as the nation’s sixth-largest airline by passenger volume, serving over 100 destinations throughout the United States, Latin America, the Caribbean, Canada, and Europe.

This comprehensive analysis examines JetBlue’s current operational performance, strategic initiatives, competitive positioning, and future outlook as the airline seeks to return to sustained profitability while maintaining its differentiated brand identity in an increasingly consolidated market.

Table of Contents

Executive Summary and Current State

JetBlue Airways enters 2026 with cautious optimism following a challenging yet transformative 2025. The airline has made measurable progress toward profitability through its comprehensive JetForward strategic initiative, which targets between $850 million and $950 million in incremental earnings before interest and taxes (EBIT) by the end of 2027. Through the first three quarters of 2025, JetBlue achieved approximately $180 million of this targeted improvement, demonstrating tangible results from operational enhancements, network optimization, and revenue diversification efforts.

However, the path forward remains fraught with obstacles. The airline reported a net loss of $425 million for the nine months ended September 30, 2025, though this represents a 43.4% improvement compared to the $751 million loss during the same period in 2024. Operating revenues declined 2.6% year-over-year to $6.8 billion, while operating expenses decreased 8.0% to $7.1 billion, reflecting both demand challenges and successful cost management initiatives.

2025 FINANCIAL PERFORMANCE SNAPSHOT (NINE MONTHS ENDED SEPTEMBER 30)

Operating Revenue: $6.818 billion (down 2.6% YoY)

Operating Expenses: $7.086 billion (down 8.0% YoY)

Operating Loss: $268 million (61.8% improvement YoY)

Net Loss: $425 million (43.4% improvement YoY)

Operating Margin: -3.9% (6.1 percentage points improvement YoY)

Revenue Passengers: 29.618 million (down 3.1% YoY)

Load Factor: 82.6% (down 0.9 percentage points YoY)

Average Fare: $212.16 (down 0.5% YoY)

CEO Joanna Geraghty emphasized the company’s improving momentum in the third quarter 2025 earnings announcement, stating that “JetBlue’s progress toward profitability is gaining momentum as a result of the swift actions we’ve taken to implement our JetForward strategy and set a strong foundation for 2026.”

Strategic Framework: The JetForward Transformation Plan

Overview and Core Pillars

Launched in 2024 and accelerated throughout 2025, the JetForward strategy represents JetBlue’s most comprehensive transformation effort since its founding in 2000. The initiative encompasses over 100 discrete projects organized around four primary pillars that address both revenue enhancement and cost optimization.

Reliable and Caring Service

Operational excellence forms the foundation of JetForward, recognizing that consistent, dependable service drives customer loyalty and reduces costly disruptions. Throughout 2025, JetBlue achieved measurable improvements in key operational metrics despite challenging circumstances including multiple severe weather events.

OPERATIONAL METRIC | Q3 2025 PERFORMANCE | YEAR-OVER-YEAR CHANGE |

|---|---|---|

A14 (On-Time Performance) | Improved | Up 2.0 percentage points |

Completion Factor | 98.6% (Q1) | Up 1.8 percentage points |

Net Promoter Score (NPS) | Improved | Up double digits year-to-date |

Customer Satisfaction | Strong | Up double digits year-to-date |

These improvements came despite significant operational challenges, including Hurricanes Helene and Melissa, which disrupted operations particularly in July 2025. The airline’s ability to maintain and even improve reliability metrics during these disruptions demonstrates the effectiveness of its operational investments in disruption management, crew scheduling optimization, and maintenance planning.

Best East Coast Leisure Network

JetBlue’s network strategy centers on dominating key East Coast leisure markets where its brand resonates strongly and where it can achieve meaningful market share. This focus area has driven the most visible strategic changes, including significant route rationalization and focused expansion in select markets.

During 2024 and 2025, JetBlue announced over 50 route exits and 15 “Blue City” closures, representing more than 20% of its pre-existing network. These cuts eliminated underperforming routes primarily in secondary cities and select international markets including Bogotá, Quito, Lima, Kansas City, and Newburgh, New York.

Simultaneously, the airline substantially increased capacity in high-performing markets. Providence, Rhode Island, saw seat capacity increase nearly 200% year-over-year, while Hartford, Connecticut, experienced growth exceeding 30%. Most significantly, JetBlue has reinforced its position as Fort Lauderdale’s largest airline, with plans to launch 17 new routes and increase frequencies on 12 high-demand routes from Fort Lauderdale-Hollywood International Airport during 2025, representing a 35% year-over-year capacity increase at that facility.

Products and Perks Customers Value

Premium product development represents a critical growth vector for JetBlue as the industry experiences robust demand for upgraded travel experiences. The airline’s premium revenue per available seat mile (RASM) outperformed core RASM by high-single digits during the first quarter of 2025, with premium segments including Mint and Even More Space generating double-digit revenue growth year-over-year.

Several major premium product initiatives are advancing on schedule. JetBlue’s first airport lounge is slated to open at New York’s John F. Kennedy International Airport Terminal 5 in the fourth quarter of 2025, followed by a Boston Logan facility in 2026. These lounges will complement the carrier’s existing premium offerings and provide additional amenity differentiation.

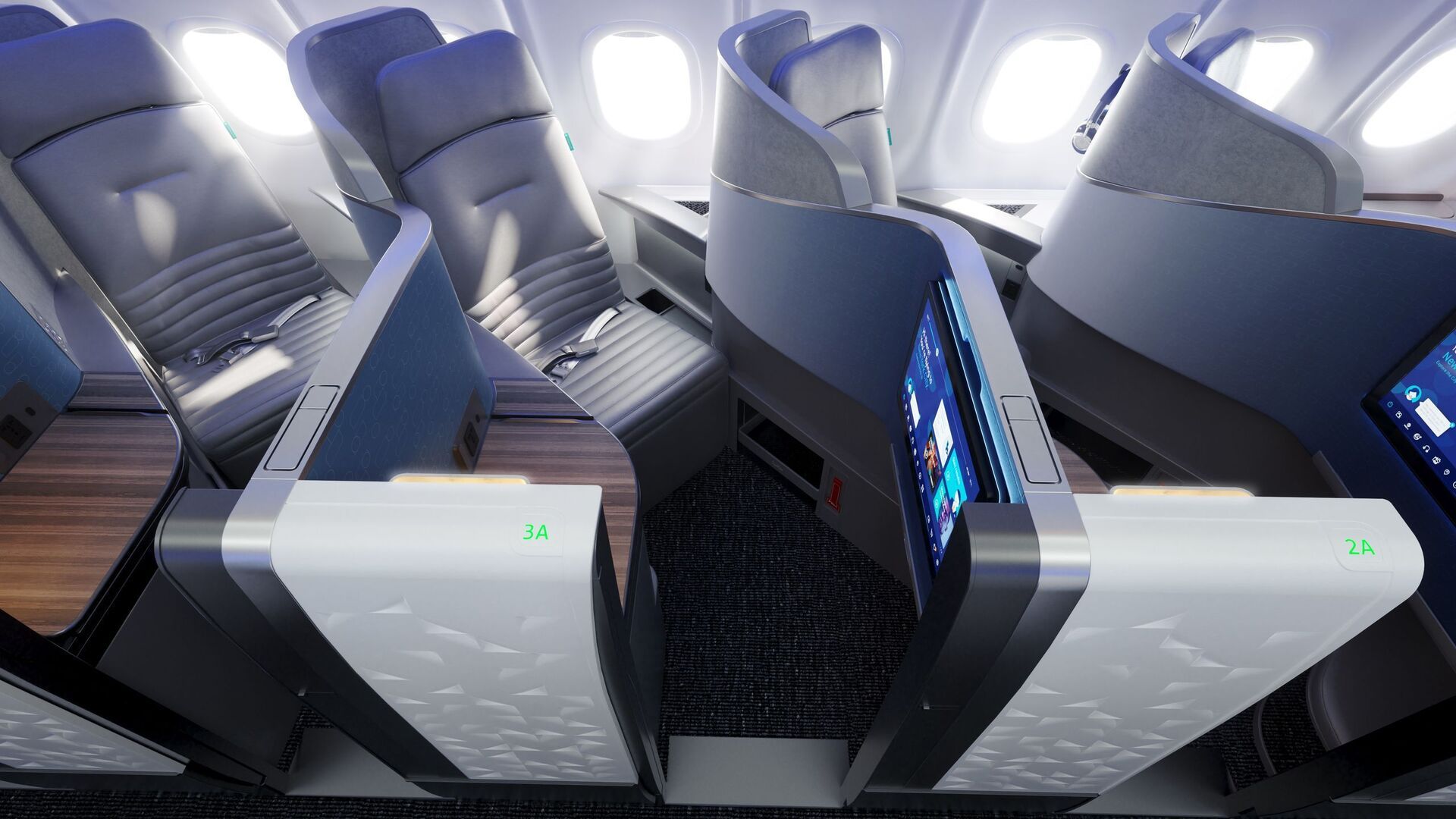

Most significantly, JetBlue confirmed plans to introduce domestic first-class seating beginning in 2026. The new product, unofficially dubbed “Mini Mint,” will feature Collins Aerospace MiQ seats in a 2-2 configuration, with three rows installed on A321 and A320 aircraft and two rows on smaller A220 aircraft. The airline expects to retrofit 25% of its non-Mint fleet by the end of 2026, with the vast majority completed by the end of 2027.

Additional revenue initiatives include enhanced merchandising of the Even More Space product through expanded distribution via Global Distribution Systems, allowing travel agents and online travel agencies to book premium economy offerings on single tickets. The airline has also announced plans for a premium co-branded credit card and continues to refine variable pricing strategies for checked baggage and other ancillary services.

A Secure Financial Future

Cost discipline and financial stability form the fourth pillar of JetForward, addressing the structural cost challenges that have pressured margins in recent years. JetBlue has identified and is advancing over 100 cost reduction initiatives focused on artificial intelligence and data science adoption, customer self-service capabilities, disruption management, and fuel consumption reduction.

The airline has demonstrated progress on unit cost management despite capacity headwinds. Operating expense per available seat mile excluding fuel (CASM ex-fuel) increased 6.0% for the nine months ended September 30, 2025, but the company improved its full-year 2025 guidance midpoint by 0.5 percentage points despite capacity being roughly one point lower than initial guidance. For the third quarter specifically, CASM ex-fuel rose 3.7% year-over-year, at the better end of the revised guidance range.

CFO Ursula Hurley emphasized the significance of this cost performance, noting that the airline “improved the midpoint of our full-year cost guidance by half a point, despite capacity roughly one point lower than initial guidance, illustrating the benefits of our strong operation and cost-reduction programs.”

Financial Targets and Progress Tracking

JetBlue provides transparent reporting on JetForward’s financial impact through regular updates on incremental EBIT generation. The airline originally targeted $800 million to $900 million in EBIT improvement by 2027 but raised this range to $850 million to $950 million in the second quarter of 2025, reflecting confidence in execution and identification of additional opportunities.

PERIOD | INCREMENTAL EBIT ACHIEVED | CUMULATIVE TOTAL | REMAINING TO 2027 TARGET |

|---|---|---|---|

H1 2024 | $90 million | $90 million | $760-860 million |

H2 2024 | $90 million | $180 million | $670-770 million |

2025 Target | $110 million | $290 million | $560-660 million |

2026-2027 Target | $560-660 million | $850-950 million | Complete |

The airline tracks both revenue and cost initiatives contributing to these targets, with revenue initiatives including premium product expansion, loyalty program enhancements, partnership revenue, and improved merchandising. Cost initiatives encompass fleet renewal savings, operational efficiency improvements, technology automation, and workforce optimization.

Fleet Strategy and Engine Challenges

Current Fleet Composition

JetBlue operates an all-Airbus narrowbody fleet following the complete retirement of its Embraer E190 aircraft by the end of 2025. As of September 2025, the airline’s average fleet consisted of 287 operating aircraft during the quarter, essentially flat year-over-year. The fleet comprises primarily Airbus A320 family aircraft, with growing numbers of next-generation A320neo and A321neo aircraft, supplemented by the new Airbus A220-300.

JETBLUE FLEET COMPOSITION (ESTIMATED AS OF LATE 2025)

Airbus A320-200: Approximately 130 aircraft

Airbus A321-200: Approximately 63 aircraft

Airbus A320neo: Approximately 37 aircraft

Airbus A321neo: Approximately 34 aircraft (including Mint-configured)

Airbus A220-300: Approximately 27 aircraft (growing rapidly)

Total Operating Fleet: ~291 aircraft

The fleet renewal strategy centers on the Airbus A220-300, which offers superior fuel efficiency, lower operating costs, and enhanced passenger comfort compared to the aging E190 aircraft it replaces. JetBlue received 27 A220 deliveries during 2024 and continues accepting new A220 aircraft in 2025 and 2026, with a substantial order book extending through the decade.

Image source: jetblue.com

The A220 replacement program has already generated approximately $95 million in avoided costs according to company disclosures, with additional benefits expected as the fleet fully replaces the E190 by year-end 2025.

Pratt & Whitney GTF Engine Crisis

The most significant operational and financial challenge facing JetBlue involves ongoing issues with Pratt & Whitney’s geared turbofan (GTF) engines that power the A320neo, A321neo, and A220 aircraft families. A manufacturing defect affecting powder metal components requires premature engine removals for inspection and potential repairs, with turnaround times extending to approximately 360 days according to February 2025 disclosures.

Throughout 2025, JetBlue has operated with mid-to-high teens numbers of aircraft grounded due to engine unavailability, representing 5-6% of its total fleet being out of service at various points. This constraint forced the airline to plan for flat capacity in 2025 despite growth ambitions, and management expects similar constraints to persist through at least mid-2026 before improvement.

The GTF crisis carries multiple implications beyond immediate capacity constraints. Aircraft utilization declined from 10.2 hours per day in 2024 to 10.0 hours per day in the first nine months of 2025, directly impacting revenue generation capability. Additionally, JetBlue extended leases on 30 older aircraft to ensure operational coverage, incurring incremental lease expense while awaiting engine availability.

CEO Geraghty acknowledged the frustration in third quarter earnings commentary, stating that “not having clear line of sight to our longer-term capacity is certainly frustrating, but we must remain focused on controlling what we can, and this is at the heart of JetForward.” The airline continues discussions with Pratt & Whitney regarding additional compensation for the disruptions and improved visibility into future aircraft-on-ground (AOG) timelines.

In late November 2025, a separate Airbus-wide software issue emerged requiring modifications across approximately 6,000 A320 family aircraft globally after a JetBlue altitude incident revealed vulnerability to solar radiation that could corrupt flight control data. While most affected aircraft have received the software update, this incident caused additional operational disruptions and flight cancellations during the peak holiday period.

Long-Term Fleet Planning

JetBlue maintains a substantial aircraft order book extending through 2030, providing fleet renewal certainty even amid near-term delivery challenges. The airline has firm orders and commitments for multiple dozens of additional A220-300 and A321neo aircraft, supporting both replacement requirements and modest growth as engine constraints ease.

The company has also confirmed interest in the Airbus A321XLR extra-long-range variant for potential network expansion, though specific order details and deployment timelines remain to be announced. The A321XLR could enable JetBlue to extend its transatlantic network beyond current destinations or launch new long-haul markets with economics superior to its existing A321LR capabilities.

Revenue Strategy and Commercial Initiatives

JetBlue has identified premium revenue growth as its most significant near-term revenue opportunity. The airline’s differentiated Mint business class product, featuring lie-flat suites on transcontinental and transatlantic routes, consistently outperforms economy in both load factors and yield premiums. Third quarter 2025 results showed premium RASM outperforming core RASM by high-single digits, with premium segments generating double-digit revenue growth.

The airline operates more than 25 daily Mint-equipped flights touching Fort Lauderdale, offering “more transcontinental lie-flat seats from South Florida than any other carrier” according to company statements. This concentration of premium product in a high-value leisure market exemplifies JetBlue’s strategy of aligning supply with demand.

Image source: cntraveler.com

The introduction of domestic first class beginning in 2026 will extend premium capabilities across virtually the entire fleet. Management projects this product will appeal to business travelers and premium leisure customers on flights of 2-4 hours where full lie-flat service is unnecessary but enhanced comfort and service are valued. With retrofits planned for 25% of non-Mint aircraft in 2026 and the vast majority by end of 2027, this initiative alone could generate tens of millions in annual incremental revenue once fully deployed.

Complementing onboard products, JetBlue’s planned airport lounges at JFK and Boston will provide pre-flight premium experiences that compete directly with legacy carriers. The lounges will be accessible to Mint passengers, top-tier Mosaic elite members, and potentially through day passes, creating both incremental revenue and enhanced brand perception.

Loyalty Program Monetization

The TrueBlue loyalty program has emerged as one of JetBlue’s most valuable financial assets, securing $2.75 billion in debt financing in 2024 with the program serving as collateral. Independent valuations from Fitch Ratings assessed TrueBlue’s value at approximately $5.5 billion, exceeding half of JetBlue’s total enterprise value and surpassing the value of many aircraft assets.

TrueBlue generated significant financial contribution throughout 2025. Nearly half of the airline’s Q3 customer flight revenue came from TrueBlue members, while royalty revenue from the program grew 11% year-over-year in the third quarter. The airline achieved record new Mosaic enrollments and elite status matches during the period, expanding the program’s most valuable member cohort.

Several initiatives aim to further monetize loyalty in 2026 and beyond. The launch of a premium co-branded credit card will tap higher-spending customer segments currently underserved by existing cards. Enhanced merchandising capabilities allow the airline to better differentiate Mosaic benefits and create clear value propositions for status attainment. Variable pricing for TrueBlue point redemptions enables yield management aligned with underlying ticket prices.

Strategic Partnerships: Blue Sky Alliance with United

Perhaps the most significant commercial development of 2025 was the October launch of the Blue Sky partnership with United Airlines, following U.S. Department of Transportation approval earlier in the year. This collaboration enables reciprocal earning and redemption between JetBlue’s TrueBlue and United’s MileagePlus loyalty programs, while future phases will include codesharing and select operational coordination.

Blue Sky addresses a critical strategic gap for JetBlue following the court-ordered dissolution of the Northeast Alliance with American Airlines. That partnership, which allowed coordination in New York and Boston markets, was ruled anti-competitive by a federal judge in 2023, with appeals rejected in late 2024. The loss of the American relationship eliminated a significant source of connecting traffic and feed at JetBlue’s most important hubs.

The United partnership differs fundamentally from the American arrangement by avoiding the route-level coordination and revenue sharing that regulators found problematic. Instead, Blue Sky focuses on loyalty integration and selective operational cooperation such as gate swaps at Newark Liberty International Airport, allowing each carrier to optimize its presence without anti-competitive effects.

For JetBlue, the partnership provides access to United’s extensive global network for award redemptions and elite recognition, enhancing TrueBlue value without requiring JetBlue to operate long-haul routes beyond its transatlantic footprint. Early 2026 will bring codesharing, enabling customers to book connecting itineraries on single tickets, which should drive incremental traffic particularly in business travel segments.

President Marty St. George emphasized the partnership’s value in third quarter earnings remarks, noting that “cross-selling flights with United’s complementary network expected to launch in early 2026, delivering more choices to fly across the globe for JetBlue and United customers.”

Transatlantic Operations

JetBlue’s transatlantic network represents a distinctive strategic asset among U.S. carriers, with service from New York-JFK and Boston to London-Gatwick and London-Heathrow, plus seasonal service to Paris, Amsterdam, and Dublin. The airline launched these routes during 2021-2022 with its premium-focused value proposition, offering Mint business class at prices substantially below legacy carrier premiums.

After initial growing pains, the transatlantic network reached profitability on a route-by-route basis during summer 2025. First quarter results showed transatlantic RASM grew 28% year-over-year on 25% lower capacity, demonstrating improved yield management and market positioning. The airline has successfully seasonalized the network, concentrating capacity during peak summer months while redeploying aircraft domestically during slower winter periods.

Management views transatlantic as a “profitable spoke” within the broader network, generating premium revenue and enhancing the brand while avoiding over-expansion. The addition of Boston to Edinburgh and Boston to Shannon service in 2025 reflects selective network expansion targeting underserved city pairs where JetBlue’s product can command a premium.

Operational Performance and Service Quality

Reliability Metrics and Improvement Trends

Operational reliability forms the cornerstone of JetBlue’s turnaround strategy, recognizing that irregular operations drive disproportionate costs through crew repositioning, passenger reaccommodation, and customer compensation. Throughout 2025, the airline achieved measurable improvements across key operational indicators despite challenging external conditions.

A14 performance, measuring arrivals within 14 minutes of scheduled time, improved by more than two percentage points in the third quarter 2025 compared to the prior year. Completion factor, representing the percentage of scheduled flights actually operated, increased nearly two percentage points despite Hurricanes Helene and Melissa causing significant disruptions particularly in July 2025.

These improvements translated directly to customer perception and financial performance. Net Promoter Score, a measure of customer willingness to recommend the airline, increased by double digits for the full year 2025 compared to 2024, building on improvements from the prior year. Higher satisfaction scores reduce customer acquisition costs and support premium pricing capability, contributing directly to revenue improvement.

The operational gains resulted from systematic investments in disruption management capabilities, crew scheduling optimization, maintenance planning improvements, and data analytics. The airline implemented predictive maintenance protocols that reduce unexpected mechanical delays, while enhanced crew scheduling algorithms minimize domino effects when weather or other factors require flight cancellations.

Cost of Poor Operations

Prior to JetForward, JetBlue’s operational reliability lagged industry averages, generating substantial avoidable costs. Each 1% improvement in completion factor saves multiple millions of dollars annually through reduced reaccommodation expenses, crew overtime, and customer goodwill costs. Similarly, better on-time performance reduces gate delays, connection misses, and customer compensation requirements.

The financial impact of operational improvements shows clearly in unit cost trends. While CASM ex-fuel increased 6.0% year-over-year for the nine months of 2025, the third quarter showed only 3.7% growth at the better end of guidance despite significant weather disruptions. This sequential improvement reflects both structural cost actions and operational efficiency gains that reduce the variable costs of irregular operations.

CFO Ursula Hurley specifically attributed third quarter cost performance to “strong operational execution” alongside structural cost initiatives, quantifying the financial value of reliability improvements.

Workforce and Labor Relations

JetBlue’s approximately 19,200 full-time equivalent employees as of September 2025 represent a 4.1% reduction compared to the prior year, reflecting network right-sizing and productivity improvements. However, the airline faces significant labor cost pressures from both market-based wage increases and recent contract improvements.

In 2024, JetBlue reached new agreements with several employee groups including flight attendants and ground operations personnel, resulting in substantial wage increases and retroactive payments. These agreements, while necessary to attract and retain talent in a tight labor market, added multiple percentage points to unit cost growth during 2024 and the first half of 2025.

Pilot staffing presents ongoing challenges industrywide, though JetBlue’s relatively attractive East Coast network and JFK/Boston bases provide recruitment advantages. The airline has invested in pipeline programs including enhanced partnerships with flight training institutions and expanded opportunities for military veteran pilots.

The company has also launched groundbreaking aircraft maintenance technician training partnerships with institutions including Vaughn College in New York and Cape Cod Community College, addressing the industrywide shortage of licensed maintenance personnel. These “Gateway Programs” provide tuition support, mentorship, and guaranteed interview opportunities for qualified candidates, strengthening JetBlue’s technical workforce pipeline.

Competitive Positioning and Market Share

Industry Structure and JetBlue’s Position

The U.S. airline industry remains highly consolidated, with four legacy carriers commanding approximately 80% of domestic market share.

JetBlue’s 3.56% market share positions it as the sixth-largest carrier nationally, substantially smaller than the “Big Four” but larger than ultra-low-cost carriers Spirit and Frontier. This mid-tier position creates both challenges and opportunities. The airline lacks the network scope, alliance partnerships, and corporate account penetration of legacy carriers, while facing intense price competition from ultra-low-cost carriers in overlapping markets.

Competitive Advantages and Differentiators

JetBlue has historically competed through a differentiated value proposition combining low-to-moderate fares with superior product amenities including complimentary high-speed Wi-Fi, seatback entertainment, generous legroom, and free snacks. This “hybrid” positioning aimed to attract customers willing to pay moderate premiums for enhanced comfort without full-service pricing.

The company’s core competitive advantages include several elements that remain distinctive even amid increasing industry competition:

East Coast Network Dominance

JetBlue holds commanding positions at several East Coast airports where slot constraints and infrastructure limitations restrict competitor entry. At New York’s JFK, JetBlue operates more flights than any other carrier and controls the entirety of Terminal 5, providing exceptional operational control and customer experience. Similar strengths exist at Boston Logan, where JetBlue operates as one of the top two carriers by departures.

Fort Lauderdale represents JetBlue’s most significant recent network investment, where the airline has grown from a secondary player to the airport’s largest carrier by 2025. This position capitalizes on Spirit Airlines’ capacity reductions following bankruptcy and provides a crucial South Florida anchor complementing Northeast operations.

Premium Product Leadership in Leisure Markets

The Mint business class product remains the only true lie-flat premium offering many leisure travelers can access on domestic transcontinental and Caribbean routes. While legacy carriers offer first class on these routes, their products typically feature angled recliners rather than full flat beds, making Mint competitively superior for customers prioritizing sleeping capability on redeye flights.

JetBlue operates the largest concentration of domestic lie-flat premium seats from South Florida and provides the only such service on many routes from Fort Lauderdale, creating significant competitive differentiation in one of the nation’s largest origin and destination leisure markets.

Technology and Customer Experience

JetBlue pioneered and continues to lead in certain passenger-facing technologies. All aircraft offer complimentary Fly-Fi high-speed internet with speeds sufficient for streaming video, while competitors often charge for comparable service or restrict bandwidth. The airline’s partnership with Amazon’s Project Kuiper satellite constellation, expected to begin deployment in 2027, will further enhance connectivity speeds and reliability.

Every seatback features a personal entertainment screen with streaming content, USB power ports, and device charging, amenities that most competitors have eliminated from narrowbody domestic fleets. These product elements directly support premium revenue generation by enhancing the perceived value relative to price.

Brand Perception and Customer Loyalty

Despite recent operational challenges, JetBlue maintains strong brand affinity particularly among East Coast leisure travelers. The airline’s Net Promoter Score significantly exceeds industry averages, and TrueBlue loyalty engagement metrics suggest deeper customer relationships than many competitors achieve.

This brand strength provides pricing power in key markets and reduces customer acquisition costs, as satisfied customers proactively seek JetBlue flights and recommend the airline to friends and family.

Competitive Threats and Challenges

JetBlue faces intensifying competitive pressures from multiple directions as the industry evolves and rivals adapt strategies.

Legacy Carrier Product Upgrades

Delta, United, and American have all invested billions in product improvements including premium economy cabins, enhanced Wi-Fi, and retrofitted business class seats. These investments narrow JetBlue’s historical product advantage, particularly as legacy carriers concentrate premium amenities on high-revenue routes where JetBlue competes directly.

Ultra-Low-Cost Carrier Price Pressure

Spirit, Frontier, and newer entrants like Avelo and Breeze compete intensely on price in many JetBlue markets, particularly in Florida where overlaps are extensive. These carriers’ structural cost advantages enable base fares often 30-50% below JetBlue’s, forcing JetBlue to discount or accept lower load factors on price-sensitive leisure routes.

Limited International Network

JetBlue’s minimal presence in Asia-Pacific, limited European footprint, and complete absence from Africa and Middle East regions constrains corporate account penetration and business travel revenue. Without alliance membership to provide connecting options, corporate travel managers often favor carriers offering one-stop global reach, limiting JetBlue’s appeal beyond point-to-point Northeast corridor and transatlantic travel.

Market Fragmentation and Overcapacity

Industrywide capacity growth, particularly from ultra-low-cost carriers, has periodically exceeded demand growth, pressuring yields. When Spirit and Frontier flood markets with additional seats seeking to fill aircraft, fare pressures cascade across all competitors including JetBlue, eroding unit revenue even when JetBlue maintains load factors.

Recent Strategic Setbacks and Adaptations

Spirit Airlines Merger Blocked

JetBlue’s most significant strategic setback arrived in January 2024 when a federal district court judge blocked the proposed $3.8 billion acquisition of Spirit Airlines following Department of Justice antitrust challenges. The judge’s ruling, spanning over 100 pages, determined that combining JetBlue’s higher-fare business model with Spirit’s ultra-low-cost approach would reduce industry competition and eliminate a price-constraining force.

JetBlue had argued the combination would create a stronger competitor to the Big Four legacy carriers while maintaining Spirit’s low-fare service through fleet and network integration. However, the court found that historical evidence suggested merged entities typically converge toward higher-fare models, thus eliminating Spirit’s price discipline benefits to consumers.

The merger termination forced both airlines into independent strategic recalibrations. For JetBlue, the blocked deal meant foregoing potential cost synergies, fleet acquisition, and market share gains that would have vaulted it closer to the major carriers in scale. The company paid Spirit shareholders substantial breakup fees totaling approximately $400 million through various payment structures, representing significant value destruction without strategic benefit.

Management’s response emphasized focusing on organic opportunities within JetBlue’s control. CEO Geraghty stated clearly that “we’re not interested in revisiting the Spirit potential acquisition. We want to really focus on improving our margins within JetBlue, delivering on JetForward, controlling what we can and keeping the team laser-focused on that.”

Northeast Alliance Dissolution

The loss of the American Airlines Northeast Alliance (NEA) partnership represents the second major regulatory setback impacting JetBlue’s competitive positioning. The NEA, launched in 2021, allowed the airlines to coordinate schedules, share revenue, and provide reciprocal benefits in New York and Boston markets, substantially enhancing both carriers’ competitive positions against Delta and United in those critical business travel hubs.

In May 2023, a federal judge ruled the partnership violated antitrust laws by reducing competition, ordering its termination. American’s appeal was rejected in November 2024, finalizing the arrangement’s end. The loss particularly impacted JetBlue by eliminating access to American’s extensive connecting traffic and corporate accounts, reducing JetBlue’s relevance for business travelers requiring global connectivity.

The Blue Sky partnership with United aims to partially offset the NEA loss by providing alternative loyalty integration and network access, though without the route-level coordination and revenue sharing that made the American relationship so financially valuable.

Financial Condition and Capital Structure

Liquidity and Cash Position

JetBlue maintained total liquidity of $2.9 billion as of September 30, 2025, excluding its undrawn $600 million revolving credit facility. This liquidity position includes cash and cash equivalents of $2.4 billion plus short-term investment securities of $483 million, providing substantial cushion against operational disruptions or demand shocks.

The airline’s liquidity strengthened significantly during 2024 through the issuance of $3.2 billion in debt secured by the TrueBlue loyalty program. This innovative financing demonstrated capital markets’ confidence in the value and stability of JetBlue’s loyalty business, while providing funding to meet near-term capital expenditure requirements and refinance certain 2026 debt maturities.

Debt and Leverage

As of September 30, 2025, JetBlue carried total debt and finance lease obligations of $8.5 billion, modestly down from $8.5 billion at year-end 2024. Against total assets of $16.6 billion, this represents a leverage ratio that while elevated remains manageable given the airline’s asset base and liquidity position.

The debt structure includes a mix of aircraft-secured financings, airport facility bonds, the loyalty-backed debt issued in 2024, and various term loans. Near-term maturities appear manageable given current liquidity, though the company faces elevated interest expense of approximately $590 million projected for full-year 2025, representing a significant earnings headwind as floating-rate debt repriced to higher base interest rates.

Capital Expenditures and Aircraft Commitments

JetBlue’s capital expenditure guidance for full-year 2025 stands at approximately $1.1 billion, covering aircraft pre-delivery payments, aircraft modifications including first-class retrofits, maintenance equipment, technology investments, and facility improvements. This level represents a reduction from approximately $1.6 billion spent during 2024, primarily reflecting fewer aircraft deliveries amid engine-related delays.

The company maintains substantial future aircraft delivery commitments extending through 2030, requiring significant capital deployment or financing in coming years. However, the airline has demonstrated flexibility by selling certain delivered aircraft and negotiating delivery timeline adjustments with Airbus to align deliveries with demand recovery and engine availability.

Profitability Outlook and Guidance

Management has committed to achieving break-even or better operating margins during 2025, representing a critical milestone following years of operating losses. Fourth quarter 2025 guidance provided in late October anticipated:

FOURTH QUARTER AND FULL YEAR 2025 GUIDANCE

Available Seat Miles Year-Over-Year:

Q4: (0.75%) to 2.25%

Full Year: (2.0%) to 0.0%

RASM Year-Over-Year:

Q4: (4.0%) to 0.0%

CASM Ex-Fuel Year-Over-Year:

Q4: 3.0% to 5.0%

Full Year: 5.0% to 6.0%

Average Fuel Price per Gallon:

Q4: $2.33 to $2.48

Interest Expense (Full Year):

Approximately $590 million

Capital Expenditures (Full Year):

Approximately $1.1 billion

The guidance anticipated continued revenue pressure with potential fourth quarter RASM declines of up to 4%, reflecting demand softness particularly in leisure troughs between peak holiday periods. However, the midpoint of guidance implied flat to modest positive unit revenue, demonstrating improving demand trends as the year progressed.

For 2026, management has indicated expectations for modest capacity growth as engine constraints gradually ease, with mid-to-high teens numbers of aircraft grounded during the first half before improving through the second half. This should enable low-single-digit capacity growth for full-year 2026, assuming engine availability improves as Pratt & Whitney has projected.

Unit cost guidance for 2026 suggests mid-single-digit CASM ex-fuel growth under flat capacity scenarios, incorporating both structural cost improvements from JetForward and continued labor cost pressures from recent contract agreements. Management expresses confidence that as capacity growth resumes, unit cost growth will moderate into the low-single digits.

Industry Context and Macro Trends for 2026

Air Travel Demand Outlook

Global air travel demand continues recovering toward and exceeding pre-pandemic levels, supported by strong consumer spending, pent-up travel demand, and generational shifts in travel preferences. The International Air Transport Association (IATA) reported October 2025 global passenger traffic growth of 6.6%, with capacity set to expand 3.6% in November and 4.7% in December 2025.

North American carriers are projected to reach 2.1 billion passengers during 2025, with continued growth anticipated through 2026. Industry forecasts suggest both revenue and passenger numbers will surpass pre-pandemic levels during 2025-2026, supporting airline profitability despite elevated costs.

However, demand composition has shifted from historical patterns. Business travel, particularly mid-week corporate traffic, remains below 2019 levels as hybrid work arrangements and videoconferencing reduce the frequency of business trips. Conversely, leisure travel and “bleisure” trips combining business and leisure elements have surged, fundamentally altering demand patterns across day-of-week and seasonal cycles.

This shift particularly benefits JetBlue’s leisure-focused network, with peak demand increasingly concentrated in Friday-Sunday periods and school holiday weeks. The airline has adjusted capacity to align with these patterns, reducing mid-week flying while increasing weekend departures to match demand.

Competitive Capacity Discipline

Industrywide capacity discipline appears improving for 2026 after several years of aggressive growth that pressured yields. Multiple carriers have announced capacity reductions or modest growth plans driven by aircraft delivery delays, engine issues, and profitability pressures.

Spirit Airlines’ bankruptcy filing and subsequent capacity reductions removed significant seats from domestic markets, particularly in Florida and the Caribbean where overlap with JetBlue is extensive. Spirit emerged from bankruptcy in March 2025 but filed again in August 2025, creating ongoing uncertainty about the carrier’s long-term viability and capacity contribution.

Frontier Airlines has similarly tempered growth ambitions, while legacy carriers have signaled discipline around domestic capacity additions. This industrywide restraint should support improved unit revenue trends during 2026 assuming demand remains solid, benefiting all carriers including JetBlue.

Regulatory and Policy Considerations

The airline industry faces evolving regulatory pressures across environmental sustainability, consumer protection, and competition policy. Environmental regulations particularly impact long-term planning, with multiple jurisdictions implementing or considering carbon taxes, emissions trading schemes, and sustainable aviation fuel mandates.

JetBlue has committed to achieving net-zero carbon emissions by 2040 and is investing in sustainable aviation fuel partnerships, fleet renewal for improved fuel efficiency, and carbon offset programs. These initiatives align with regulatory trends while potentially providing marketing advantages as environmentally conscious consumers increasingly factor sustainability into purchase decisions.

On the consumer protection front, the U.S. Department of Transportation has proposed or implemented multiple rules regarding fee transparency, refund policies, and service commitments. While adding compliance costs, these regulations may benefit JetBlue by requiring competitors to disclose previously hidden fees, potentially highlighting JetBlue’s more transparent pricing model.

Competition policy remains uncertain following the blocked Spirit merger and NEA dissolution. The current administration’s aggressive antitrust enforcement approach toward airline combinations suggests future consolidation will face substantial scrutiny, likely preserving JetBlue’s independent status absent major industry disruption.

Strategic Opportunities for 2026 and Beyond

Market-Specific Dominance Strategy

Rather than pursuing nationwide scale, JetBlue increasingly focuses on achieving dominant market share in select focus cities where its brand resonates and infrastructure provides competitive advantage. This strategy, articulated in the airline’s focus on becoming “#1 somewhere” rather than a distant follower everywhere, aims to generate the revenue premiums and cost efficiencies that market leadership enables.

Fort Lauderdale exemplifies this approach. By concentrating capacity additions in South Florida while retrenching from weaker markets, JetBlue has ascended to the airport’s largest carrier position, enabling improved slot utilization, better connection opportunities, and increased brand visibility. This concentration should yield both revenue benefits through higher corporate account penetration and cost advantages through denser operations.

Similar opportunities may exist in Providence, Hartford, and select Caribbean gateways where JetBlue can leverage existing strength into clear market leadership. The company has indicated openness to such strategies pending proof of returns from the Fort Lauderdale investment.

The domestic first-class rollout beginning in 2026 represents perhaps JetBlue’s highest-return near-term investment. Retrofit costs appear modest compared to potential revenue uplift, with each first-class seat commanding fare premiums of $50-150 per segment over economy while consuming similar seat pitch as two standard economy seats.

Industry experience suggests domestic first-class products generate incremental revenue approximately 3-5% of total ticket revenue once fully deployed, implying potential annual revenue uplift of $250-400 million for JetBlue assuming industry-average performance. If JetBlue can leverage its brand reputation and operational reliability to achieve above-average first-class load factors and premiums, returns could exceed these benchmarks.

The lounge strategy similarly offers attractive returns. While capital costs for lounge construction are significant, operational costs are relatively low, and lounges generate both direct revenue through day passes and credit card partnerships, plus indirect revenue through enhanced elite status appeal and improved customer retention.

International Network Expansion

JetBlue’s transatlantic network achieved profitability during 2025, validating the business case and suggesting potential for selective expansion. The airline has announced plans to add Boston to Edinburgh and Boston to Shannon routes, demonstrating confidence in sustainable transatlantic economics.

Additional European destinations remain under evaluation, with potential markets including Barcelona, Rome, Manchester, and Glasgow representing underserved city pairs from JetBlue’s Northeast hubs. The incoming Airbus A321XLR will enable new markets requiring extended range beyond current A321LR capabilities, potentially opening Scandinavia, Southern Europe, or even Middle East destinations.

Latin America and Caribbean expansion offers opportunities with lower competitive intensity and aircraft requirements than European flying. The region aligns well with JetBlue’s leisure focus and brand strength, with potential to add frequencies or new markets in Colombia, Brazil, Peru, and Central America pending aircraft availability and economic returns.

Technology and Operational Innovation

JetBlue continues investing in technology-enabled operational and commercial improvements that drive both cost savings and revenue enhancement. Artificial intelligence and machine learning applications in crew scheduling, maintenance planning, and revenue management offer millions in potential annual benefits through better decision-making and automation.

The airline’s partnership with Amazon’s Project Kuiper for next-generation satellite connectivity could provide competitive advantage if deployed successfully. Offering streaming-quality internet on all flights would differentiate JetBlue from competitors still operating legacy connectivity systems or charging for service, potentially supporting modest fare premiums and enhancing customer satisfaction.

Self-service initiatives in customer support, rebooking, and ancillary purchases reduce staffing requirements while improving customer experience through reduced wait times and 24/7 availability. JetBlue has identified these areas as major focus points within its cost reduction portfolio.

Risk Factors and Challenges

Persistent Engine Constraints

The Pratt & Whitney GTF engine situation remains JetBlue’s most significant operational risk extending into 2026. While the company expects gradual improvement through the year, delays in Pratt & Whitney’s remediation timeline or additional issues could force extended capacity constraints, limiting growth and revenue opportunities.

Aircraft grounded for extended periods incur carrying costs without generating revenue, directly impacting profitability. Moreover, utilization constraints force higher aircraft ownership costs per available seat mile, pressuring unit costs even as the company makes progress on controllable cost items.

Cost Inflation Pressures

Labor costs, the largest controllable expense category, face persistent inflation as airline worker wage expectations increase amid low unemployment and union negotiating power. JetBlue’s recent contract agreements provide wage increases exceeding inflation for multiple years, locking in unit cost growth that only improving productivity or capacity growth can offset.

Maintenance costs are escalating industrywide as aircraft age and supply chain constraints limit parts availability. JetBlue’s fleet, while being renewed with A220 deliveries, still includes substantial numbers of older A320 and A321 aircraft requiring increasing maintenance attention as they age beyond 15-20 years.

Airport costs including landing fees, facility rents, and passenger facility charges continue escalating as airports invest in infrastructure improvements. JetBlue’s concentration at high-cost Northeast airports including JFK, Boston, and Newark exposes it disproportionately to these increases.

Competitive Intensity

The industry’s oligopolistic structure creates ongoing competitive pressures as larger carriers leverage network scope, loyalty programs, and corporate account penetration to capture premium revenue. JetBlue lacks Star Alliance, SkyTeam, or oneworld membership, limiting its appeal for corporate travelers requiring global connectivity and status recognition across partners.

Ultra-low-cost carrier competition constrains pricing power in leisure markets, with Spirit, Frontier, and newer entrants offering base fares often substantially below JetBlue’s even after including ancillary fees. When overcapacity emerges, these carriers typically discount aggressively to maintain loads, forcing industry-wide fare pressure.

My Final Thoughts: Outlook for 2026 and Strategic Assessment

As JetBlue Airways approaches 2026, the airline stands at a decisive inflection point in its two-decade history. The comprehensive JetForward transformation strategy has begun yielding measurable financial improvements, operational metrics have strengthened materially, and strategic initiatives from domestic first class to the United partnership position the company for sustainable profitability.

However, significant headwinds persist. Engine constraints will continue limiting capacity growth through at least mid-2026, competitive intensity remains fierce across both legacy and ultra-low-cost competitors, and structural cost challenges require sustained execution of efficiency initiatives to offset. The loss of the Spirit merger opportunity and Northeast Alliance forced strategic recalibration that may limit scale advantages relative to larger rivals.