Dear Readers,

Welcome to the AviationOutlook Newsletter.

Your One-Stop source for the most relevant Aviation news briefs and industry insights (MINUS noise).

✅ 1 Email ✅ 5 Min Read ✅ 0 Time Wasted

🫵 YOU become industry-smart!

Here are the 10 Top Aviation Industry Updates for you today.Let’s get started.

Lufthansa’s Southern Strategy: ITA Airways Integration and Airline Alliance Realignment Explained

Lufthansa Group has kickstarted ITA Airways' integration following its 41% acquisition, marking a pivotal shift in European aviation alliances.

ITA already started its SkyTeam exit and will conclude by April 30, 2025, with Star Alliance membership slated for early 2026. It's a strategic realignment that reshapes loyalty benefits, operational synergies, and global connectivity.

This move accelerates Lufthansa’s dominance in Southern Europe while positioning ITA for profitability within 2025 (expected).

Key Points

Alliance Transition: ITA's SkyTeam exit concludes April 30, 2025, with Star Alliance accession starting H1 2026.

Loyalty Integration: Immediate reciprocity between Lufthansa's Miles & More (36M members) and ITA's Volare (2.7M members).

Terminal Consolidation: Starting March 30, 2025, ITA relocates to Lufthansa terminals in Frankfurt (T1) and Munich (T2) to streamline connections.

Codeshares & Network: Over 100 codeshare routes go live on March 30, 2025; expands to 250+ Lufthansa destinations once fully integrated.

Lounge Access: Reciprocal lounge access also begins March 30, 2025, including 130 Lufthansa lounges and ITA's facilities.

Profitability Target: Lufthansa CEO Carsten Spohr projects ITA will turn profitable within 2025.

What It Means

I see this as a deliberate play by Lufthansa to fortify its Southern European footprint, leveraging ITA’s Rome hub to counter Air France-KLM and IAG’s strongholds.

The alliance shift weakens SkyTeam’s Mediterranean presence but bolsters Star Alliance’s transatlantic reach, especially with United and Air Canada partnerships.

For travelers, seamless loyalty perks and expanded codeshares mean smoother intra-Europe and long-haul itineraries—though SkyTeam flyers lose a key Italian partner.

Operationally, terminal consolidation and schedule optimization should reduce layover times, but the 10+ month gap between SkyTeam exit and Star accession risks loyalty program fragmentation.

Lufthansa’s move here signals long-term confidence in ITA’s post-Alitalia revival.

Other Key Aviation and Aerospace Industry Updates for Today 👇

Aerospace Industry Gets Relief as US-Canada Trade War Paused

Trump has agreed to pause 25% tariffs on Canadian imports for 30 days following discussions with Prime Minister Trudeau.

The pressure from the International Association of Machinists and Aerospace Workers (IAM) Union, representing 600,000 members, who warned about job losses and supply chain disruptions, also seems to have played a role in this decision.

Canada has also suspended its planned retaliatory tariffs while both nations work on border security initiatives, including a joint strike force to combat organized crime and fentanyl trafficking.

Spirit Airlines Launches 5 Spring Routes From Myrtle Beach Airport

Spirit Airlines is expanding its Myrtle Beach service with five nonstop routes this spring, including a new seasonal connection to Louisville and resumed service to Chicago, Cleveland, Latrobe, and Rochester.

The expansion aims to connect travelers to over 60 miles of beaches and golf courses along the Grand Strand, with flights now available for booking through Spirit's website.

This addition complements Spirit's existing network serving Myrtle Beach International Airport.

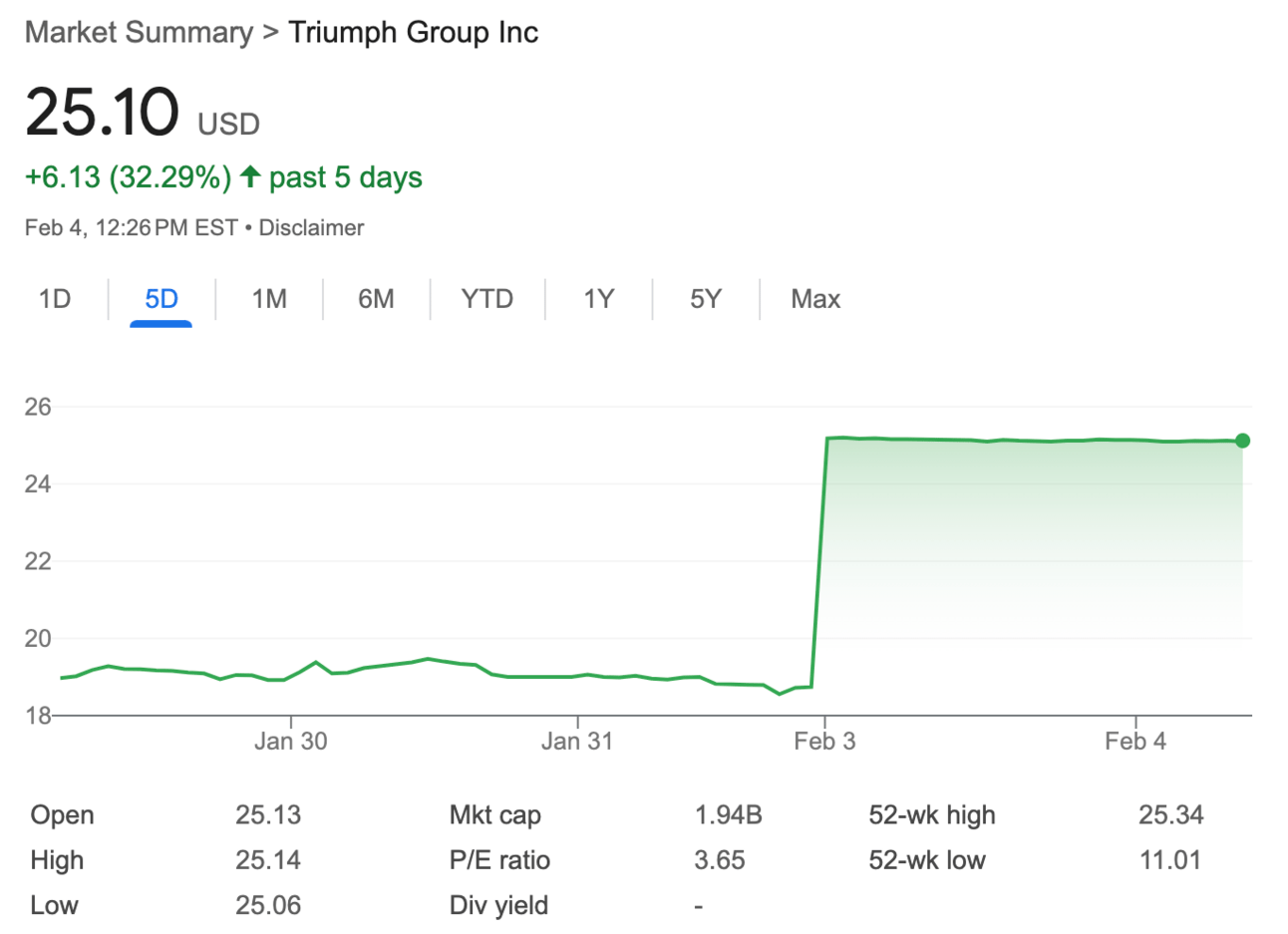

Aerospace Supplier Triumph Group Goes Private in Landmark $3 Billion Aerospace Deal

Warburg Pincus and Berkshire Partners have agreed to acquire Triumph Group for $3 billion, taking the aerospace supplier private.

Shareholders will receive $26 per share, representing a 123% premium "unaffected closing stock price". The deal, announced February 3, sent Triumph's shares up 34% to $25.10.

The transaction, expected to close in second half 2025, follows Triumph's strategic restructuring and recent strong performance, with Q2 FY2025 showing 34% growth in commercial aftermarket sales.

Textron Aviation Delivers Canada's First Cessna SkyCourier Cargo Aircraft

Textron Aviation has delivered its first Cessna SkyCourier to Air Bravo Corporation in Canada, following recent Transport Canada certification.

The twin-engine turboprop freighter will transport cargo across remote areas of Ontario, operating from Thunder Bay, Sudbury, Barrie, and Meaford.

This milestone comes as Textron works to increase production after a recent machinists strike that impacted Q4 2024 revenue, which dropped by $242 million to $1.3 billion.

Delta A350 to Connect Los Angeles and Australia in Nearly 16 Hour Flight

Delta will launch thrice-weekly nonstop flights between Los Angeles and Melbourne starting December 3, 2025, using a 275-seat Airbus A350-900.

The 7,921-mile route, Delta's third-longest, will feature four cabin classes, including 40 Delta One suites.

Flights depart LAX at 9:25 PM on Monday, Wednesday, and Friday, arriving in Melbourne at 8:15 AM.

Return flights leave at 10:25 AM on Wednesday, Friday, and Sunday, marking Delta's third Australian destination after Sydney and Brisbane.

Sun Country Reports 138 Percent Profit Growth in Fourth Quarter

Sun Country Airlines posted record Q4 2024 revenue of $260.4 million, up 6.1% year-over-year, with net income jumping 138% to $13.4 million.

The airline achieved a 10% operating margin and $0.24 earnings per share. Full-year revenue reached $1.08 billion, with cargo revenue growing 13.1%.

The company plans to add eight Amazon freighter aircraft in 2025 and has reached tentative agreements with flight attendants and dispatchers unions.

Major Aviation Reforms Follow Fatal Jeju Air Crash and Air Busan Fire

South Korea has launched a 10-week Aviation Safety Innovation Committee to rebuild its safety system following two major incidents.

The initiative comes after December 2024's Jeju Air crash that killed 179 people (probably due to bird strikes), and the January 28, 2025, Air Busan fire caused by a power bank battery fire in the overhead bin.

The 20-member committee will focus on improving maintenance at budget airlines, enhancing airport operations, and revising safety protocols.

Air Busan has now banned power banks in overhead bins.

ENGINeUS 100 Electric Motor Gets Green Light for Commercial Aviation

Safran's ENGINeUS 100 electric motor has received EASA certification, becoming the first certified electric motor for commercial aviation.

The 125kW motor, designed for aircraft up to 19 passengers, completed 1,500 hours of testing and 100 flight hours. With a 5kW/kg power-to-weight ratio, it features integrated power electronics and air cooling.

Production will begin in 2026 at facilities in France and UK, targeting 1,000 units annually.

Several manufacturers, including Diamond Aircraft, Bye Aerospace, and VoltAero, have already selected the motor.

VX4 eVTOL Completes Critical Flight Tests

Vertical Aerospace has completed Phase 2 testing of its VX4 eVTOL aircraft at Cotswold Airport, conducting over 30 piloted flights focusing on hover capabilities and low-speed maneuvers.

The aircraft exceeded stability expectations with zero system failures during testing.

The company, which recently raised $90 million and appointed Dómhnal Slattery as Chairman, is now preparing for wingborne flight testing, pending UK Civil Aviation Authority approval.

This makes Vertical only the second company globally (after Joby Aviation) to achieve piloted thrustborne flight in a full-scale vectored thrust eVTOL.