Europe’s aviation sector continues to demonstrate resilience and growth potential as we approach 2026, with Ryanair standing as the undisputed leader among low-cost carriers.

The Dublin-based airline has delivered exceptional financial performance in recent quarters, positioning itself strategically for sustained expansion despite industry-wide challenges.

This comprehensive analysis provides detailed insights into Ryanair’s strategic position, financial performance, growth strategies, and future outlook.

Table of Contents

Executive Summary: Record Performance Amid Industry Transformation

Ryanair has established a commanding position in the European aviation market through a combination of operational excellence, strategic fleet management, and aggressive cost control.

The airline’s first half of fiscal year 2026 results demonstrate remarkable momentum, with profit after tax surging 42% to €2.54 billion on revenue growth of 13% to €9.82 billion.

This performance reflects not only strong demand recovery but also the airline’s ability to capitalize on favorable market dynamics, including capacity constraints affecting competitors and successful fare recovery strategies.

Financial Performance Analysis: Dissecting Record Results

First Half FY2026 Highlights

Ryanair’s H1 FY2026 results reveal a business firing on all cylinders. The airline transported 119 million passengers, representing a 3% increase year-over-year, while maintaining industry-leading load factors of 95%.

More impressively, average fares climbed 13% to approximately €58, benefiting from the timing of Easter holidays in Q1 and strong recovery from prior year fare declines.

Key Financial Metrics | H1 FY2026 | H1 FY2025 | Change |

|---|---|---|---|

Total Revenue | €9.82 billion | €8.69 billion | +13% |

Scheduled Revenue | €6.91 billion | €5.95 billion | +16% |

Ancillary Revenue | €2.91 billion | €2.74 billion | +6% |

Operating Profit | €2.86 billion | €2.01 billion | +42% |

Profit After Tax | €2.54 billion | €1.79 billion | +42% |

Passengers | 119.0 million | 115.3 million | +3% |

Average Fare | €58 | €52 | +13% |

Load Factor | 95% | 95% | Stable |

Source: Ryanair H1 FY26 Results

The second quarter alone saw profit after tax reach €1.72 billion, up 20% from the prior year period. This exceptional performance was driven by robust demand across both leisure and business travel segments, with revenue per passenger climbing 9%.

Revenue Composition and Ancillary Strategy

A critical component of Ryanair’s financial success stems from its sophisticated ancillary revenue model.

Ancillary revenues, comprising fees for baggage, seat selection, priority boarding, and other services, now represent approximately 30-32% of total revenue, generating €2.91 billion in H1 FY2026. This revenue stream grew 6% despite only 3% traffic growth, demonstrating effective yield management and product optimization.

The breakdown of revenue sources illustrates the diversification of Ryanair’s business model:

Revenue Category | H1 FY2026 | Percentage of Total |

|---|---|---|

Scheduled Revenues | €6.91 billion | 70.4% |

Ancillary Revenues | €2.91 billion | 29.6% |

Total Operating Revenues | €9.82 billion | 100% |

Cost Management Excellence

Ryanair’s cost discipline remains a cornerstone of its competitive strategy. Despite inflationary pressures across the aviation industry, the airline achieved remarkable cost control with unit costs rising just 1% per passenger in H1 FY2026. Total operating expenses increased only 4% to €6.96 billion, significantly below the 13% revenue growth rate.

Operating Expense Breakdown | H1 FY2026 | H1 FY2025 | Change |

|---|---|---|---|

Fuel and Oil | €2.97 billion | €2.90 billion | +2% |

Airport and Handling | €1.01 billion | €0.96 billion | +4% |

Staff Costs | €926 million | €897 million | +3% |

Route Charges (ATC) | €725 million | €633 million | +14% |

Depreciation | €688 million | €627 million | +10% |

Marketing & Distribution | €439 million | €467 million | -6% |

Maintenance & Repairs | €205 million | €184 million | +11% |

Total Operating Expenses | €6.96 billion | €6.68 billion | +4% |

The airline’s effective fuel hedging strategy has been particularly noteworthy. Ryanair has hedged approximately 85% of H2 FY2026 fuel requirements at $76 per barrel and extended its FY2027 hedge coverage to 80% at just under $67 per barrel, locking in price savings exceeding 10% compared to current market rates.

Image source: brilliantmaps.com

Competitive Positioning: Widening the Moat

Market Leadership in European Low-Cost Aviation

Ryanair maintains an overwhelming lead in the European low-cost carrier segment. The airline operates with 104% more seat capacity than its closest competitor easyJet, effectively doubling the volume of its nearest rival. This scale advantage translates directly into superior unit economics and negotiating leverage with airports, suppliers, and regulatory bodies.

European LCC Market Share | Approximate Seat Capacity | Market Position |

|---|---|---|

Ryanair | ~200 million passengers annually | #1 |

easyJet | ~98 million passengers annually | #2 |

Wizz Air | ~65 million passengers annually | #3 |

The competitive gap continues to widen as Ryanair benefits from supply chain constraints affecting competitors. Industry capacity remains constrained through at least 2030 due to aircraft production delays, Pratt & Whitney engine repair issues impacting Airbus operators, and ongoing airline consolidation across Europe.

Cost Leadership Strategy

Ryanair’s cost advantage represents its most formidable competitive moat. The airline has systematically driven down unit costs through a combination of fleet standardization, airport negotiations, operational efficiency, and ancillary revenue optimization. With a fleet of over 640 Boeing 737 aircraft (including 204 of the newer 737-8200 “Gamechanger” variants), Ryanair achieves unmatched economies of scale in maintenance, training, and spare parts management.

Key competitive advantages include:

Fleet Ownership: Ryanair’s owned fleet of 610 unencumbered aircraft eliminates expensive lease costs that burden competitors. This financial strength widens the cost gap versus rivals exposed to long-term financing arrangements and rising aircraft lease rates.

Airport Strategy: The airline prioritizes secondary airports with lower fees while maintaining strategic presence at primary hubs where yield justifies the cost. This flexible approach allows Ryanair to shift capacity away from high-cost markets like Germany and Austria toward more favorable environments in Sweden, Italy, Albania, and Morocco.

Fuel Hedging: Sophisticated fuel hedging provides cost certainty and competitive advantage when oil prices spike, as demonstrated by the current hedge positions protecting margins through FY2027.

Operational Efficiency: Industry-leading turnaround times (25 minutes) and aircraft utilization rates maximize asset productivity while minimizing ground time costs.

Image source: enginecowl.com

Fleet Expansion and Modernization: Foundation for Growth

Boeing 737 MAX Deployment Accelerates

After weathering Boeing delivery delays that constrained growth in prior periods, Ryanair has experienced accelerating aircraft deliveries through 2025. The airline had 204 Boeing 737-8200 “Gamechanger” aircraft in its fleet of 641 total aircraft as of October 2025, with the remaining 6 aircraft from its initial 210-unit order expected to arrive well ahead of summer 2026.

These next-generation aircraft deliver compelling operational advantages:

Aircraft Attribute | 737-8200 “Gamechanger” | Advantage vs. 737-800NG |

|---|---|---|

Seat Capacity | 197 seats | +4% capacity |

Fuel Burn per Seat | 16% lower | Reduced operating costs |

CO₂ Emissions per Seat | 16% lower | Environmental benefit |

Noise Footprint | 40% quieter | Airport access advantages |

Long-Term Fleet Strategy: MAX 10 Order

Looking beyond immediate deliveries, Ryanair has positioned itself for sustained growth with an order for 300 Boeing 737 MAX 10 aircraft worth approximately $40 billion at list prices. Boeing expects MAX 10 certification by mid-2026, with Ryanair’s first 15 aircraft scheduled for delivery in spring 2027 and the full 300-unit order book extending through March 2034.

The MAX 10 will carry 228 passengers (20% more than current MAX 8 aircraft) while consuming 20% less fuel per seat, delivering substantial unit cost reductions. To prepare for this fleet transition, Ryanair has launched an aggressive pilot recruitment and training program, investing approximately €25 million annually to build a pipeline of first officers ready for captain upgrades when MAX 10 deliveries accelerate in FY2029/FY2030.

Ryanair has also hedged currency risk by locking in approximately 35% of its MAX 10 capital expenditure at an average exchange rate of €1 = $1.24, securing meaningful savings on these dollar-denominated aircraft purchases.

Environmental Performance Through Fleet Modernization

Fleet renewal delivers tangible environmental benefits supporting Ryanair’s pathway to net zero emissions by 2050. Beyond the fuel efficiency of new aircraft, Ryanair has retrofitted scimitar winglets to approximately 60% of its Boeing 737NG fleet by September 2025, reducing fuel burn by 1.5% and noise by 6%. The complete retrofit program covering all 409 NG aircraft will be finished by end of 2026.

The airline has also invested $500 million in 30 CFM LEAP-1B spare engines featuring latest-generation technology that reduces fuel consumption and CO₂ emissions per seat by up to 20%. Over 50% of these engines were delivered by September 2025.

Growth Strategy for 2026 and Beyond

Revised Traffic Projections

Ryanair has raised its FY2026 passenger forecast to 207 million passengers, up from a previous estimate of 206 million, reflecting earlier-than-expected Boeing deliveries and robust demand trends. This represents 3% growth over the 200.2 million passengers carried in FY2025, when Ryanair became the first European airline to exceed 200 million annual passengers.

Traffic Growth Trajectory | Passengers (millions) |

|---|---|

FY2025 (Actual) | 200.2 |

FY2026 (Forecast) | 207.0 |

FY2027 (Target) | 215.0 |

FY2034 (Long-term Target) | 300.0 |

The long-term strategic vision calls for 800 aircraft and 300 million passengers by FY2034, representing a compound annual growth rate of approximately 4% over the next decade.

Strategic Base Expansion

Ryanair continues to optimize its network by allocating capacity toward markets offering favorable cost structures and growth potential while reducing presence in high-cost jurisdictions. Two significant base openings exemplify this strategy:

Tirana, Albania Base (April 2026): Ryanair will establish a new three-aircraft base at Tirana Airport representing a $300 million investment. The base will operate 33 routes (including 10 new destinations) and support 4 million annual passengers, creating over 3,000 direct and indirect jobs. The airline plans to potentially expand to six based aircraft within five years if traffic develops according to projections.

Trapani-Marsala, Sicily Base (January 2026): A $200 million investment will establish a new base with two initially based aircraft (potentially expanding to four), operating 23 routes including 11 new destinations. This represents Ryanair’s return to Trapani after closing its previous base there a decade ago, reflecting improved airport economics and regional market opportunities. The base will create over 800 local jobs.

These cost-effective expansions in lower-cost markets contrast sharply with capacity reductions in Germany, where Ryanair cut over 800,000 winter 2025 seats in protest of high aviation taxes and fees.

Route Network Optimization

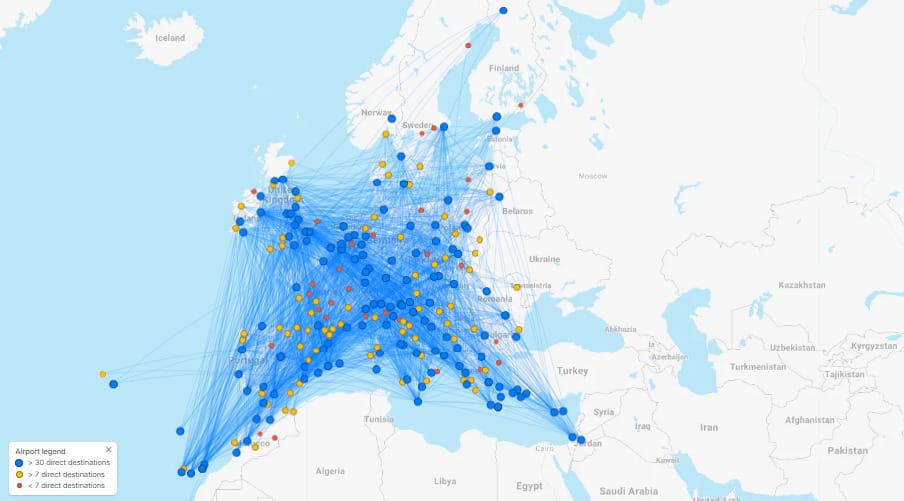

Ryanair now operates over 2,500 routes across its network, connecting 224 airports in 36 countries from 95 bases. The summer 2026 schedule includes 91 additional routes beyond the winter 2025/26 program, targeting both underserved markets and high-demand leisure destinations.

The network strategy prioritizes:

Secondary Airport Dominance: Maintaining cost advantages through strategic use of lower-cost secondary airports

Point-to-Point Efficiency: Avoiding hub complexity and connection costs

Market Flexibility: Rapidly reallocating capacity toward profitable routes and markets

Business Travel Penetration: Expanding frequencies and connectivity to attract price-sensitive business passengers

Challenges and Risk Factors

Despite strong performance, Ryanair faces several headwinds that could impact near-term results and require strategic management:

Aircraft Delivery Uncertainties

While Boeing deliveries have improved substantially in recent months, ongoing production challenges in the aerospace supply chain create continued uncertainty. Any renewed delays would directly constrain capacity growth and potentially force costly wet-lease arrangements or market share concessions to competitors.

Fuel Price Volatility

Although Ryanair’s hedging program provides near-term protection, longer-term fuel price volatility remains a persistent risk. The airline has hedged 80% of FY2027 requirements but remains exposed to market movements beyond that horizon. Geopolitical tensions, particularly conflicts in Ukraine and the Middle East, could trigger supply disruptions and price spikes.

Air Traffic Control Disruptions

Route charges increased 14% in H1 FY2026, driven by higher Eurocontrol rates. Ryanair has been vocal in criticizing European ATC infrastructure shortcomings, particularly understaffing at major control centers in France, Germany, and Spain. These operational disruptions increase costs and reduce reliability.

Environmental Compliance Costs

Emissions Trading System (ETS) costs continue to escalate, with Ryanair anticipating environmental costs rising from €1.1 billion to €1.4-1.5 billion in FY2027. Sustainable Aviation Fuel (SAF) blend mandates introduced in January 2025 add further cost pressures, though Ryanair’s fleet efficiency partially mitigates these impacts relative to competitors.

Labor Cost Inflation

Staff costs increased 3% in H1 FY2026 reflecting collective labor agreement commitments and competitive pilot recruitment markets. As MAX 10 deliveries approach, accelerated pilot training investments will temporarily inflate unit costs before delivering efficiency gains as these aircraft enter service.

Macroeconomic Uncertainties

European economic headwinds, including potential recession risks, currency volatility, and geopolitical instability, could dampen travel demand. However, Ryanair’s ultra-low-cost position typically provides resilience during economic downturns as consumers trade down from higher-cost carriers.

Sustainability Initiatives and Environmental Strategy

Pathway to Net Zero 2050

Ryanair has articulated a comprehensive environmental strategy aligned with the 2015 Paris Agreement, UN Sustainable Development Goals, and aviation industry’s Destination 2050 initiative. The airline targets reducing emissions intensity to 50 grams of CO₂ per passenger-kilometer by 2031, representing a 27% reduction from current levels.

Key environmental initiatives include:

Fleet Modernization: New aircraft deliver 16% lower fuel burn and emissions per seat, with winglet retrofits adding 1.5% efficiency improvements to the legacy fleet.

Sustainable Aviation Fuel: Ryanair has committed to ambitious SAF adoption targets, though commercial availability and cost premiums remain challenges across the industry.

Operational Efficiency: Continuous improvement programs optimize flight paths, reduce taxiing time, and minimize auxiliary power unit usage.

Research Partnership: Ryanair extended its funding partnership with Trinity College Dublin’s Sustainable Aviation Research Centre through 2030 with an additional €2.5 million commitment, supporting research into SAF production, zero-carbon propulsion, and non-CO₂ emissions reduction.

ESG Recognition

Ryanair’s sustainability performance has earned recognition from leading ESG rating agencies, maintaining an “A” rating from MSCI, “A-” from CDP, and ranking as the #1 global large-cap airline in Sustainalytics assessments. These ratings reflect the airline’s environmental efficiency relative to industry peers, driven primarily by young fleet, high load factors, and point-to-point network efficiency.

Financial Strength and Capital Allocation

Robust Balance Sheet

Ryanair’s financial position has strengthened considerably, with net cash reaching over €1.5 billion at September 30, 2025 (up from €1.3 billion at March 31, 2025) despite €1.2 billion in debt repayments, €1.1 billion in capital expenditure, and €0.4 billion in shareholder distributions during H1 FY2026.

Balance Sheet Highlights | Sept 30, 2025 |

|---|---|

Gross Cash | €3.0 billion |

Gross Debt | €1.5 billion |

Net Cash | €1.5 billion |

Shareholders’ Equity | €9.0 billion |

Credit Rating (Fitch & S&P) | BBB+ |

The airline is on track to become entirely debt-free by May 2026 following repayment of its final €1.2 billion bond maturity using internal cash resources. This financial strength provides strategic flexibility for opportunistic aircraft purchases, market share capture during competitor distress, and continued shareholder returns.

Ryanair has implemented a comprehensive capital return program combining share buybacks and dividends. In May 2025, the board authorized a €750 million share buyback program, with approximately 25% completed (€188 million, 7 million shares purchased and cancelled) by September 2025. Additionally, the board declared an interim dividend of €0.193 per share payable in February 2026, demonstrating confidence in cash generation and commitment to shareholder value creation.

Industry Context and Market Dynamics

European Aviation Recovery

The European airline industry has demonstrated strong recovery momentum following the COVID-19 pandemic, with passenger numbers approaching and in some cases exceeding pre-pandemic levels. Low-cost carriers have captured disproportionate market share gains, with LCC penetration in Europe reaching 21.12% of total seat capacity compared to just under 15% for US LCCs.

Industry-wide capacity constraints through at least 2030 create a favorable supply-demand environment for efficiently-operated carriers like Ryanair. Boeing and Airbus continue to face production bottlenecks, while Pratt & Whitney engine issues have grounded significant portions of the Airbus A320neo fleet, removing capacity from markets where Ryanair can capture demand.

Competitive Dynamics

Legacy carriers continue to struggle with higher cost structures, limited fleet flexibility, and hub complexity that undermines point-to-point economics. Several European airlines face consolidation or restructuring, including Air Europa, SAS, and TAP, removing capacity and creating market share opportunities for low-cost operators.

Among LCC competitors, Ryanair’s scale advantages continue to widen. easyJet operates approximately half of Ryanair’s capacity, while Wizz Air focuses primarily on Central and Eastern European markets where overlap with Ryanair remains limited. The competitive moat created by Ryanair’s cost leadership, financial strength, and aircraft orderbook positions the airline to capture the majority of European short-haul growth over the next decade.

Management Outlook and Guidance

Near-Term Expectations (FY2026)

Ryanair management has indicated cautious optimism for FY2026 results while acknowledging several uncertainties. The airline expects to recover all of the 7% full-year fare decline experienced in FY2025, supporting reasonable profit growth. However, H2 comparisons become more challenging as the company faces stronger prior-year fare benchmarks.

Management emphasized that Q3 fare outcomes will depend heavily on close-in Christmas and New Year bookings, while Q4 visibility remains essentially zero at this stage of the year. The absence of Easter benefits in Q4 FY2026 (Easter falls in April 2026, shifting the revenue benefit to FY2027 Q1) creates an additional headwind versus the prior year.

Key risks to guidance include potential conflict escalation in Ukraine or the Middle East, macroeconomic shocks, adverse fuel price movements, and continued European ATC disruptions and mismanagement.

Long-Term Strategic Vision

CEO Michael O’Leary has articulated an ambitious growth trajectory targeting 300 million passengers and 800 aircraft by FY2034. This vision relies on several strategic pillars:

Cost Leadership Maintenance: Continuing to widen the unit cost gap versus competitors through fleet efficiency, operational excellence, and ancillary revenue optimization.

Market Share Capture: Leveraging industry capacity constraints and competitor financial weakness to consolidate Ryanair’s position as Europe’s dominant short-haul carrier.

Network Expansion: Selective growth in underserved markets and strategic capacity reallocation away from high-cost jurisdictions toward more favorable regulatory environments.

Technology Investment: Deploying latest-generation aircraft and operational systems to maintain efficiency advantages while meeting environmental targets.

Financial Discipline: Maintaining a strong balance sheet and conservative financial management to weather industry cycles and capitalize on distressed opportunities.

My Final Thoughts: Positioned for Sustained Leadership

Ryanair enters 2026 from a position of exceptional strength, having delivered record profitability while navigating industry-wide challenges including Boeing delivery delays, fuel price volatility, and increased environmental compliance costs. The airline’s fundamental competitive advantages remain intact and are in fact widening relative to European competitors.

The combination of accelerating aircraft deliveries, effective fuel hedging, disciplined cost management, and strategic network optimization positions Ryanair to capture disproportionate market share as European short-haul capacity remains constrained through the end of the decade. Management’s long-term vision of 300 million passengers by FY2034 appears achievable given current trajectory and industry dynamics.

Ryanair represents a compelling case study in sustainable competitive advantage through operational excellence and strategic discipline. The airline’s ability to maintain ultra-low unit costs while investing in fleet modernization, technology, and environmental sustainability demonstrates that cost leadership and responsible corporate citizenship are not mutually exclusive objectives.

As we look toward 2026 and beyond, Ryanair’s strategic positioning suggests continued strong financial performance, market share gains, and shareholder value creation.

The key variables to monitor include aircraft delivery execution, fare pricing power in a capacity-constrained environment, fuel cost management, and regulatory developments affecting operating costs and market access across Europe.

The European aviation landscape continues to evolve, but Ryanair’s fundamental business model, financial strength, and execution capabilities position the airline to remain Europe’s leading low-cost carrier for years to come.