Batik Air Malaysia stands at a transformative phase as the airline accelerates its regional footprint through aggressive network expansion and fleet modernization.

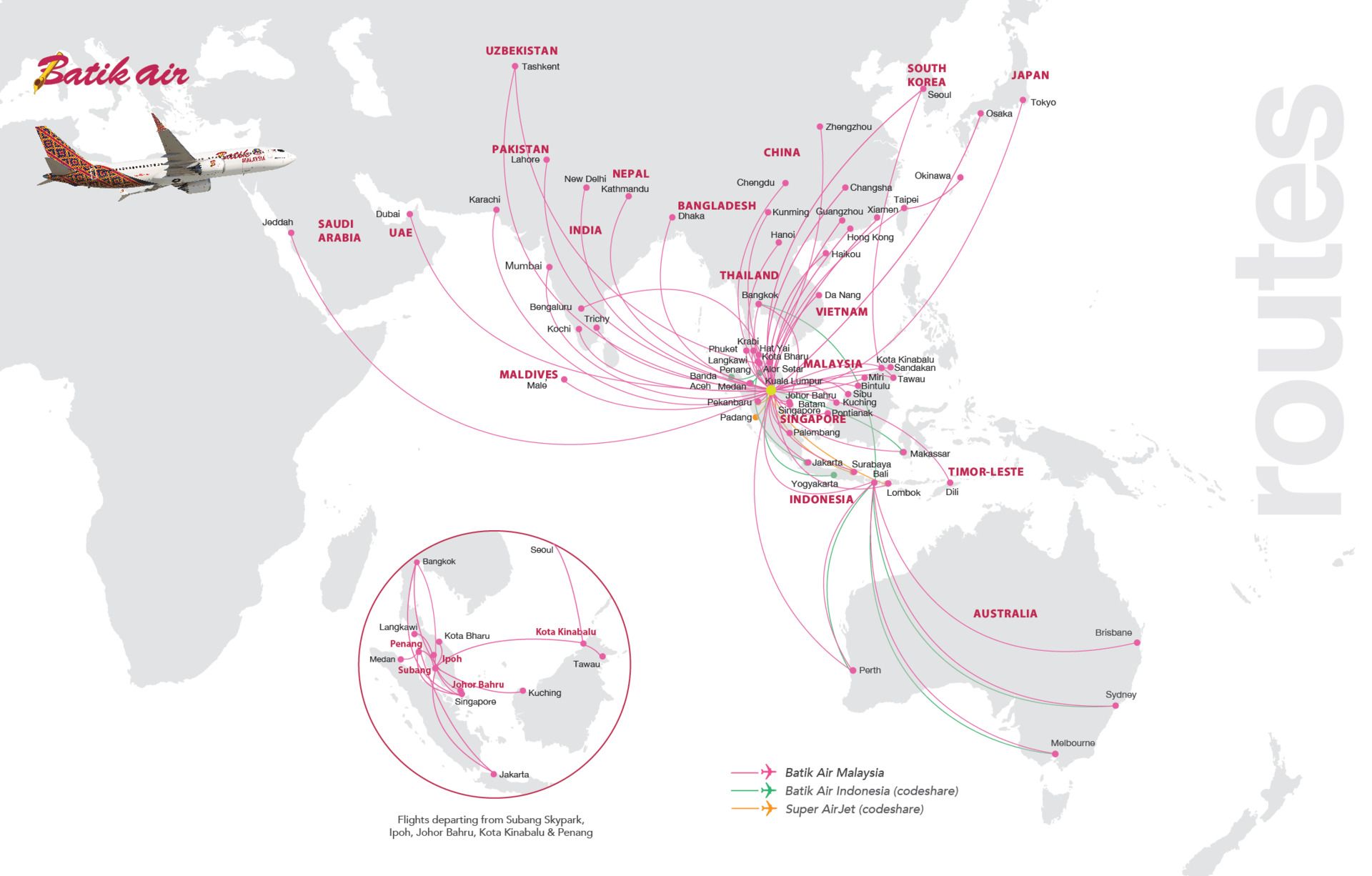

The full-service carrier, operating under the Lion Air Group umbrella, is positioning itself as a critical connector between Southeast Asia, Australia, and emerging markets across the Asia-Pacific region.

The airline’s strategic moves in December 2025 signal a decisive commitment to capturing market share in a region experiencing rapid post-pandemic recovery.

Also Read:

Table of Contents

Image Source: Flickr

Aggressive Network Expansion Reshaping Regional Connectivity

December 2025 marked a watershed moment for Batik Air Malaysia with the launch of nine new routes on December 8, representing one of the most significant single-day network launches in the airline’s history. This expansion reflects careful planning and a clear vision for regional growth, according to CEO Datuk Chandran Rama Muthy.

The new routes strategically strengthen connectivity across multiple Malaysian hubs. Four services operate from Sultan Abdul Aziz Shah Airport (Subang), including flights to Singapore, Jakarta, Johor Bahru, and Langkawi.

Route Category | New Destinations | Strategic Focus |

|---|---|---|

International from Subang | Singapore, Jakarta | Business travelers, time-sensitive passengers |

Domestic from Subang | Johor Bahru, Langkawi | Regional connectivity, tourism |

Penang expansion | Medan, Singapore | Northern Malaysia gateway |

Kota Kinabalu growth | Enhanced connectivity | East Malaysia hub development |

The move to Changi Airport Terminal 4 on November 11, 2025, supports this expansion strategy. Terminal 4 provides enhanced facilities and operational efficiency as the airline scales its Singapore operations.

This terminal shift aligns with broader Lion Air Group coordination at Changi, creating seamless connectivity for passengers across the group’s carriers.

Image source: batikair.com.my

Fleet Expansion Strategy: Targeting 70 Aircraft by 2030

Batik Air Malaysia has announced ambitious plans to expand its fleet to approximately 70 aircraft within five years, with the majority being Boeing 737 narrowbody aircraft. As of December 2025, the carrier operates 46 aircraft with an average fleet age of 9.5 years.

The current fleet composition demonstrates balanced operational capabilities:

Current Fleet Breakdown (December 2025):

Narrowbody Aircraft (43 units, avg. age 9.4 years):

- 23 Boeing 737-800

- 17 Boeing 737 MAX 8

- 3 ATR 72-600

Widebody Aircraft (3 units):

- 3 Airbus A330-300

This measured growth approach contrasts sharply with expansion strategies that have led to financial distress at other Southeast Asian carriers. The airline plans to add five to eight aircraft annually, carefully matching capacity to route demand and yield projections.

The Boeing 737 MAX fleet handles longer-range missions with superior fuel efficiency. Meanwhile, the proven 737-800s maintain dense short-haul routes under four hours.

The widebody A330 fleet serves specific peak demand periods, particularly Hajj and Umrah traffic. Limited Australia services may utilize these aircraft, though the carrier maintains discipline against overbuilding widebody capacity.

Multi-Hub Strategy Creating Operational Flexibility

Batik Air Malaysia’s multi-hub approach differentiates it from single-hub competitors. The strategy balances seasonal demand shifts across three primary operational bases.

Kuala Lumpur International Airport (KLIA) serves as the main hub, handling 40% of connecting traffic. This provides the network’s core foundation with comprehensive international and domestic connectivity.

Kota Kinabalu emerges as a rising hub in East Malaysia. The location taps South Korean and Australian leisure flows while offering Indonesian and South Asian travelers expanded routing options. Year-round tourism growth in Sabah reduces traditional seasonality challenges.

Sultan Abdul Aziz Shah Airport (Subang) offers time-pressed business passengers simplified access near downtown Kuala Lumpur. This relieves KLIA capacity constraints while serving a premium market segment.

Image source: en.wikipedia.org

Hub Location | Primary Function | Key Markets Served |

|---|---|---|

KLIA | Main international hub | Global connectivity, transfer traffic |

Kota Kinabalu | East Malaysia gateway | Korea, Australia, Indonesia |

Subang | Business hub | Bangkok, Singapore, Jakarta |

Business Model: Hybrid Service Targeting Market Gap

Operating as a full-service carrier within the Lion Air Group, Batik Air Malaysia competes directly with traditional carriers like Malaysia Airlines and Garuda Indonesia. However, its hybrid approach fills a critical market gap between ultra-low-cost carriers and premium full-service airlines.

The airline layers its fleet configuration based on route characteristics. Dual-class cabins serve premium routes requiring business-class offerings. Single-class layouts optimize density on migrant-labor and leisure flows where price sensitivity dominates demand.

This flexibility allows Batik Air to serve diverse passenger segments: migrant workers from Bangladesh, Pakistan, Nepal, and India; rising Southeast Asian middle-class travelers seeking comfort without premium pricing; business passengers requiring efficiency; and leisure tourists across the Asia-Pacific region.

The approach leverages Lion Air Group network synergies for aircraft repositioning, capacity swaps, and route adaptation. This group-level flexibility provides significant advantages compared to smaller independent carriers.

Visit Malaysia 2026: Catalyst for Growth

Malaysia’s Visit Malaysia 2026 campaign provides a powerful tailwind for Batik Air’s expansion. The initiative aims to attract 35.6 million tourists and generate RM147.1 billion in tourism receipts annually.

Batik Air plays a central role in this national tourism push. The airline handles eight scheduled flights and one charter flight among 21 new international routes launching from December 2025 through mid-January 2026.

Recent route launches directly support Visit Malaysia 2026 objectives:

Tashkent to Langkawi: Launched December 18, 2025, opening Central Asian markets

Bangkok to Subang: Enhanced Thai connectivity ahead of tourism campaign

Medan and Singapore to Penang: Strengthened northern Malaysia gateway access

The airline unveiled a special Visit Malaysia 2026 livery on its Boeing 737 MAX aircraft, demonstrating commitment to the national initiative alongside Malaysia Airlines and AirAsia.

Competitive Environment and Market Positioning

Batik Air Malaysia operates in an intensely competitive Southeast Asian aviation market. The carrier faces competition across multiple segments.

Low-cost carriers like AirAsia dominate price-sensitive leisure markets with aggressive pricing and extensive regional networks. These carriers maintain cost advantages through single-class configurations and ancillary revenue models.

Full-service carriers including Malaysia Airlines and Garuda Indonesia offer premium products with lounge access, frequent flyer programs, and alliance memberships. These airlines target business travelers and premium leisure passengers.

Hybrid carriers like Batik Air occupy the middle ground. The carrier provides more comfort than ultra-low-cost options without full-service premium pricing. This positioning appeals to emerging middle-class travelers across Southeast Asia.

Batik Air’s competitive advantages include Lion Air Group backing for financial stability and operational support; flexible fleet deployment across multiple hubs; strategic route selection targeting underserved markets; and hybrid service model filling market gaps between extremes.

Recent Industry Recognition

In December 2025, Batik Air received three industry awards, providing external validation for its operational improvements and service quality enhancements.

While specific award categories were not detailed, this recognition demonstrates industry acknowledgment of the carrier’s progress.

Operational Challenges and Risk Factors

Despite positive momentum, Batik Air faces several operational and market challenges.

Fleet growth execution risk remains significant. Scaling from 46 to 70 aircraft requires substantial capital investment, pilot recruitment and training, and maintenance infrastructure expansion. Any delays in aircraft deliveries or crew availability could constrain growth plans.

Intense price competition from established low-cost carriers pressures yields on price-sensitive routes. Maintaining service differentiation while controlling costs presents an ongoing challenge.

Economic sensitivity affects demand across key markets. Slowdowns in Indonesia, Malaysia, or Australia could reduce passenger traffic and yields. Currency fluctuations impact cost structures and revenue realization.

Fuel price volatility represents the largest operational cost variable. Rising oil prices could compress margins, particularly on longer international routes.

Regulatory environment changes could affect bilateral air service agreements, slot availability, or operational requirements across the network.

My Final Thoughts

Batik Air Malaysia enters 2026 with clear strategic momentum built on network expansion, fleet modernization, and multi-hub operational flexibility. The airline’s measured approach to growth contrasts with historical expansion failures across Southeast Asian aviation.

The carrier’s hybrid service model positions it well to capture emerging middle-class travel demand across the region. Visit Malaysia 2026 provides near-term growth catalyst while longer-term demographics favor continued aviation expansion across Southeast Asia.

Success hinges on execution discipline. Managing fleet growth without overextending financially, maintaining service quality while controlling costs, and adapting to competitive pressures will determine whether Batik Air achieves its 70-aircraft vision by 2030.

The airline’s Lion Air Group affiliation provides both opportunities and risks. Group-level synergies offer operational advantages, yet performance challenges at sister carriers could impact investor confidence and access to capital.

The carrier’s performance through 2026 will offer valuable insights into sustainable growth models for full-service carriers operating in highly competitive environments.