The advanced air mobility (AAM) sector witnessed a significant turning point in 2025 with the complete shutdown of Lilium Aerospace GmbH, once considered among the most promising electric vertical takeoff and landing (eVTOL) aircraft developers.

Founded in 2015 and backed by over $1.5 billion in funding, the German company’s journey from industry pioneer to insolvency provides critical insights for eVTOL professionals regarding technical innovation, financial sustainability, and certification timelines.

Table of Contents

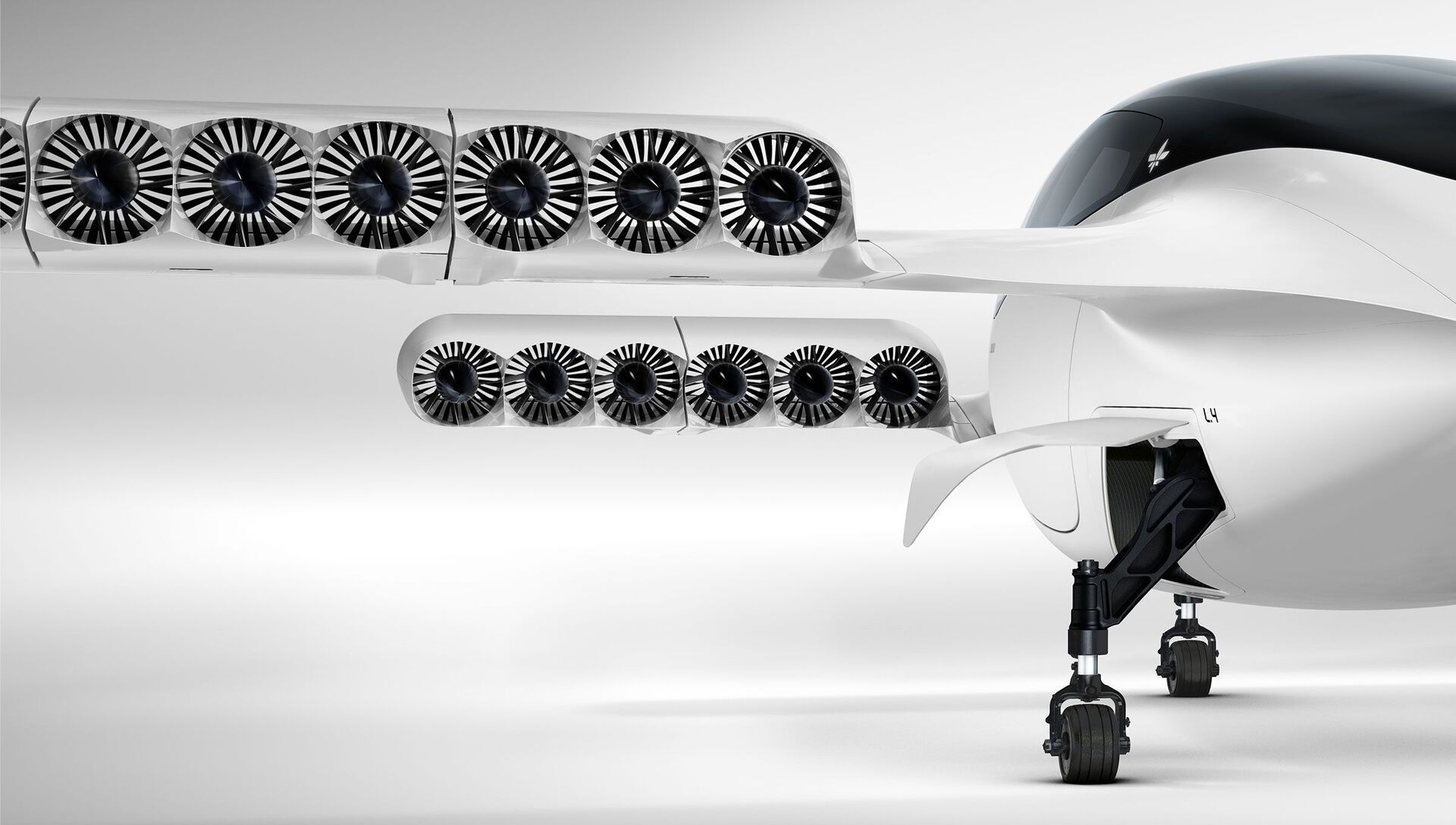

Image source: lilium.com

Technical Architecture and Innovation

Lilium’s technical approach distinguished itself through a unique propulsion architecture featuring 30 battery-electric ducted fan engines integrated within the main wings and canard surfaces.

This configuration represented a departure from conventional multirotor designs, with the ducted fans serving as the only moving exterior components during flight operations.

The seven-seater Lilium Jet specifications demonstrated ambitious performance targets for regional air mobility applications. According to technical documentation, the aircraft was designed for a maximum cruise speed of 280 km/h (170 mph) with a range of 300 kilometers (approximately 160 nautical miles).

The propulsion system generated approximately 320 kW of total power, distributed across the 30 electric ducted fans arranged strategically along the airframe.

Image source: lilium.com

The electric jet propulsion system utilized tilt-rotor technology, with all 30 engines rotating from vertical orientation during takeoff to horizontal positioning for cruise flight. This transition enabled the aircraft to operate efficiently across different flight phases while maintaining aerodynamic performance.

The maximum takeoff weight was specified at 3,175 kilograms, with a cruise altitude capability of 3,000 meters (10,000 feet).

Aircraft Specification | Value |

|---|---|

Passenger Capacity | 7 seats |

Maximum Speed | 280 km/h (170 mph) |

Range | 300 km (160 nmi) |

Electric Motors | 30 ducted fans |

Power Output | 320 kW total |

Cruise Altitude | 3,000 m (10,000 ft) |

Max Takeoff Weight | 3,175 kg |

Certification Achievements

Lilium secured notable regulatory milestones that positioned the company as a certification leader within the eVTOL sector.

In June 2023, the company became the first eVTOL manufacturer to obtain both European Union Aviation Safety Agency (EASA) and Federal Aviation Administration (FAA) certification bases for a powered-lift eVTOL aircraft. The FAA issued the G-1 certification basis for the Lilium Jet, establishing comprehensive airworthiness requirements for the type certificate validation process.

Subsequently, in November 2023, Lilium received EASA Design Organization Approval (DOA), qualifying the company to design and hold type certificates for aircraft developed according to EASA’s Special Condition for VTOL (SC-VTOL) rules.

This dual certification approach reflected strategic planning for global operations across European and North American markets.

CERTIFICATION TIMELINE

2023 June: FAA G-1 Certification Basis issued

2023 November: EASA Design Organization Approval received

2024-2026: Type certification process ongoing (discontinued)

2026: Planned first deliveries (never realized)

The certification strategy involved concurrent development programs with both regulatory authorities, requiring substantial technical documentation and compliance demonstrations.

However, the timeline for actual type certificate issuance extended beyond initial projections, with first deliveries rescheduled to 2026 before operations ceased.

Financial Trajectory and Insolvency

The financial collapse of Lilium unfolded through two distinct insolvency filings within a four-month period.

In October 2024, the company filed its initial insolvency application after failing to secure a €50 million loan from the Bavarian government. This funding proved critical for sustaining operations and attracting additional private investment to bridge the gap toward certification completion.

The company briefly found hope in December 2024 when Mobile Uplift Corporation, a consortium of European and North American investors, agreed to acquire the operating assets of Lilium GmbH and Lilium eAircraft GmbH.

The creditors committee approved this asset deal, temporarily rebranding the entity as Lilium Aerospace.

However, this acquisition collapsed in February 2025, triggering the second insolvency filing and subsequent business closure.

Financial Event | Date | Details |

|---|---|---|

Total Capital Raised | 2015-2024 | Over $1.5 billion |

First Insolvency Filing | October 2024 | €50M government loan rejected |

Rescue Investment Agreed | December 2024 | Mobile Uplift Corporation deal |

Second Insolvency Filing | February 2025 | Investment deal collapsed |

Operations Ceased | February 2025 | ~1,000 employees laid off |

The financial requirements for bringing an eVTOL aircraft through certification proved substantially higher than initially projected.

Despite deploying $1.5 billion toward development efforts and achieving significant technical milestones, including FAA G-1 certification basis approval, the capital proved insufficient to reach revenue-generating operations.

Manufacturing Infrastructure and Workforce

At its operational peak, Lilium maintained a complex international manufacturing network designed to support serial production. The company employed over 2,500 personnel across facilities in Germany, Spain, Portugal, France, and Brazil. Production operations included composite fuselage assembly, propulsion system integration, and certification testing infrastructure.

The manufacturing strategy involved partnerships with established aerospace suppliers to leverage existing production capabilities. These collaborations encompassed cabin interior development, electrical wiring interconnection systems, and structural components fabrication.

However, the workforce was significantly reduced during the insolvency proceedings, with approximately 1,000 employees remaining during the failed rescue attempt before final closure eliminated all positions.

Asset Disposition and Technology Transfer

Following the business shutdown, Lilium’s intellectual property became the subject of competitive acquisition processes.

In October 2025, Archer Aviation acquired Lilium’s portfolio of approximately 300 advanced air mobility patent assets for €18 million. This acquisition included patents covering high-voltage systems, battery management, aircraft design, flight controls, electric engines, propellers, and critically, ducted fan technology.

The patent portfolio represented innovations developed through Lilium’s $1.5 billion research and development investment. Archer Aviation specifically noted that the acquisition provides what is believed to be the leading patent portfolio on ducted fan technology globally, with potential applications extending beyond urban air mobility into light-sport and regional aircraft sectors.

LILIUM PATENT PORTFOLIO ACQUISITION

Buyer: Archer Aviation Inc.

Purchase Price: €18 million

Patent Count: ~300 assets

Key Technologies:

- Ducted fan systems

- High-voltage electrical systems

- Battery management systems

- Advanced aircraft design

- Flight control systems

- Electric propulsion engines

Additional asset acquisition efforts emerged from other industry participants. Advanced Air Mobility Group (AAMG) expressed interest in acquiring intellectual property, testing facilities, and personnel.

However, the competitive bid process ultimately favored Archer Aviation’s patent portfolio acquisition.

Industry Implications

The Lilium shutdown represents the first major casualty among well-funded eVTOL developers, raising critical questions about capital requirements, certification timelines, and business model viability.

The company deployed substantial resources toward innovative ducted fan technology and achieved meaningful certification milestones, yet failed to bridge the financial gap between development and commercial operations.

For aviation industry analysts and eVTOL sector professionals, several key takeaways emerge from this analysis. The capital intensity required for bringing novel aircraft configurations through certification substantially exceeds early-stage projections. Dual certification strategies, while potentially valuable for global market access, compound resource requirements and timeline uncertainties.

Finally, even sophisticated technical solutions and regulatory progress cannot compensate for an inadequate financial runway to reach revenue-generating operations.

The technology developed by Lilium will continue influencing the sector through patent acquisitions by remaining industry participants.

Whether alternative business structures or consolidation strategies can address the fundamental challenges revealed by Lilium’s trajectory remains a critical question for the advanced air mobility sector’s future development.