As China’s aviation sector continues its post-pandemic transformation, Shandong Airlines stands at a pivotal crossroads.

Controlled by Air China Limited with a 23% direct stake and majority ownership through parent company Shandong Aviation Group, this regional carrier has emerged as a critical player within China’s domestic aviation network.

Understanding Shandong Airlines’ operational framework, financial dynamics, and strategic positioning offers valuable insights into the broader Chinese aviation market’s evolution.

Table of Contents

Image source: wikimedia.org

Corporate Structure and Ownership Dynamics

Shandong Airlines’ ownership structure underwent significant changes in 2023 when Air China completed its acquisition of a controlling 66% stake in Shandong Aviation Group, up from 49.4%.

This consolidation strengthened Air China’s strategic control over Shandong Airlines, which remains co-funded by regional investors, including Shandong Hi-Speed Group and Shandong Finance Group. The remaining shares continue to trade publicly, maintaining market liquidity while reinforcing the carrier’s integration within Air China’s broader network strategy.

This ownership architecture positions Shandong Airlines as a vital regional subsidiary within China’s aviation ecosystem, benefiting from Air China’s resources while maintaining operational flexibility for regional market development.

Fleet Composition and Operational Scale

FLEET PROFILE (2025)

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Total Aircraft: 139 Boeing 737 series

Average Fleet Age: 11.5 years (8.1 years per some sources)

Fleet Type: All-Boeing configuration

Primary Models: 737-800, 737-900, 737 MAX variants

Employee Count: ~5,000 globally

Pilot Workforce: ~800

Cabin Crew: ~1,600

Shandong Airlines operates an exclusively Boeing 737 fleet, a strategic decision that simplifies maintenance operations, reduces training complexity, and optimizes operational costs.

According to fleet tracking data from September 2025, the airline maintains 139 active aircraft with an average age of 11.5 years. This single-fleet strategy aligns with many successful low-cost and regional carriers worldwide, enabling standardized crew qualifications and streamlined spare parts inventory.

The carrier has committed to fleet modernization through previous Boeing orders placed in 2014, including 34 Boeing 737 MAX aircraft.

As Boeing resumed 737 MAX deliveries to Chinese airlines in 2025, Shandong Airlines positioned itself to benefit from improved fuel efficiency and reduced operating costs associated with next-generation aircraft.

Fleet Metrics | 2025 Data |

|---|---|

Total Fleet Size | 139 aircraft |

Primary Aircraft Type | Boeing 737 Series |

Average Age | 11.5 years |

Fleet Strategy | Single-type operations |

Maintenance Hubs | Jinan, Qingdao, Yantai |

Network Architecture and Route Development

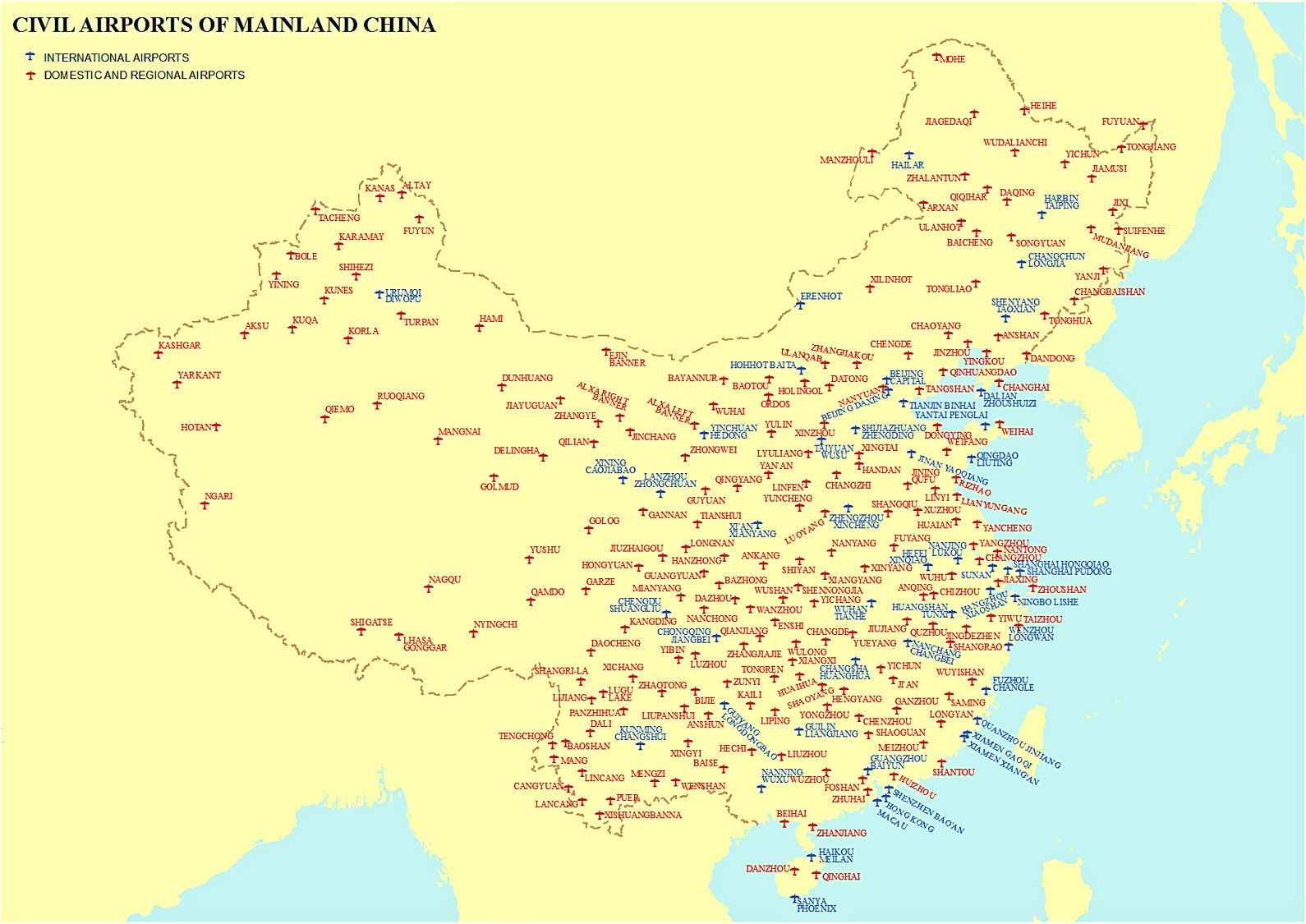

Shandong Airlines operates an extensive domestic and regional network spanning over 380 routes with more than 4,700 weekly flights connecting over 80 cities.

The carrier’s hub strategy centers on three primary nodes within Shandong Province: Jinan Yaoqiang International Airport (TNA), Qingdao Jiaodong International Airport (TAO), and Yantai Penglai International Airport (YNT).

Image source: wikipedia.org

International expansion has accelerated in 2025, with new routes targeting Southeast Asian markets.

In October 2025, the airline launched its first Qingdao-Southeast Asia cargo route, connecting Qingdao with Bangkok and extending to Vietnam and the Philippines. In September, Shandong Airlines introduced passenger service between Seoul and Wuyishan, strengthening Northeast Asian connectivity.

As a Star Alliance member, Shandong Airlines leverages integrated codeshare agreements with partner carriers, expanding its global reach beyond direct operations. This alliance membership provides passengers with seamless connections across Asia, Europe, and North America while enabling the airline to participate in joint frequent flyer programs.

NETWORK COVERAGE SNAPSHOT

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Total Routes: 380+ domestic, regional, international

Cities Served: 80+ major Chinese cities

Weekly Flights: 4,700+

Primary Hubs: Jinan (TNA), Qingdao (TAO), Yantai (YNT)

International Focus: Japan, South Korea, Thailand, Singapore

Alliance: Star Alliance member

Financial Performance and Market Positioning

Shandong Airlines reported revenues of CNY 19.59 billion (approximately $2.7 billion USD) for the fiscal year ending December 31, 2024, representing an 8.3% increase from CNY 18.29 billion in 2023.

This revenue growth reflects the carrier’s operational resilience amid challenging market conditions affecting the broader Chinese aviation sector.

Financial Indicators | 2024 | 2023 | Change |

|---|---|---|---|

Total Revenue | CNY 19.59 billion | CNY 18.29 billion | +8.3% |

Sales Revenue | CNY 19.42 billion | CNY 18.09 billion | +7.4% |

Net Profit | $25.0 million | N/A | Positive margin |

Profit Margin | 1.6% | N/A | Modest profitability |

However, Chinese carriers, including Shandong Airlines continue facing structural headwinds.

Reuters indicates that while airlines returned to profitability during summer 2025 peak season, recovery remains weaker than international peers due to slowed economic growth and intense domestic competition. Chinese regulators have summoned airlines for closed-door meetings addressing concerns over excessively low ticket prices that erode profitability.

Despite these pressures, Shandong Airlines maintains a stable financial footing through operational efficiency, strategic cost management, and its position within Air China’s network. The carrier’s 1.6% profit margin in 2024 demonstrates disciplined financial management while navigating competitive pricing dynamics.

Operational Excellence and Service Portfolio

Shandong Airlines differentiates its service offering through diversified revenue streams beyond traditional passenger operations. The carrier provides comprehensive services including:

Passenger Services

Dual-cabin configuration (Economy and Business Class)

Domestic trunk routes from Shandong province to major Chinese cities

Growing international connectivity to Northeast and Southeast Asia

Cargo and Logistics

Dedicated cargo services with specialized routes

Express cargo handling for time-sensitive shipments

Integrated logistics solutions supporting regional supply chains

Technical Services

Line maintenance operations for owned fleet

Ground handling services at hub airports

Crew training programs supporting operational standards

This multi-service approach provides revenue diversification, reducing dependence on passenger ticket sales alone. The airline’s August 2025 launch of a Qingdao-Tokyo cargo route with 18-ton one-way capacity demonstrates commitment to freight market development as a profit center.

Strategic Outlook for 2026 and Beyond

Several key factors will shape Shandong Airlines’ trajectory through 2026 and subsequent years:

Fleet Modernization

The ongoing introduction of Boeing 737 MAX aircraft represents a critical efficiency driver.

Following Boeing’s resumption of deliveries to China in mid-2025, with expectations for 50 aircraft deliveries to Chinese carriers through year-end, Shandong Airlines stands to benefit from younger, more fuel-efficient aircraft that reduce per-seat operating costs.

International Network Expansion

The carrier’s recent focus on Southeast Asian cargo and passenger routes positions it to capture growing cross-border trade and tourism demand.

China’s 2025/26 winter-spring flight season signals steady growth in air travel demand, with regulatory support for route expansion.

Market Consolidation Benefits

As Air China’s regional subsidiary, Shandong Airlines benefits from network integration, shared resources, and coordinated scheduling.

This positioning offers competitive advantages over independent carriers facing capital constraints and pricing pressures.

Industry Recovery Dynamics

The broader Chinese aviation market faces a gradual recovery path.

China’s domestic aviation remained above pre-pandemic levels in September 2025, though international traffic recovery lags. Shandong Airlines’ strong domestic foundation provides stability while international routes develop.

Competitive Pressures

Intense domestic competition and regulatory pricing concerns remain challenges.

The airline must balance load factor optimization with yield management to maintain profitability amid competitive fare environments.

Risk Factors and Challenges

Aviation industry professionals should monitor several risk dimensions:

Economic Sensitivity: Slower Chinese economic growth directly impacts discretionary travel demand and corporate travel budgets.

Regulatory Environment: Government intervention on pricing and capacity allocation affects revenue management flexibility.

Fleet Dependency: Single-supplier aircraft strategy creates vulnerability to Boeing production issues or delivery delays.

Geopolitical Factors: US-China trade tensions periodically impact aircraft deliveries and international route viability.

High-Speed Rail Competition: China’s extensive bullet train network continues capturing short-haul air travel demand on key domestic corridors.

Final Thoughts

Shandong Airlines approaches 2026 with solid operational fundamentals, strategic ownership backing, and expanding network reach. The carrier’s focus on operational efficiency, fleet modernization, and service diversification provides a foundation for navigating China’s complex aviation environment.

While industry-wide challenges persist around pricing pressure and economic headwinds, Shandong Airlines’ integration within Air China’s network and its strong regional positioning offer competitive advantages.

Its trajectory through 2026 will reflect broader trends in Chinese domestic aviation: measured growth, efficiency prioritization, and strategic network development, balancing domestic strength with international ambition.

The airline’s ability to leverage Star Alliance connectivity, optimize its all-Boeing fleet, and capitalize on cargo opportunities alongside passenger operations positions it for continued relevance in one of the world’s most dynamic aviation markets.