Executive Summary

Financial Momentum: Q3 2025 revenue for GE Aerospace reached $11.3 billion (up 26% YoY) with operating profit of $2.3 billion and adjusted EPS rising 44% to $1.66.

Market Leadership: CFM International (50/50 JV with Safran) commands approximately 40% of the large commercial aircraft engine market through its dominant LEAP engine family.

Services Growth Engine: Commercial services revenue surged 28% in Q3 2025, driven by internal shop visits (up 33%) and spare parts sales (up over 25%), representing more than 70% of commercial engine revenue.

Defense Expansion: Defense & Propulsion Technologies segment achieved 26% revenue growth in Q3 2025, reaching $2.8 billion with 75% profit growth and 380 basis points of margin expansion.

Also Read:

Table of Contents

Introduction

GE Aerospace stands at a defining moment in its history as an independent entity focused solely on aviation propulsion and systems.

Following its April 2024 separation from General Electric, the company has delivered exceptional financial performance while navigating an industry rebounding from years of pandemic-induced constraints.

With revenue surging 26% in Q3 2025 and the LEAP engine program achieving record delivery rates, GE Aerospace demonstrates operational excellence across commercial and defense sectors.

Yet persistent supply chain challenges, intensifying competition, and regulatory pressures will shape its trajectory through 2026 and beyond.

Business Overview and Revenue Drivers

Company Foundation

GE Aerospace operates as a world-leading provider of jet and turboprop engines with an installed base of approximately 49,000 commercial and 29,000 military aircraft engines. The company employs approximately 53,000 people globally and maintains manufacturing, service, and engineering facilities across multiple continents.

Headquartered in Evendale, Ohio, GE Aerospace traces its aviation heritage back over a century. The company’s separation from its former parent organization created a pure-play aerospace company focused exclusively on aircraft propulsion and related systems.

Business Segments Structure

The company operates through two primary reporting segments, each addressing distinct market opportunities:

Commercial Engines & Services (CES)

CES represents the larger segment, generating $8.9 billion in Q3 2025 revenue. This segment provides engines for commercial aircraft ranging from narrowbody single-aisle jets to large widebody international aircraft.

The segment operates on a razor-and-blade business model. Original equipment sales establish long-term customer relationships, while aftermarket services generate recurring revenue streams over 25-30 year engine lifecycles.

Key engine programs include:

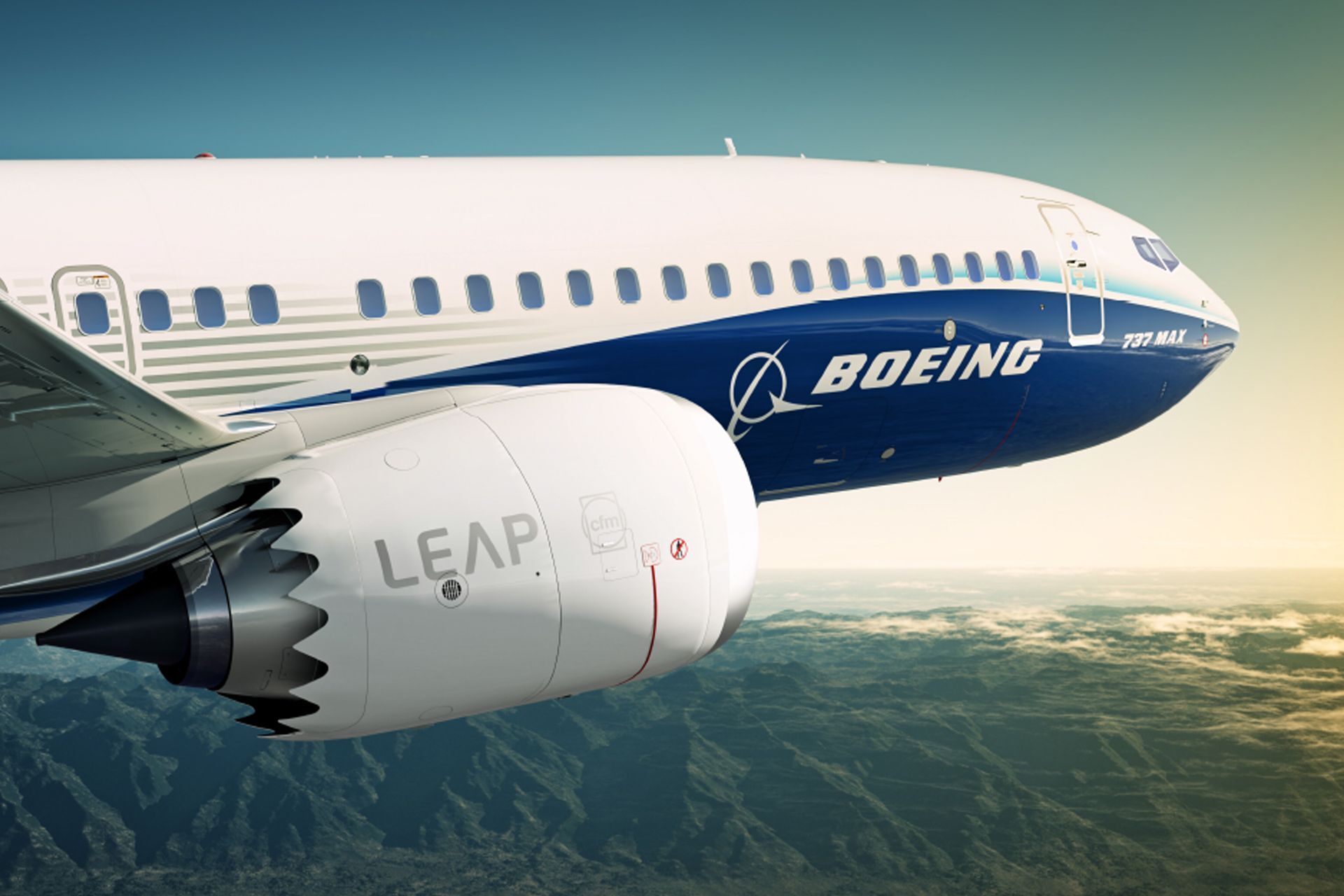

LEAP Family: Powers Boeing 737 MAX and Airbus A320neo family aircraft

GEnx Series: Serves Boeing 787 Dreamliner and 747-8

GE9X: World’s most powerful commercial jet engine for Boeing 777X

CFM56: Legacy engine with extensive installed base requiring ongoing maintenance

Defense & Propulsion Technologies (DPT)

DPT generated $2.8 billion in Q3 2025 revenue. This segment encompasses military engines, marine and industrial power systems, and additive manufacturing capabilities.

Notable defense engine platforms include:

F414: Powers F/A-18E/F Super Hornet with 1,600+ engines delivered and 5 million+ flight hours

F110: Serves F-15 and F-16 fighter aircraft across multiple air forces

T700/T901: Helicopter turboshaft engines for military rotorcraft

CF34: Regional jet engines for commercial and military transport aircraft

Image source: geaerospace.com

Revenue Performance (LTM)

Based on Q3 2025 data, GE Aerospace’s last twelve months (LTM) revenue reached approximately $41.6 billion. This represents substantial growth from $38.7 billion in full-year 2024.

The revenue composition reflects the services-oriented business model:

Revenue Category | Q3 2025 Performance | Growth Rate |

|---|---|---|

Commercial Services | Strong growth driver | +28% YoY |

Commercial Equipment | LEAP deliveries accelerating | +22% YoY |

Defense & Systems | Volume and pricing gains | +24% YoY |

Propulsion & Additive | All businesses growing | +29% YoY |

Services revenue growth outpaces equipment revenue, improving overall margin profile. Internal shop visits increased 33% YoY in Q3 2025 as airlines accelerated maintenance to address aging fleets and durability requirements.

Key Product Lines and Programs

LEAP Engine Family

The LEAP (Leading Edge Aviation Propulsion) engine represents GE Aerospace’s most strategically important program. Developed through CFM International, LEAP engines feature advanced materials, including ceramic matrix composites and additive manufacturing components.

LEAP achieved record deliveries in Q3 2025, up 40% YoY. The engine exclusively powers the Boeing 737 MAX and holds approximately 76% market share on the Airbus A320neo family versus Pratt & Whitney’s GTF engine at 24%.

The LEAP backlog extends years into the future, with Boeing and Airbus facing production constraints limiting their ability to deliver aircraft despite strong demand.

GE9X Program

The GE9X powers the Boeing 777X widebody aircraft. As the world’s most powerful commercial jet engine with over 100,000 pounds of thrust, the GE9X represents technological advancement but faces delayed entry into service due to Boeing’s 777X certification timeline.

Korean Air’s recent order for 28 additional GE9X engines demonstrates continued confidence despite program delays. The GE9X provides competitive positioning against Rolls-Royce’s Trent XWB for next-generation widebody aircraft.

TrueChoice Services Platform

GE Aerospace’s TrueChoice suite offers flexible service agreements allowing airlines to customize maintenance, repair, and overhaul coverage. These long-term service agreements (LTSAs) generate predictable revenue streams while providing airlines with cost certainty and operational reliability.

Services margins significantly exceed equipment margins. The expanding services revenue demonstrates successful installed base monetization as aircraft utilization rates approach pre-pandemic levels.

Competitive Analysis and Market Position

The commercial aircraft engine industry operates as an effective oligopoly with extremely high barriers to entry. Three major manufacturers dominate: GE Aerospace (through CFM International joint venture), Pratt & Whitney, and Rolls-Royce.

CFM International holds approximately 40% of the world’s commercial aircraft engine market share. GE Aerospace’s independent programs contribute an additional 14%, giving the company influence over more than half the commercial engine market.

Market share distribution by platform:

Narrowbody Aircraft Engines:

- LEAP (CFM/GE-Safran): 76% on A320neo family

- CFM56 (Legacy): Dominant on previous generation aircraft

- PW1000G (Pratt & Whitney): 24% on A320neo family

Widebody Aircraft Engines:

- GE/CFM: Strong presence on Boeing platforms

- Rolls-Royce: Leadership on Airbus widebody platforms

- Split market with program-specific competition

Porter’s Five Forces Analysis

Threat of New Entrants: Very Low

Barriers to entry in aircraft engine manufacturing rank among the highest in any industry. New engine development requires $1-3 billion in capital investment and 10-15 years to market.

Regulatory certification demands extensive testing to demonstrate safety and reliability. The FAA and EASA certification processes create time and cost barriers that discourage new competitors.

Existing customer relationships and installed base advantages further protect incumbents. Airlines prefer proven engines with established maintenance networks and spare parts availability.

Bargaining Power of Suppliers: Moderate to High

GE Aerospace faces significant supplier concentration in specialized components. Castings, forgings, and advanced materials come from limited suppliers with specialized capabilities.

Supply chain constraints have restricted engine production throughout 2024-2025. GE Aerospace increased material input from priority suppliers by over 35% YoY in Q3 2025, but bottlenecks persist.

The company addresses supplier power through vertical integration in critical areas and strategic partnerships. Investments in additive manufacturing reduce reliance on traditional casting suppliers.

Bargaining Power of Buyers: Moderate

Major airlines possess substantial negotiating leverage due to large fleet purchases. Boeing and Airbus, as airframe manufacturers, influence engine selection through exclusive or preferred arrangements on specific aircraft platforms.

However, switching costs limit buyer power once engine selection occurs. Airlines invest heavily in maintenance infrastructure, tooling, and personnel training specific to chosen engine types.

Long-term service agreements lock in customers over extended periods. The installed base creates captive demand for spare parts and overhaul services where GE Aerospace maintains pricing power.

Threat of Substitutes: Low

No realistic substitutes exist for jet engines in commercial aviation. Alternative propulsion technologies (electric, hydrogen) remain decades from commercial viability for large aircraft.

Sustainable Aviation Fuel (SAF) represents an adaptation rather than substitution. All GE Aerospace engines operate on SAF blends, with research supporting 100% SAF capability.

The CFM RISE program explores open fan architecture for 20%+ efficiency improvement, but this represents evolutionary technology advancement rather than disruptive substitution.

Competitive Rivalry: High

Competition focuses on three dimensions: technology/performance, pricing, and service capabilities. Engine manufacturers compete intensely for new aircraft program selections and aftermarket share.

Pratt & Whitney’s geared turbofan (GTF) technology provides fuel efficiency advantages but has faced durability challenges requiring extensive inspections. These problems benefited GE Aerospace’s LEAP program as airlines shifted preferences.

Rolls-Royce dominates certain widebody platforms but lacks competitive narrowbody offerings. The company focuses on the Trent engine family and future UltraFan technology development.

Competitive Moat Assessment

GE Aerospace maintains several durable competitive advantages:

Technological Leadership: Decades of engineering experience and extensive intellectual property create knowledge barriers. Advanced materials expertise (ceramic matrix composites, additive manufacturing) provides performance advantages.

Installed Base: With approximately 49,000 commercial engines in service, GE Aerospace benefits from network effects. Maintenance infrastructure, parts distribution, and technical support systems favor continued customer loyalty.

Switching Costs: Airlines face significant costs to change engine suppliers, including training, tooling, inventory, and maintenance procedure modifications. These switching costs typically exceed $100 million for major fleet transitions.

Scale Economics: High fixed costs in development and certification create advantages for large-volume producers. GE Aerospace’s production scale enables lower unit costs than potential entrants could achieve.

Joint Venture Structure: The CFM International partnership with Safran combines complementary capabilities while sharing development costs and risks. This structure strengthens competitive positioning versus independent competitors.

Image source: geaerospace.com

Recent Developments and Timeline

2025 Major Milestones

Q1 2025 (January - March)

January 23: Announced Q4 2024 results showing 19% revenue growth

February: Initiated dust ingestion testing for CFM RISE program

March: Faced tariff challenges with estimated $500 million impact

Q2 2025 (April - June)

April: CEO Larry Culp advocated for tariff-free aerospace trade under WTO Aircraft Agreement

May: Resolved three-week strike with labor agreement

June: Announced price increases to offset tariff costs

Q3 2025 (July - September)

July 17: Q2 earnings showed 30% revenue growth

August: Achieved record LEAP engine deliveries

September: Completed supersonic test campaign for solid-fueled ramjet technology

October 21: Q3 results exceeded expectations, raised full-year guidance

Q4 2025 (October - December)

November: Announced $14 million investment in Pune, India facility expansion

November: Announced partnership with BETA Technologies for hybrid-electric turbogenerator development

December 1: Elected Wesley G. Bush (former Northrop Grumman CEO) to Board of Directors

December 16: CT7-2E1 engine surpassed 500,000 flight hours milestone

Strategic Investments

GE Aerospace committed substantial capital to capacity expansion throughout 2025. The company invested $53 million in its West Jefferson, Ohio facility to support increased engine production.

Globally, GE Aerospace committed $1 billion over five years (starting 2024) to expand and upgrade MRO facilities worldwide. This investment supports the growing services business as aircraft utilization increases.

The Pune, India facility received two separate investments totaling $44 million over 2024-2025. These investments support manufacturing for both commercial and defense programs while aligning with India’s aerospace industry development initiatives.

Technology Advancement Programs

The CFM RISE program achieved significant milestones in 2025. Dust ingestion testing began, validating durability improvements learned from LEAP and GEnx programs.

RISE targets more than 20% fuel efficiency improvement and 20% lower carbon emissions compared to current engines. The program explores open fan architecture, hybrid electric capability, and 100% SAF compatibility.

GE Aerospace’s hybrid electric technology development accelerated through the BETA Technologies partnership. This collaboration focuses on distributed propulsion systems for future aircraft architectures.

Financial and Commercial Implications

Revenue Growth Drivers

GE Aerospace’s revenue acceleration reflects multiple favorable trends converging simultaneously. Global air passenger traffic growth of 4.9% projected for 2026 drives increased aircraft utilization and maintenance demand.

The company benefits from three distinct growth engines:

Equipment Volume Recovery: LEAP engine deliveries increased 40% in Q3 2025. Supply chain improvements enabled production acceleration, though constraints remain. Boeing and Airbus face production limitations, creating pent-up demand.

Services Revenue Expansion: Shop visit revenue increased 33% in Q3 2025 as airlines address maintenance backlogs. Spare parts revenue grew over 25%, reflecting both volume increases and favorable pricing dynamics.

Defense Program Growth: Military engine deliveries surged 83% YoY in Q3 2025. Increased defense spending globally and modernization programs drive sustained demand for fighter engines and support systems.

Margin Improvement Trajectory

Operating margins expanded through operational efficiency gains and favorable business mix. The services business carries significantly higher margins than equipment sales.

The following factors drive margin expansion:

Margin Driver | Impact | Timeline |

|---|---|---|

Services Mix Shift | +150-200 bps annually | Ongoing through 2027 |

LEAP Volume Leverage | +50-100 bps per year | As production scales |

FLIGHT DECK Lean | +30-50 bps annually | Continuous improvement |

Pricing Actions | Offsets inflation | Negotiated periodically |

FLIGHT DECK represents GE Aerospace’s proprietary lean operating system. This methodology drives continuous improvement across manufacturing, engineering, and services operations.

Management raised 2025 guidance to $6.00-$6.20 adjusted EPS (from prior $5.60-$5.80) and $7.1-$7.3 billion free cash flow. The guidance increase reflects sustained momentum and improved visibility.

Cash Generation and Capital Allocation

Free cash flow conversion exceeded 130% in Q3 2025, demonstrating working capital efficiency. The services business generates cash upfront through long-term service agreements, then delivers services over extended periods.

GE Aerospace prioritizes capital allocation toward:

Organic Investment: R&D spending supports LEAP durability improvements, RISE program development, and next-generation technologies

Capacity Expansion: Manufacturing investments enable volume growth and supply chain de-bottlenecking

Shareholder Returns: Dividend payments and potential share repurchases as free cash flow grows

The company maintains financial flexibility for strategic opportunities while investing for growth. The separated company structure eliminates legacy corporate overhead and focuses capital on aerospace-specific priorities.

Commercial Implications for Industry Participants

Airlines

Rising engine costs affect airline economics through multiple channels. Equipment prices increase to reflect tariffs and inflation. Service agreement pricing adjusts upward, though long-term contracts provide some protection.

However, supply chain constraints create opportunity costs. Airlines face $11 billion in costs through 2025 from delayed aircraft deliveries and extended maintenance events.

GE Aerospace’s production improvements partially alleviate these pressures. Accelerated LEAP deliveries enable Boeing and Airbus to reduce backlogs. Improved spare parts availability reduces aircraft-on-ground events.

Airframe Manufacturers

Boeing and Airbus depend critically on engine supplier performance. GE Aerospace’s production acceleration directly enables aircraft delivery growth. Boeing delivered approximately 185 aircraft with Airbus in December 2025, supported by improved engine availability.

LEAP market share gains versus GTF benefit Boeing’s 737 MAX program. Airlines switching from A320neo to 737 MAX cite engine reliability preferences. Airbus faces challenges from Pratt & Whitney’s durability issues.

The CFM RISE program’s timeline affects future aircraft development decisions. Next-generation narrowbody aircraft depend on engine technology readiness. Delays in RISE potentially extend current aircraft generation lifecycles.

MRO Service Providers

Independent MRO providers face intensifying competition from OEM service expansion. GE Aerospace’s services growth reflects market share gains from third-party shops.

OEMs leverage proprietary data, technical expertise, and parts availability to capture aftermarket revenue. This trend pressures independent providers, particularly for newer engine types with advanced diagnostics.

However, capacity constraints create opportunities. GE Aerospace’s $1 billion MRO investment indicates insufficient capacity to serve all demand. Independent providers can focus on legacy engines and specialized services.

Key Risks and Scenarios

Supply Chain Vulnerability (Probability: High)

Despite improvements, supply chain constraints remain the primary near-term risk. Critical components, including castings, forgings, and specialty material,s face production bottlenecks.

Worst Case Scenario: Supplier failures or quality issues force production slowdowns. LEAP deliveries decline, missing guidance and disappointing customers. Revenue growth decelerates and margins compress from inefficiency costs.

Probability Assessment: 30-40% risk of significant disruptions through 2026. Supply chain challenges persist industrywide despite mitigation efforts.

Mitigation Strategies: GE Aerospace increases supplier support, expands dual-sourcing, and vertically integrates selected capabilities. Foreign trade zone expansion reduces tariff impacts.

Competitive Technology Disruption (Probability: Low-Moderate)

Pratt & Whitney resolves GTF durability issues and regains market share. Rolls-Royce’s UltraFan program achieves superior efficiency, threatening LEAP’s competitive position.

Worst Case Scenario: Airlines defer commitments awaiting next-generation engines. LEAP production excess develops, forcing pricing concessions. RISE program delays compound technology gap concerns.

Probability Assessment: 15-25% risk of material competitive disadvantage by 2028. Current technology leadership and GTF issues provide buffer period.

Mitigation Strategies: Accelerate RISE development timeline. Continuous LEAP improvement maintains competitiveness. Service quality and reliability differentiate beyond pure technology metrics.

Geopolitical and Trade Policy Risks (Probability: Moderate)

Tariff impacts of $500 million in 2025 could expand if trade tensions escalate. Export controls restrict sales to certain markets. Defense program dependencies on government budgets create volatility.

Worst Case Scenario: Trade conflicts intensify, disrupting global supply chains. Export restrictions limit international sales. Defense budget cuts reduce military engine orders.

Probability Assessment: 25-35% risk of escalating trade restrictions through 2026-2027. Political dynamics remain unpredictable with administration changes.

Mitigation Strategies: Geographic diversification of manufacturing. Price escalation clauses in contracts. Strengthen relationships with allied governments for defense programs.

Regulatory and Environmental Pressures (Probability: Moderate-High)

Increasingly stringent emissions regulations may require accelerated technology transitions. SAF mandates affect operational economics. Noise regulations restrict operations at certain airports.

Worst Case Scenario: Unexpected regulatory changes render current engines non-compliant. Retrofit requirements impose massive costs. SAF availability constraints limit growth.

Probability Assessment: 35-45% risk of significant regulatory changes by 2030. Environmental focus increases globally with uncertain implementation approaches.

Mitigation Strategies: Proactive emissions reduction through RISE program. 100% SAF compatibility development. Engagement with regulators to shape practical requirements.

Cyclical Downturn Risk (Probability: Low)

Economic recession reduces air travel demand. Airlines cancel or defer aircraft orders. Maintenance spending declines as carriers preserve cash.

Worst Case Scenario: Global recession triggers 20%+ demand contraction. Aircraft production cuts severely impact engine deliveries. Services revenue declines from reduced utilization.

Probability Assessment: 15-20% risk of severe downturn through 2026-2027. Strong underlying demand fundamentals and supply constraints provide cushion.

Mitigation Strategies: Services business provides revenue stability. Long-term backlogs buffer near-term volatility. Cost flexibility through lean operations enables margin defense.

SWOT Analysis

Strengths

Market Leadership Position: GE Aerospace commands approximately 40% market share through CFM International, providing scale advantages and pricing power. The LEAP engine dominates narrowbody aircraft with 76% share on A320neo family.

Installed Base and Switching Costs: With 49,000 commercial engines in service, the company generates recurring aftermarket revenue over multi-decade lifecycles. Airlines face prohibitive costs to switch engine suppliers.

Services Business Model: More than 70% of commercial engine revenue comes from high-margin services. This recurring revenue stream provides stability and cash generation significantly exceeding equipment sales.

Technological Capabilities: Advanced materials expertise (ceramic matrix composites, additive manufacturing), digital analytics, and engineering depth create competitive moats. Century of aviation experience provides institutional knowledge advantages.

Financial Strength: Strong free cash flow generation, improved margins, and pure-play focus enable strategic investments without legacy corporate burdens. Separation created efficient capital allocation structure.

Partnership Leverage: The CFM International joint venture with Safran combines complementary capabilities while sharing development costs. Engine Alliance partnership (GE-Pratt & Whitney) serves widebody market.

Defense Portfolio Diversification: Military engines, marine propulsion, and additive manufacturing capabilities provide revenue stability and technology cross-pollination opportunities.

Weaknesses

Supply Chain Dependencies: Reliance on concentrated supplier base for critical components creates vulnerability. Material availability constraints limited production growth throughout 2024-2025.

Cyclical Exposure: Commercial aviation demand fluctuates with economic conditions. Equipment sales particularly vulnerable to airline financial health and aircraft manufacturer production rates.

Program Concentration Risk: Heavy dependence on LEAP program for growth creates vulnerability if competitive dynamics shift. Single program failure would significantly impact results.

GE9X Program Delays: Boeing 777X certification delays reduce near-term GE9X revenue and complicate profitability management. Development costs extended without offsetting revenue.

Geographic Revenue Concentration: Significant exposure to U.S. and European markets creates vulnerability to regional economic challenges. Emerging market opportunities remain underdeveloped relative to competitors.

Labor Relations Complexity: Unionized workforce and specialized technical skills create retention challenges. Three-week strike in 2025 demonstrated labor vulnerabilities.

Opportunities

Global Air Travel Growth: IATA projects 4.9% passenger traffic growth in 2026, driving increased aircraft production and utilization. Long-term fundamentals support sustained expansion.

Services Penetration Expansion: Aftermarket capture rate can increase through proprietary diagnostics, data analytics, and comprehensive service solutions. Digital capabilities enable new service offerings.

Defense Modernization Programs: Global military spending increases support fighter engine demand. F414 international programs (India, Korea) provide multi-decade growth opportunities.

Emerging Market Development: India investments position company for local content requirements and regional aerospace growth. Asia-Pacific offers long-term expansion potential.

Next-Generation Technologies: CFM RISE program targets 20%+ efficiency improvement, supporting future platform wins. Hybrid-electric and hydrogen capabilities position company for sustainable aviation transition.

MRO Capacity Expansion: $1 billion facilities investment enables services growth capture. Capacity constraints in industry create pricing power and market share opportunities.

Additive Manufacturing Scale: Production 3D printing capabilities reduce costs, enable design optimization, and create competitive advantages. Technology transfer across programs drives efficiency.

Threats

Pratt & Whitney GTF Recovery: If Pratt & Whitney resolves durability issues, the GTF could regain A320neo market share through superior fuel efficiency. Technology competition intensifies long-term.

Rolls-Royce UltraFan Development: Successful UltraFan program could threaten widebody market position and establish efficiency benchmark. Next-generation competition creates technology race.

Chinese Competition Emergence: COMAC and AECC development, while currently limited, represents long-term competitive threat in world’s largest aviation market. Government support enables sustained investment.

Environmental Regulation Acceleration: Unexpected emissions requirements could render current engines non-compliant or economically obsolete. Regulatory uncertainty creates investment risk.

Economic Recession Impact: Severe downturn would reduce airline profitability, defer aircraft orders, and contract maintenance spending. Cyclical vulnerability remains despite strong fundamentals.

Tariff and Trade Policy Uncertainty: Escalating trade tensions increase costs and restrict market access. $500 million 2025 tariff impact could expand with policy changes.

Supplier Financial Distress: Concentrated supply base creates vulnerability to supplier bankruptcies or quality failures. Tier 2/3 supplier fragility increases with aerospace production ramp.

PESTEL Analysis

Political Factors

Government aerospace policy significantly impacts GE Aerospace across commercial and defense operations. U.S. government support for domestic aerospace manufacturing through trade agreements, export financing, and R&D collaboration provides competitive advantages.

Defense spending priorities directly affect military engine demand. The F414 program benefits from U.S. and allied fighter aircraft modernization initiatives. India’s $1 billion F404 engine deal demonstrates defense export opportunities.

Trade policy creates uncertainty and cost pressures. The company advocated for restoring the WTO Aircraft Agreement’s tariff-free regime for aerospace products. Export controls restrict sales to certain countries, limiting market opportunities.

Economic Factors

Global economic growth drives air travel demand. Post-pandemic recovery continued through 2025, with passenger traffic approaching normalized growth rates. Economic expansion in Asia-Pacific leads global aviation growth.

Interest rates affect airline capital investment decisions. Higher financing costs increase aircraft acquisition expenses, potentially slowing order rates. However, current backlogs provide multi-year production visibility.

Currency fluctuations impact international competitiveness and translated earnings. Dollar strength versus Euro affects CFM International dynamics and competitive positioning versus European rivals.

Supply chain inflation drives cost pressures across raw materials, components, and labor. Pricing actions partially offset inflation, but margin compression risk exists if cost increases exceed price realization.

Environmental consciousness shapes customer preferences and regulatory direction. Airlines face pressure from customers and stakeholders to reduce carbon footprints. Sustainable aviation fuel adoption and fuel-efficient engines gain importance.

Air travel democratization in emerging markets expands the addressable customer base. Growing middle classes in Asia, Latin America, and Africa create long-term demand drivers for commercial aviation.

Workforce demographics affect labor availability and costs. Aerospace manufacturing requires highly skilled technical workers facing retirement waves. Competition for engineering talent intensifies across defense and commercial sectors.

Technological Factors

Digital transformation enables new capabilities across design, manufacturing, and services. Additive manufacturing reduces production costs and enables complex geometries. Data analytics improve engine monitoring and predictive maintenance.

Materials science advances drive performance improvements. Ceramic matrix composites operate at higher temperatures, improving efficiency. Advanced coatings extend component life and reduce maintenance costs.

Alternative propulsion technologies remain developmental but require monitoring. Hybrid-electric systems show promise for regional aircraft. Hydrogen propulsion faces fundamental infrastructure and physics challenges for large commercial aircraft.

Automation and robotics increase manufacturing productivity. However, aerospace certification requirements limit speed of technology adoption compared to other industries.

Environmental Factors

Climate change pressures accelerate emissions reduction requirements. Aviation contributes approximately 2-3% of global CO2 emissions, creating political and social pressure for mitigation.

The CFM RISE program targets more than 20% emissions reduction through efficiency improvements. SAF compatibility enables 80%+ lifecycle emissions reduction when sustainably produced fuel achieves scale.

Noise regulations restrict operations at airports, particularly in Europe. Engine designs balance efficiency with noise reduction requirements. Community opposition to airport expansion affects long-term growth potential.

Water usage and waste management in manufacturing operations face increasing scrutiny. GE Aerospace must demonstrate environmental stewardship across global facilities to maintain operating licenses and community support.

Legal Factors

Certification requirements govern all aspects of engine design, manufacturing, and maintenance. FAA and EASA regulations mandate extensive testing and documentation. Certification timelines span years, creating barriers to entry and competitive change.

Intellectual property protection enables technology leadership. Patent portfolios protect innovations in materials, manufacturing processes, and engine architectures. Trade secret protection covers proprietary manufacturing techniques.

Contract structures with airlines and OEMs define risk allocation and performance obligations. Long-term service agreements contain complex terms regarding coverage, pricing escalation, and performance guarantees.

Environmental regulations govern emissions, noise, and operational practices. Compliance costs increase, but regulations create competitive moats by raising barriers to entry.

Labor regulations and union agreements affect operating flexibility. Collective bargaining agreements with multiple unions define compensation, work rules, and workforce management practices.

Implications by Stakeholder

Airlines (Actionable Insights)

Near-Term Actions: Accelerate negotiations for long-term service agreements while GE Aerospace seeks to expand installed base. Favorable pricing available before capacity constraints tighten further.

Fleet Planning: Consider LEAP reliability advantages in narrowbody fleet decisions. GTF durability issues create operational risks despite fuel efficiency benefits. Diversified engine portfolio reduces single-supplier dependency.

Maintenance Optimization: Leverage GE Aerospace’s digital capabilities for predictive maintenance. Engine health monitoring reduces unplanned maintenance events and optimizes shop visit timing.

Sustainability Strategy: Coordinate with GE Aerospace on SAF testing and certification. Early collaboration positions airlines as sustainability leaders while supporting infrastructure development.

Airframe Manufacturers (Actionable Insights)

Supply Chain Collaboration: Deep engagement with GE Aerospace on production planning enables better aircraft delivery scheduling. Engine availability governs delivery rates more than airframe capacity.

Next-Generation Planning: Monitor CFM RISE program progress closely. Technology readiness affects timing for next-generation narrowbody aircraft launches. Delay risks extend current platform lifecycles.

Competitive Dynamics: LEAP market share gains strengthen Boeing’s 737 MAX positioning versus A320neo. Airbus must address engine diversity strategy given GTF challenges.

Risk Management: Develop contingency plans for engine supply disruptions. Secondary sourcing agreements or inventory buffers mitigate single-supplier risks on sole-source platforms.

Defense Organizations (Actionable Insights)

Modernization Programs: F414 and F110 engines offer proven performance for fighter modernization initiatives. International operators benefit from established supply chains and technical support.

Industrial Collaboration: Leverage GE Aerospace’s India investment for local content requirements. Co-production arrangements support domestic aerospace industry development while ensuring supply security.

Technology Transfer: Negotiate intellectual property rights and technology transfer provisions. Balance acquisition cost optimization with long-term industrial capability development.

Lifecycle Cost Management: Structure performance-based logistics agreements to align costs with operational readiness. GE Aerospace’s predictive maintenance capabilities reduce operating costs.

Suppliers (Actionable Insights)

Capacity Investment: GE Aerospace’s production growth creates expansion opportunities for qualified suppliers. Capital investment in capacity and quality systems yields long-term revenue growth.

Quality Performance: Supply chain constraints make quality and delivery reliability paramount. Suppliers demonstrating consistency gain preferred status and pricing power.

Technology Collaboration: Partner with GE Aerospace on advanced manufacturing techniques. Additive manufacturing, automation, and digital integration create competitive advantages.

Geographic Strategy: Consider proximity to GE Aerospace facilities for supply chain efficiency. Foreign trade zone locations reduce tariff impacts and transportation costs.

Investors (Actionable Insights)

Growth Drivers: Services revenue expansion and LEAP production scaling drive sustained revenue and margin growth. Installed base monetization provides multi-decade visibility.

Risk Factors: Monitor supply chain health through delivery metrics and management commentary. Geopolitical developments affect tariff costs and market access.

Valuation Considerations: Services mix shift justifies premium valuations versus historical manufacturing multiples. Recurring revenue and cash generation support higher earnings multiples.

Capital Allocation: Track management’s balance between growth investment, shareholder returns, and financial flexibility. Pure-play structure enables focused capital deployment.

Primary Sources and References

Company Filings and Reports

GE Aerospace Q3 2025 Earnings Report - Official quarterly results announcement

GE Aerospace Q2 2025 Earnings Report - Second quarter financial results

GE Aerospace Q1 2025 Earnings Report - First quarter financial results

GE Aerospace Investor Relations - Corporate financial information and presentations

Press Releases and Corporate Communications

GE Aerospace News and Press Releases - Official company announcements

CFM International RISE Program Overview - Next-generation engine technology program

GE Aerospace India Investment Announcement - Pune facility expansion details

GE Aerospace Sustainability Initiatives - Alternative fuels and environmental programs

Industry Reports and Analysis

IATA Global Outlook for Air Transport - December 2025 - Air travel demand forecasts

Deloitte 2026 Aerospace and Defense Industry Outlook - Industry trends and analysis

S&P Global Market Intelligence Analysis - Market research and forecasts

Third-Party News and Commentary

Reuters GE Aerospace Coverage - Industry news reporting

Aviation Week and Flight Global Analysis - Technical aviation journalism

The Motley Fool Investment Analysis - Business performance assessment

My Final Thoughts

GE Aerospace emerges as a remarkably focused enterprise following decades of corporate complexity. The pure-play structure eliminates distractions and aligns incentives around a single mission: aircraft propulsion excellence.

The company’s competitive position appears robust through 2026 and likely beyond. Market share leadership, technological capabilities, and the installed base advantage create durable moats against disruption.

Yet success breeds its own challenges. As the dominant player with substantial pricing power, GE Aerospace must balance short-term margin optimization against long-term customer relationships. Airlines with limited alternatives may eventually seek regulatory intervention or champion new entrants.

The services business model transformation deserves recognition as genuinely strategic rather than merely operational. Shifting from transactional equipment sales to multi-decade partnerships fundamentally changes business economics and competitive dynamics.

Supply chain resilience remains the critical execution variable. Management’s ability to navigate component shortages, supplier financial health, and geopolitical disruptions will largely determine whether growth potential converts to actual results.

Environmental pressures create both risk and opportunity. Companies dismissing sustainability as marketing face regulatory and competitive disadvantages. GE Aerospace’s proactive technology development through RISE positions it favorably, though execution and timing remain uncertain.

The defense business provides underappreciated strategic value beyond financial diversification. Technology development for military applications often yields commercial benefits. Defense relationships provide geopolitical positioning advantages in an increasingly multipolar world.

For industry participants, GE Aerospace’s trajectory suggests oligopolistic stability rather than disruptive change. Suppliers should invest in quality and capacity to capture growth. Airlines should negotiate long-term agreements recognizing limited alternatives. Competitors must make multi-billion dollar technology bets or accept niche positioning.

The coming years will reveal whether GE Aerospace can sustain exceptional performance as supply chains normalize and competitive dynamics evolve. The fundamentals appear solid, but aerospace history demonstrates that today’s leaders must continuously reinvent themselves or face irrelevance.

Social Factors