Chinese regional carrier Tianjin Airlines enters 2026 at a pivotal moment. As global aviation recovers and domestic competition intensifies, the carrier finds itself balancing operational growth with persistent financial pressures.

The carrier operates within a challenging environment. While serving over 130 cities across its network, Tianjin Airlines must simultaneously address profitability concerns, expand its international footprint, and compete against both major carriers and high-speed rail alternatives.

Table of Contents

Image source: en.wikipedia.org

Corporate Structure and Ownership Dynamics

Tianjin Airlines operates as a key component of the restructured HNA Aviation Group. The carrier’s ownership structure underwent significant transformation following HNA Group’s bankruptcy restructuring completed in 2022, one of China’s largest debt-restructuring cases.

Currently, Hainan Airlines holds 47.8% of Tianjin Airlines, with Haikou Zhenping Investment controlling 47.9%. This ownership arrangement emerged from the broader HNA Group reorganization, which involved strategic investor Liaoning Fangda Group taking control of HNA’s flagship aviation business.

The restructuring completed its legal proceedings when the Higher People’s Court of Hainan Province approved the plan in October 2021. This provided Tianjin Airlines with a more stable foundation after years of financial uncertainty within the HNA conglomerate.

Ownership Component | Percentage |

|---|---|

Hainan Airlines | 47.8% |

Haikou Zhenping Investment | 47.9% |

Other Stakeholders | 4.3% |

Fleet Composition and Regional Focus

The airline maintains a fleet of approximately 110 aircraft with an average age of 8.6 years. This dual-type fleet strategy serves distinct operational purposes.

FLEET BREAKDOWN BY AIRCRAFT TYPE

Airbus A320 Family: Primary domestic narrowbody operations

Airbus A330-200/300: Long-haul international routes

Embraer E190/E195: Regional and feeder connections

The Embraer regional jet fleet deserves particular attention. Tianjin Airlines operates as Asia’s largest E-Jets operator with 62 aircraft, positioning it as a pioneer in China’s regional aviation market. The carrier was China’s first operator of Embraer jets, having signed contracts for 22 additional aircraft (20 Embraer 195s and 2 Embraer 190-E2s) in mid-2015.

This regional jet focus allows Tianjin Airlines to serve secondary cities and thin routes that larger aircraft cannot efficiently operate. The strategy aligns with China’s push to develop regional aviation connectivity, particularly in western and northern provinces.

Network Strategy and International Expansion

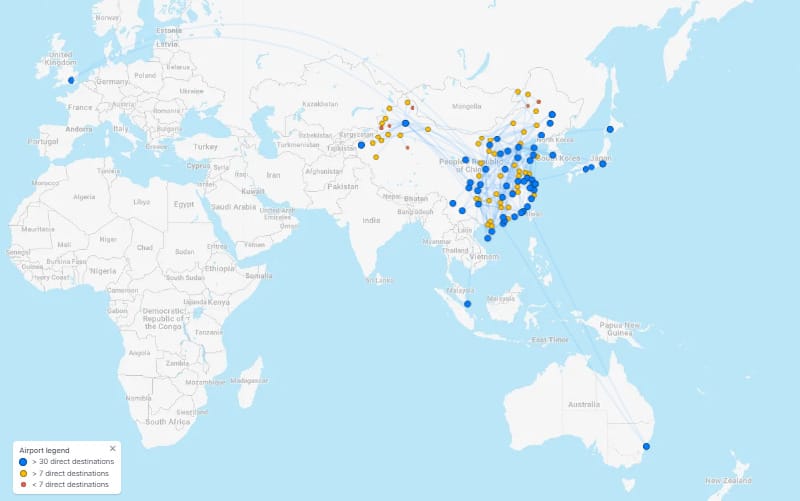

Tianjin Airlines operates from eight major bases: Tianjin, Xi’an, Hohhot, Urumchi, Chongqing, Guiyang, Haikou, and Dalian. This multi-hub approach enables comprehensive coverage across western and northern China, regions historically underserved by aviation.

The carrier serves 114 domestic destinations and 7 international destinations as of December 2025. While domestic operations dominate, international expansion has accelerated notably.

In November 2025, Tianjin Airlines resumed nonstop service between Chongqing and Moscow, operating weekly A330 flights. The airline announced plans to increase frequency to twice weekly starting March 2026, responding to growing demand for China-Russia connectivity.

This route exemplifies Tianjin Airlines’ international strategy: connecting secondary Chinese cities directly to foreign destinations, avoiding competition with major carriers on primary routes like Beijing or Shanghai.

Image source: brilliantmaps.com

Previous international ventures include the UK market. Tianjin Airlines launched flights from London Gatwick to Chongqing and Tianjin in June 2018, marking its European debut. However, current schedules indicate these routes are no longer operating as of December 2025.

Financial Performance and Operational Challenges

The carrier’s financial situation reflects broader challenges facing Chinese regional airlines. According to available data, Tianjin Airlines reported annual revenue of $1.1 billion with a negative profit margin of 2.9%, resulting in a net loss of $32 million in 2024.

These figures must be contextualized within the Chinese aviation industry’s recovery trajectory. China’s “big three” airlines (China Eastern, China Southern, Air China) only achieved their first profitable nine-month period post-pandemic in 2025, indicating the challenging environment.

CHINESE AVIATION INDUSTRY CHALLENGES 2025

Intense Domestic Competition: Route clustering and price pressure

Economic Headwinds: Slowed GDP growth affecting demand

High-Speed Rail: Structural competitive threat on domestic routes

Capacity Oversupply: Airlines adding capacity faster than demand growth

Chinese airlines face recovery headwinds including slower economic growth and intense domestic competition. Regulators summoned several carriers for closed-door meetings in 2025 to address concerns over excessively low ticket prices, indicating the severity of pricing pressure.

Financial Metric | 2024 Performance |

|---|---|

Annual Revenue | $1.1 billion |

Profit Margin | (2.9%) |

Net Profit | ($32.0 million) |

For Tianjin Airlines specifically, operational efficiency and network optimization remain priorities for achieving sustainable profitability. The carrier must balance capacity growth with yield management while competing against both legacy carriers and low-cost competitors.

Service Quality and Operational Capabilities

Tianjin Airlines holds Skytrax’s 3-Star airline certification, indicating mid-tier service quality for both airport and onboard products. The rating covers seats, amenities, food and beverages, in-flight entertainment, cleanliness, and staff service.

The carrier offers Business and Economy class configurations across its fleet. The airline employs approximately 6,000 people globally, including roughly 900 pilots and 1,900 flight attendants.

Infrastructure capabilities include dedicated maintenance facilities and digital systems for scheduling, electronic ticketing, and baggage management. The airline reports safely operating for 10 consecutive years, flying safely for more than 1.8 million continuous hours.

Recent operational initiatives focus on digital transformation. The carrier implements passenger self-service technology, digital baggage tracking, and operational sustainability projects, aligning with broader industry trends toward technological adoption.

Competitive Positioning and Strategic Direction

Tianjin Airlines occupies a distinctive niche within Chinese aviation. Unlike the “big three” carriers focusing on trunk routes between major cities, Tianjin Airlines emphasizes regional connectivity and feeder services.

The carrier’s largest competitive advantage lies in its Embraer fleet. As the first Embraer operator in China and Asia’s largest E-Jets operator, Tianjin Airlines pioneered a regional aviation model that redefined operations in secondary markets.

This positioning allows the carrier to serve routes where larger aircraft prove economically unviable. Cities in western China, Inner Mongolia, and other less-developed regions require aviation connectivity but generate insufficient demand for 737 or A320 operations.

However, competition intensifies from multiple directions. High-speed rail networks continue expanding, offering competitive travel times on routes under 1,000 kilometers. Structural competition from rail adds persistent pressure on domestic aviation markets.

Additionally, other regional carriers and low-cost carriers increasingly contest secondary city markets. Spring Airlines and Juneyao Airlines, both profitable carriers, demonstrate that cost-efficient operations can succeed in China’s competitive environment.

Outlook for 2026 and Strategic Imperatives

Several key factors will shape Tianjin Airlines’ trajectory through 2026 and beyond.

International Expansion: The Moscow route increase to twice-weekly service in March 2026 signals growing international ambitions. Additional long-haul routes connecting secondary Chinese cities to foreign destinations present opportunities for differentiation from major carriers.

Fleet Optimization: Balancing the Airbus narrowbody and Embraer regional jet mix will remain critical. The regional jets enable niche route development, while A320 family aircraft provide operational flexibility for higher-demand markets.

Cost Management: Achieving profitability requires aggressive cost control while maintaining service quality. Operational efficiency initiatives around network optimization and digital transformation must deliver measurable improvements.

Demand Recovery: China’s aviation recovery depends on broader economic conditions. IATA projects modest revenue growth of 1.3% year-over-year for 2025, with continued recovery expected into 2026.

Competitive Response: How Tianjin Airlines responds to pricing pressure and capacity oversupply will determine its market position. The carrier must avoid destructive price competition while defending its regional market share.

My Final Thoughts

The airline’s ability to leverage its regional jet fleet, develop secondary city connectivity, and achieve operational efficiency will determine whether it emerges as a sustainable player or faces continued financial struggles.

The carrier enters 2026 with a clearer ownership structure post-restructuring, an established network across underserved regions, and growing international operations.

Whether these advantages translate into profitability depends on execution across operations, cost management, and strategic positioning in an increasingly competitive market.