Executive Summary

Revenue Momentum: Safran delivered exceptional performance in 2025 with nine-month revenue reaching €22.6 billion, up 14.9% year-over-year, driven by record LEAP engine deliveries and robust aftermarket services growth.

Strategic Expansion: The July 2025 acquisition of Collins Aerospace’s flight control and actuation business for $1.8 billion positions Safran as a global leader in critical aircraft systems.

Production Acceleration: LEAP engine deliveries surged 40% in Q3 2025 to 511 units, supporting Safran’s target of producing 2,500 engines annually by 2028 through expanded manufacturing in Morocco and India.

Tariff Headwinds Managed: Despite facing an estimated €100-150 million impact from international tariffs in 2025, the company raised full-year guidance across all financial metrics, demonstrating operational resilience.

Also Read:

Table of Contents

Business Overview and Key Revenue Drivers

Safran stands as a global aerospace titan headquartered in Paris, France. The company operates through three primary segments that collectively form an integrated aerospace ecosystem.

The Propulsion segment generates approximately 51% of group revenue and represents the crown jewel of Safran’s portfolio.

Through its 50-50 joint venture with GE Aerospace, CFM International has established itself as the world’s largest commercial aircraft engine manufacturer, commanding a 39% market share as of 2020.

Image source: wikipedia.org

In the first nine months of 2025, Safran delivered 1,240 LEAP engines, representing a 21% increase from the same period in 2024. The third quarter alone saw a dramatic 40% surge to 511 engines, demonstrating the company’s success in overcoming supply chain constraints.

Beyond commercial engines, Safran’s propulsion portfolio includes the M88 military jet engine powering France’s Rafale fighter, helicopter turbines through Safran Helicopter Engines, and propulsion systems for missiles and space launchers.

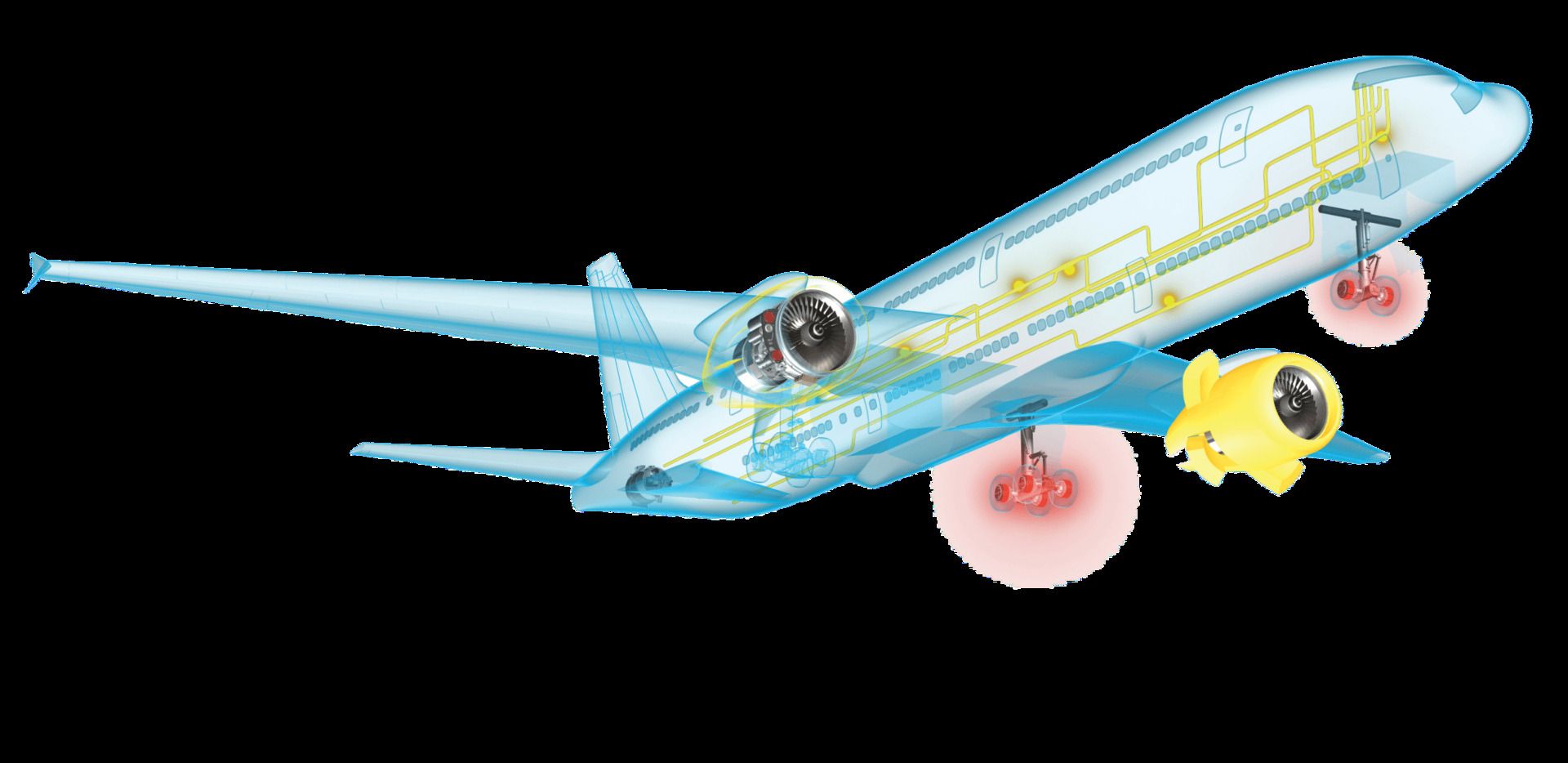

The Equipment & Defense segment accounts for 38% of revenue and positions Safran as the world’s second-largest aircraft equipment manufacturer. This division supplies critical systems including landing gear and braking systems (where Safran holds leading positions on programs like the A320, A350, and Boeing 787), nacelles, electrical wiring interconnection systems, fuel systems, and avionics.

Image source: safran-group.com

The July 2025 acquisition of Collins Aerospace’s actuation and flight control business strengthens this segment significantly. The acquired business generated approximately $1.55 billion in 2024 revenue and brings mission-critical systems for both commercial and military platforms.

Defense activities within this segment include the AASM Hammer precision-guided munition system, optronics and navigation systems, inertial navigation units, and satellite communications equipment. Safran Electronics & Defense secured contracts in 2025 including the Eurofl’Eye distributed panoramic vision system for NH90 helicopters and a $47 million contract with the U.S. Navy.

The Aircraft Interiors segment contributes 11% of group revenue through Safran Cabin, providing seats (particularly premium business class configurations), galleys, lavatories, in-flight entertainment systems, and water and waste management equipment. In the first half of 2025, Safran delivered 1,238 business class seats, compared to just 750 in the same period of 2024, reflecting strong demand from airlines upgrading their premium cabins.

Latest Financial Performance (LTM)

For the nine months ended September 30, 2025, Safran reported:

Revenue: €22.6 billion (+14.9% YoY)

Recurring Operating Income: Not disclosed for 9M period

Operating Margin: Expected 17%+ for full year

Free Cash Flow: €1.8 billion in H1 2025

The revenue breakdown by segment shows healthy growth across all divisions:

Segment | 9M 2025 Revenue | YoY Growth | Organic Growth |

|---|---|---|---|

Propulsion | €11.6 billion | +18.2% | +19.9% |

Equipment & Defense | €8.6 billion | +11.9% | +9.2% |

Aircraft Interiors | €2.4 billion | +10.8% | +13.5% |

The aftermarket services business demonstrates particularly robust performance. Civil engine spare parts revenue surged 19.5% in dollar terms during the nine-month period, while services revenue grew 22.2%.

This aftermarket strength reflects the maturation of the installed LEAP fleet, which is now generating increasing maintenance, repair, and overhaul (MRO) demand alongside the still-strong CFM56 legacy engine population.

Competitive Analysis and Market Positioning

Porter’s Five Forces Analysis

Threat of New Entrants: Low

The commercial aircraft engine market presents formidable barriers to entry that effectively protect established players like Safran. Developing a modern turbofan engine requires investments exceeding $10 billion over 10-15 years.

The LEAP engine development program, launched in 2008, required significant capital before entering service in 2016. Beyond financial requirements, new entrants face regulatory hurdles including lengthy certification processes with aviation authorities, lack of established relationships with airframe manufacturers, and the need for a global MRO network to support in-service engines.

The duopoly structure between CFM International (GE-Safran) and Pratt & Whitney for narrowbody engines, with Rolls-Royce and GE dominating widebody propulsion, has remained stable for decades.

Chinese and Russian manufacturers face significant technological gaps despite substantial government support.

Bargaining Power of Suppliers: Moderate

Safran’s supplier relationships present nuanced dynamics. For strategic components like titanium forgings, special alloys, and advanced composites, the supplier base remains concentrated. The company addresses this through long-term agreements, vertical integration for critical components, and development of alternative sources.

Supply chain constraints significantly impacted the industry in 2024-2025. However, Safran CEO Olivier Andriès noted in November 2025 that the global supply chain situation is improving, though it remains a watch item.

Safran has invested heavily in expanding its supplier network, particularly through its Morocco manufacturing hub. The company announced in October 2025 a €350 million investment to establish new LEAP engine assembly and MRO facilities in Morocco, which will support the goal of producing 2,500 LEAP engines annually by 2028.

Bargaining Power of Buyers: Moderate to High

Airlines and aircraft manufacturers wield considerable negotiating power, particularly for new aircraft orders involving hundreds of engines worth billions of dollars. Boeing and Airbus can influence engine selection and negotiate favorable terms given the scale of their purchases.

However, Safran benefits from several countervailing factors. Once an airline commits to an engine type for their fleet, switching costs become prohibitive. A fleet transition requires pilot retraining, maintenance crew certification, spare parts inventory replacement, and potentially different ground support equipment.

The company has cultivated long-term service agreements that provide revenue visibility. These Rate Per Flight Hour (RPFH) contracts, where airlines pay based on actual engine usage, transferred substantial aftermarket revenue streams. In H1 2025, Services revenue grew 21.1% in dollar terms, partly driven by LEAP RPFH contracts beginning to contribute to profitability.

For the Equipment & Defense segment, Safran faces more competition as aircraft manufacturers can select from multiple suppliers for systems like landing gear or electrical systems. However, the technical specifications and certification requirements for each aircraft program create switching costs once a supplier is selected.

Threat of Substitutes: Low to Moderate

In the near to medium term, turbofan engines face limited direct substitution threats for commercial aviation. Alternative propulsion technologies remain in early development stages.

Sustainable Aviation Fuel (SAF) represents an evolution rather than substitution, as it works with existing engine technology. Safran actively supports SAF adoption, with LEAP engines certified to operate on 100% SAF.

Electric and hydrogen propulsion systems attract significant research investment, but commercial viability remains distant for anything beyond regional aircraft. Safran participates in these technology development efforts, including the CFM RISE program targeting 20% fuel efficiency improvement for engines entering service in the 2030s.

For defense products, substitution threats vary by application. Precision-guided munitions like the AASM Hammer system face competition from alternative weapons systems, though Safran’s products have achieved strong market acceptance.

Competitive Rivalry: High

The aerospace industry exhibits intense competition despite its concentrated structure. In commercial aircraft engines, CFM International competes directly with Pratt & Whitney’s geared turbofan (GTF) technology on the Airbus A320neo platform.

The competitive dynamics favor Safran’s LEAP engine in several aspects. The LEAP captures approximately 60% market share on A320neo family orders. While Pratt & Whitney’s GTF offers superior fuel efficiency specifications, it has experienced significant durability issues requiring premature engine removals and impacting airline operations.

These GTF reliability challenges created opportunities for CFM. Several airlines switched engine selections or placed additional LEAP orders. The LEAP engine demonstrated improving maturity metrics, with mean time between removal rates approaching mature engine levels.

In widebody engines, GE Aerospace (Safran’s CFM partner) competes with Rolls-Royce, while Safran supplies components. The Equipment segment faces competition from companies like Collins Aerospace (now partially acquired), Liebherr, Meggitt (now part of Parker Hannifin), and others across its diverse product portfolio.

Safran’s competitive advantages stem from multiple reinforcing factors. The company benefits from decades of engineering expertise in propulsion systems, with institutional knowledge accumulated across multiple engine programs.

The installed base moat provides powerful economics. With over 37,500 CFM engines delivered since the partnership’s inception, the maintenance, repair, and overhaul revenue streams provide stable, high-margin cash flows. The LEAP backlog exceeded 14,000 engines as of early 2025, ensuring production visibility for years.

Long-term contracts create substantial switching costs. Airlines that commit to LEAP-powered aircraft face multi-billion-dollar investments in infrastructure, training, and spare parts inventory. The Rate Per Flight Hour contracts that now account for a significant portion of LEAP aftermarket revenue lock in relationships for 10-15 years.

Regulatory moats protect market positions. Engine certification requires exhaustive testing and validation, creating time and cost barriers for competitors. Maintenance organizations must obtain regulatory approval for repair procedures, creating additional switching costs for airlines.

Technology leadership provides competitive advantages, though rivals also invest heavily in R&D. Safran dedicated €649 million to self-funded R&D in H1 2025, with particular focus on decarbonization technologies through programs like CFM RISE.

Recent Developments and Strategic Timeline

2024

February: Full-year 2024 results showed revenue of €27.3 billion, up 17.8% year-over-year

May: Paris Air Show showcased new technologies and secured major orders

July: Safran completed acquisition of Collins Aerospace flight control and actuation business

October: Announced Morocco expansion with €350 million investment for LEAP production

2025

January: Acquired Component Repair Technologies Inc. (CRT) to expand MRO capabilities

February: Signed contract with HAL India for forged parts production supporting LEAP engines

February: Bell Textron contract secured for flight testing solutions for U.S. Army FLRAA program

April: Won 16th Crystal Cabin Award for Connected Interiors innovation

June: Memorandum of understanding with Bombardier to advance defense innovation

July: Closed $1.8 billion acquisition of Collins actuation and flight control activities

September: Partnership with Skyted to integrate silent communication technology into RAVE IFEC systems

October: Third quarter delivered record 511 LEAP engines, full-year guidance raised

November: Technology transfer agreement with India for AMCA fifth-generation fighter engine

The India partnership represents a strategic milestone. Safran agreed to unprecedented full technology transfer for co-developing a clean-sheet engine for India’s Advanced Medium Combat Aircraft (AMCA). The partnership, valued at approximately $7 billion over its lifecycle, includes transfer of sensitive “hot section” technologies and positions Safran as India’s strategic defense partner.

Safran continues expanding its Indian footprint across civil and defense aerospace. CEO Olivier Andriès announced in November 2025 that investments exceeding €30 million would support civil engine MRO and LEAP-1A final assembly capabilities in India.

Financial and Commercial Implications

The aerospace industry’s recovery trajectory creates favorable conditions for Safran’s business model. Global air traffic continues rebounding toward and exceeding pre-pandemic levels, driving demand across the company’s product portfolio.

From a non-investor operational perspective, Safran’s financial performance reflects several underlying business dynamics. The 18.3% revenue growth in Q3 2025 demonstrates the operating leverage inherent in the company’s model. As LEAP production increased 40% to 511 engines in the quarter, fixed costs spread across larger volumes improved unit economics.

The aftermarket business exhibits particularly attractive financial characteristics. Spare parts for civil engines grew 16.1% in Q3 2025 in dollar terms, while services surged 24.2%. These revenues typically generate operating margins of 30-40%, significantly exceeding original equipment margins of 10-15%.

The Collins acquisition transforms Safran’s competitive position in actuation and flight controls while providing near-term financial benefits. Management expects the transaction to be accretive to earnings per share from year one and generate approximately $50 million in annual pre-tax cost synergies by 2028.

Currency exposure represents a significant financial factor. With approximately 60% of revenues denominated in U.S. dollars while costs are predominantly in euros, exchange rate movements materially impact reported results. Safran maintains a sophisticated hedging program covering $54 billion in the third quarter of 2025, with coverage extending through 2029.

The full-year 2025 guidance, raised in October 2025, reflects management’s confidence despite tariff headwinds:

Revenue growth: 11-13% (previously low-teens)

Recurring operating income: €5.1-5.2 billion (previously €5.0-5.1 billion)

Free cash flow: €3.5-3.7 billion (previously €3.4-3.6 billion)

The €100-150 million estimated tariff impact in 2025 stems primarily from flows between China and the U.S., Section 232 tariffs on aluminum, steel, and copper, and products not eligible under bilateral trade agreements. Safran benefits from the EU-U.S. aerospace agreement and USMCA eligibility for many products, significantly reducing exposure compared to initial worst-case scenarios.

Boeing’s 737 MAX production recovery directly affects Safran’s near-term outlook. The FAA approved Boeing’s increase to 42 aircraft per month in October 2025, with each aircraft requiring two LEAP-1B engines. Safran CEO Andriès expressed confidence in February 2025 that Boeing would reach production targets, noting a “very good start” to the year.

Key Risks and Mitigation Strategies

Supply Chain Disruptions (Probability: High / Impact: High)

Supply chain constraints remain the primary risk factor acknowledged by management. Tier 2 and Tier 3 suppliers face challenges meeting increased production demands, particularly for castings, forgings, and specialized components.

The impact manifests through production delays, increased costs, and potential quality issues. In 2024-2025, supply chain bottlenecks delayed LEAP deliveries and constrained Boeing and Airbus production rates.

Mitigation: Safran pursues multiple strategies including supplier development programs providing technical and financial support, geographic diversification through the Morocco hub expansion, long-term supplier agreements offering volume visibility, and selective vertical integration for critical components.

The company reported improvement through 2025, with CEO Andriès noting the supply chain situation is getting better in November 2025.

Geopolitical and Trade Tensions (Probability: Moderate / Impact: Moderate)

International tensions affect Safran through tariffs, export restrictions, and potential loss of market access. The 2025 tariff environment created an estimated €100-150 million headwind despite mitigation efforts.

China represents both a significant market opportunity and geopolitical risk. COMAC’s C919 aircraft powered by LEAP-1C engines faces uncertain export prospects. U.S. export controls could potentially restrict Safran’s ability to supply engines or receive components from its U.S. CFM partner.

Mitigation: Safran benefits from its joint venture structure with GE Aerospace, providing access to U.S. markets and programs. The EU-U.S. aerospace trade agreement exempts most products from tariffs. Geographic production diversification in Morocco, Mexico, and India reduces concentration risk.

The company maintains active government relations across multiple jurisdictions and structures programs to comply with evolving export control regimes.

Technology Transition and Decarbonization (Probability: Medium / Impact: High)

The aviation industry faces mounting pressure to reduce carbon emissions. Regulatory requirements, customer demands, and competitive dynamics drive investment in sustainable technologies.

The risk manifests if Safran’s technology development lags competitors or if disruptive technologies emerge faster than anticipated. Electric or hydrogen propulsion could potentially displace turbofan engines, though this appears unlikely for narrowbody and larger aircraft before 2040.

Mitigation: Safran invests heavily in next-generation technologies through the CFM RISE program targeting 20% fuel efficiency improvement with open-fan architecture, 100% SAF compatibility across current engine portfolio, hydrogen combustion research through partnerships, and electrical propulsion for regional aircraft.

The company participates in European and global initiatives supporting SAF production scale-up and infrastructure development.

Boeing and Airbus Production Rates (Probability: Moderate / Impact: High)

Safran’s engine deliveries depend directly on Boeing and Airbus build rates. Both airframers face quality issues, supply chain challenges, and regulatory scrutiny that constrain production.

Boeing’s ongoing quality and safety challenges following the 737 MAX issues affect build rates. Airbus announced in late 2025 it would adjust delivery targets due to supply chain constraints.

Mitigation: The installed base provides revenue stability independent of new engine deliveries. Long-term production backlogs for both Boeing and Airbus (exceeding 14,000 aircraft combined) ensure demand visibility. The Equipment & Defense segment’s diversification across multiple programs reduces concentration risk.

Safran maintains close coordination with airframe customers to align production capabilities with their build plans.

Defense Program Execution (Probability: Low / Impact: Moderate)

Defense contracts typically involve fixed prices, technical requirements, and delivery schedules. Cost overruns, technical challenges, or program cancellations create financial exposure.

Mitigation: Safran’s defense revenue diversifies across multiple programs, countries, and product types. The company benefits from France’s defense modernization commitments and export success of platforms like the Rafale fighter. Program management discipline and early risk identification help avoid major overruns.

SWOT Analysis

Strengths

Market Leadership: CFM International holds 39% global market share in commercial engines with industry-leading LEAP technology

Installed Base Economics: Over 37,500 CFM engines in service generate stable, high-margin aftermarket revenues

Technological Capabilities: Decades of propulsion system expertise with strong R&D pipeline

Diversification: Three complementary business segments reduce concentration risk

Strategic Partnerships: 50-50 JV with GE Aerospace provides scale, technology access, and market reach

Long-term Contracts: RPFH and other service agreements provide multi-year revenue visibility

Financial Strength: Strong balance sheet with €1.9 billion net cash position as of June 2025

Weaknesses

Supply Chain Dependence: Reliance on complex global supplier network creates vulnerability

Geographic Concentration: Significant manufacturing in France and Europe exposes to regional economic conditions

Currency Exposure: Euro cost base with dollar revenue creates FX sensitivity despite hedging

Narrow body Concentration: LEAP engine success creates dependence on 737 MAX and A320neo programs

Limited Widebody Exposure: Safran lacks the widebody engine leadership position of GE or Rolls-Royce

Opportunities

Production Ramp-up: LEAP deliveries targeting 2,500 engines annually by 2028 from approximately 1,700 in 2025

Aftermarket Growth: Maturing LEAP fleet will drive MRO revenue as CFM56 declines

Geographic Expansion: India partnership for AMCA engine provides defense and civil opportunities

Technology Leadership: CFM RISE program positions for next-generation engine market

Market Consolidation: Collins acquisition strengthens position in actuation and flight controls

Defense Growth: Global defense spending increases support equipment and propulsion demand

Sustainable Aviation: SAF adoption and decarbonization technologies create new revenue streams

Threats

Competitive Pressure: Pratt & Whitney GTF competes on A320neo despite reliability issues

Airframer Concentration: Dependence on Boeing and Airbus production rates creates exposure

Economic Downturn: Global recession would reduce air travel demand and airline orders

Regulatory Changes: Emission standards, noise requirements, or certification rules could require costly redesigns

Technological Disruption: Emergence of alternative propulsion systems could disrupt business model

Geopolitical Tensions: Trade restrictions, tariffs, or conflicts affect supply chains and markets

Supply Chain Failure: Critical supplier bankruptcy or quality failure could halt production

PESTEL Analysis

Political

Aerospace and defense face significant political influences. Government support through R&D funding, export credit financing, and diplomatic engagement shapes market access. The France-India strategic partnership facilitating the AMCA engine technology transfer exemplifies political factors enabling commercial relationships.

Trade policies directly affect operations. The 2025 tariff environment created headwinds, though bilateral agreements mitigated impact. Export controls on defense technologies and dual-use items constrain market access, particularly regarding China.

Defense procurement decisions reflect political priorities. France’s commitment to Rafale fighter production ensures M88 engine volume. European defense integration initiatives create opportunities for Safran’s systems.

Economic

Global air traffic growth drives long-term demand fundamentals. Industry forecasts project continuing traffic increases of 4-5% annually over the next two decades, supporting aircraft orders and aftermarket activity.

Airline profitability affects new aircraft orders and MRO spending patterns. The post-pandemic recovery has restored airline financial health, though economic uncertainty could impact near-term ordering.

Currency fluctuations create significant earnings volatility. The dollar’s strength in 2025 created translation headwinds, though Safran’s hedging program limits cash flow impact.

Interest rates affect aircraft financing costs and airline capital expenditure decisions. Defense budgets in Safran’s key markets (France, European Union, India) show growth trajectories supporting equipment demand.

Environmental awareness drives demand for more efficient aircraft and engines. Public pressure on airlines to reduce carbon footprints accelerates fleet renewal toward newer, more efficient aircraft powered by LEAP engines.

Workforce demographics affect Safran’s operations. Aerospace engineering talent remains highly sought after globally. The company employs specialized training programs to develop capabilities.

Air travel democratization in emerging markets creates growth opportunities. India’s expanding middle class supports domestic aviation growth and defense modernization.

Technological

Rapid technological change characterizes aerospace. Composite materials, additive manufacturing, digital twins, and artificial intelligence transform design and manufacturing processes.

Decarbonization technologies represent the industry’s primary innovation focus. CFM RISE program targets revolutionary efficiency gains through open-fan architecture, hybrid-electric configurations, and 100% SAF compatibility.

Digitalization enables new business models. Predictive maintenance using engine sensor data, remote diagnostics, and digital platforms enhance aftermarket services.

Autonomous systems for defense applications create new requirements for sensors, computing, and control systems where Safran holds positions.

Environmental

Aviation’s environmental impact faces increasing scrutiny. The industry committed to net-zero CO2 emissions by 2050, requiring dramatic efficiency improvements, SAF adoption, and potentially new propulsion technologies.

Noise regulations near airports affect engine design requirements. LEAP engines demonstrate significant noise reductions versus predecessors.

Manufacturing environmental footprint faces regulatory pressure. Safran committed to 50% reduction in scope 1 and 2 emissions by 2030 versus 2018 baseline.

SAF production scaling remains critical. Safran supports initiatives to expand SAF availability, though production currently meets less than 1% of jet fuel demand globally.

Legal

Product liability exposure for engine failures or accidents creates significant legal risk. Safran maintains substantial insurance coverage and designs for extreme reliability.

Intellectual property protection remains critical for technology leadership. The company actively patents innovations and protects trade secrets.

Competition law affects partnerships and acquisitions. The Collins acquisition required antitrust review and divestiture of Safran’s North American electro-mechanical actuation activities to Woodward.

Export control compliance is essential for defense business. Violations carry severe penalties including program debarment.

Implications by Stakeholder

Airlines and Aircraft Operators

LEAP engine production acceleration improves new aircraft delivery prospects, though supply chain constraints still delay deliveries versus pre-pandemic norms. Airlines benefit from improving engine reliability as the LEAP fleet matures, reducing operational disruptions.

The shift toward rate-per-flight-hour contracts transfers maintenance cost predictability to airlines while ensuring engine performance guarantees. This model particularly advantages smaller carriers lacking in-house MRO capabilities.

SAF compatibility across Safran’s engine portfolio enables airlines to meet sustainability commitments without fleet replacement, though SAF pricing premiums affect operating economics.

Aftermarket capacity expansions through the Morocco hub and Premier MRO network improvements should reduce engine shop visit times and spare engine requirements.

Aircraft Manufacturers (Boeing and Airbus)

Safran’s LEAP production ramp supports airframer build rate increases, though engine deliveries remain a constraining factor through 2025-2026. The 2,500 engine annual production target by 2028 would support narrowbody build rates exceeding 60 per month per manufacturer.

The Collins acquisition strengthens Safran’s position as a strategic systems supplier, increasing content per aircraft and deepening integration with airframe design processes.

Technology development through CFM RISE aligns with airframer timelines for next-generation aircraft potentially entering service in the 2030s.

Safran’s financial strength and supply chain management capabilities position it as a reliable partner versus smaller suppliers facing financial stress.

Defense Customers

The AMCA engine partnership demonstrates Safran’s willingness to transfer sensitive technologies to strategic partners, distinguishing it from competitors less willing to share intellectual property.

Expanding defense portfolios from the Collins acquisition and organic development provide integrated solutions for military platforms.

Production capacity expansions support increased defense equipment deliveries amid global rearmament trends.

Safran’s dual civil-defense business model provides scale advantages and technology cross-pollination unavailable to pure-play defense contractors.

Suppliers

Safran’s Morocco investment and supplier development programs create opportunities for capable suppliers to increase content and volumes.

Long-term agreements provide volume visibility supporting supplier capital investment decisions, though they also require suppliers to absorb inflation risks.

The company’s quality and delivery performance expectations intensify pressure on suppliers to meet aerospace-grade requirements.

Vertical integration strategies for critical components could reduce opportunities for some suppliers.

Employees

Production growth creates employment opportunities across Safran’s global footprint, with particular expansion in Morocco, India, and Mexico.

Technology transition toward decarbonization requires workforce reskilling and new capabilities in areas like electrical systems and digital technologies.

The Collins acquisition brings approximately 9,000 employees into the Safran organization, creating integration challenges and opportunities.

Local Communities and Governments

Manufacturing expansions generate economic development opportunities, particularly in the Morocco hub supporting 2,500 annual LEAP engine production.

The India partnership extends beyond commercial transactions to strategic defense cooperation and technology transfer, building bilateral relationships.

Safran’s commitment to 50% emissions reduction by 2030 addresses community concerns about manufacturing environmental impact.

Defense programs support national sovereignty objectives while creating high-skilled employment.

My Final Thoughts

Safran enters 2026 from a position of operational strength tempered by external uncertainties. The company has successfully navigated the post-pandemic recovery, achieving record financial performance through the first nine months of 2025.

The LEAP engine’s market success validates Safran and GE Aerospace’s technology choices.

While Pratt & Whitney’s geared turbofan offered theoretical efficiency advantages, operational reliability ultimately determines commercial viability. CFM’s methodical approach to LEAP maturation positions the engine family for long-term market leadership.

The Collins acquisition represents strategic evolution rather than merely financial engineering. Flight control and actuation systems complement Safran’s existing equipment portfolio while positioning the company for next-generation aircraft integrating advanced flight controls with propulsion system integration.

Supply chain constraints will likely persist through 2026 despite reported improvements. The aerospace industry’s rapid production ramp stresses a supplier base that contracted during the pandemic. Safran’s investments in supplier development and geographic diversification address this systematically, though bottlenecks will constrain growth in the near term.

Geopolitical fragmentation poses challenges for a company with global operations and diverse customer base. The ability to serve both Western and emerging market customers requires careful navigation of export controls, trade policies, and technology transfer restrictions. Safran’s partnership model with GE Aerospace and localized production expansions provide flexibility unavailable to more concentrated competitors.

The decarbonization imperative will reshape aerospace over the next two decades. Safran’s substantial R&D investments through CFM RISE and other programs position it for this transition, though technology uncertainty remains high. SAF adoption appears most viable for near-term emissions reductions, while revolutionary propulsion technologies face longer development timelines and greater commercial risks.

From an operational perspective rather than investment thesis, Safran demonstrates the characteristics of industry leaders.

Strong market positions in growing segments, technology leadership maintained through disciplined R&D, long-term customer relationships with high switching costs, and operational excellence enabling margin expansion characterize the company’s competitive position.

The installed base economics provide stability often underappreciated by those focused on new engine deliveries.

Over 37,500 CFM engines in service generate predictable aftermarket demand largely independent of economic cycles or new aircraft orders.

As the LEAP fleet grows from approximately 3,000 engines today toward 10,000 by decade’s end, this aftermarket foundation strengthens.

Social